Simplify your businesses’ accounting with a payment platform that easily syncs with Quickbooks

Streamlining your business’s accounting practices is one of the most important steps you can take to maintain the integrity of your company as well as to pave the way for intelligent growth.

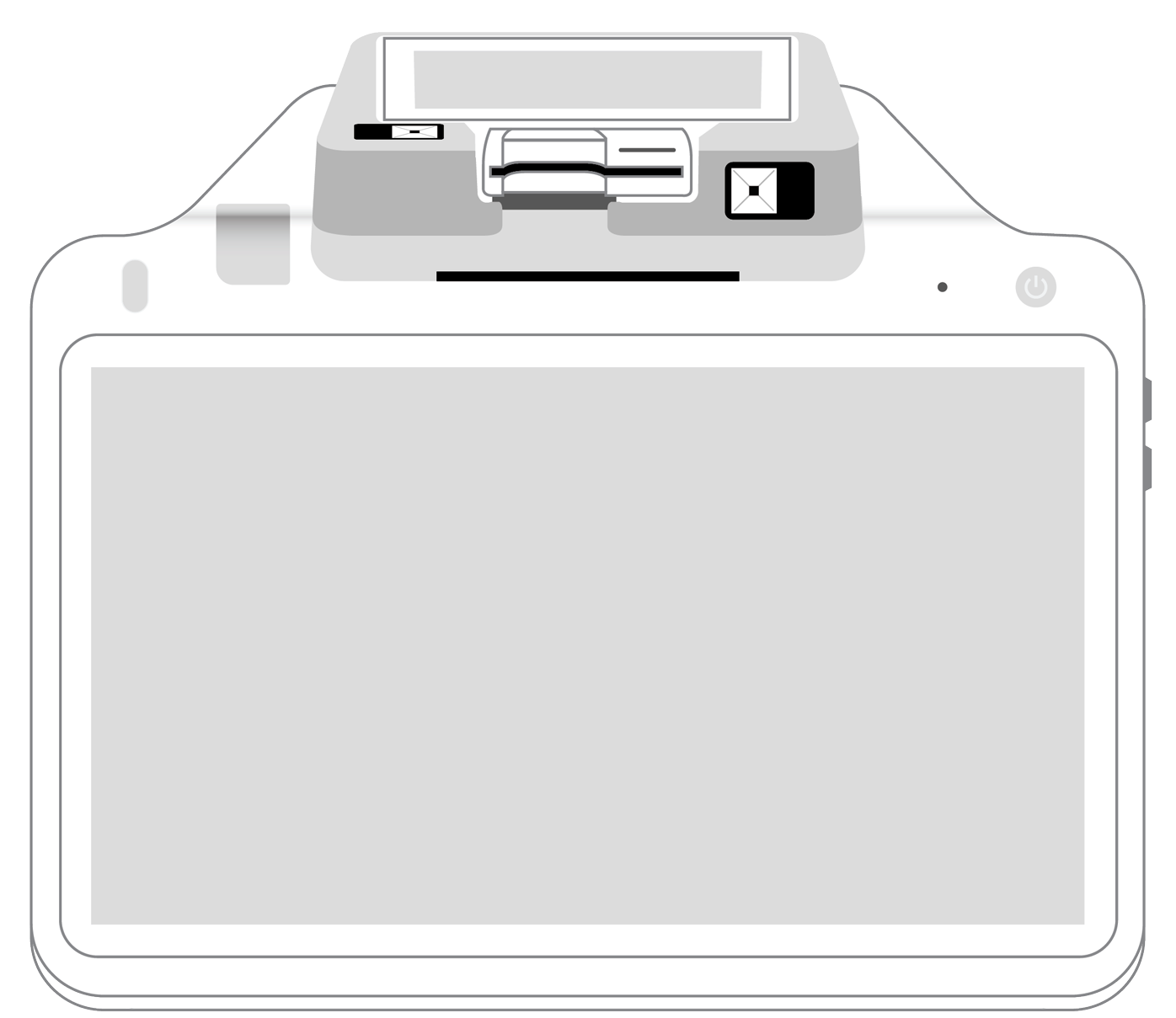

Today’s smart terminal technology possesses all of the tools you will need to make your financial operations easier and more efficient.

Payment platform defined.

Before we dive in, let’s get our terminology straight. A payment platform is a digital infrastructure designed to facilitate the transfer of funds from one party to another.

In the case of your business, it will assist you in securely taking money from your customers in exchange for goods and services. In other words, you can think of it as an intermediary between you and your customers.

Not all platforms are the same.

Don’t make the mistake of believing that one size fits all when it comes to payment platforms. In fact, they differ wildly in their features and costs. Therefore, it is vital to do your research before committing to anyone.

Start by choosing a processor that will allow you to take payments from multiple channels. While many of your customers may continue to want to use their credit or debit cards, an increasing number will probably prefer other options.

These include but are not limited to payments from digital wallets like Apple Pay and Google Pay, electronic invoices, and mobile payments. The more options you give that are compatible with your audience’s preferences, the higher your profits are likely to be.

Additionally, the mobile payments ecosystem is becoming more influential with every passing year as buyers continue to shift their shopping behaviors over to their smartphones.

In keeping with this trend, you need a processing platform that will work with all types of mobile payments. Once you have it, you will be able to complete transactions from anywhere, even if someone does not have a plastic credit card handy. For optimal functioning, you need a payment platform that integrates seamlessly with other mobile software.

No platform would be complete without a robust data analytics toolkit. By using this system for reporting data that is stored in your smart terminal, you can gain invaluable insights into your customers’ shopping behaviors and preferences as well as the health of your business as a whole.

Although this array of features may sound complex, using your processing platform shouldn’t be. Look for one that is user-friendly without requiring extensive training. Insist on one that is easy to navigate so that you can get to the features you need quickly.

Also, require that the platform contains prompt, effective customer service via several channels. In the event that you encounter difficulties, it is imperative that you get the assistance you need quickly so that you can be up and running again as soon as possible.

Finally, insist on a platform that is in total compliance with all industry security features, including the Payment Card Industry Data Security Standard (PCI DSS).

With these safeguards in place, all cardholder data will be processed via secure channels using strict protocols, allowing you and your customers to rest easy in the knowledge that you are doing all you can to protect against data breaches.

The importance of integration.

One of the best things about a good payment processing platform is that it can integrate seamlessly with QuickBooks. This will be great news for your accounting department since QuickBooks remains one of the most respected bookkeeping software suites in the business.

The term “integration” refers to your payment platform’s ability to interface seamlessly with third-party software. Once you configure your system properly, you can look forward to all of the benefits that QuickBooks brings to businesses of all sizes.

For starters, you can access QuickBooks on your desktop computer, online, via their mobile point of sale app and when you use their card reader. The app lets you process transactions manually from anywhere without the need for a card reader.

Furthermore, the QuickBooks Payments software works effortlessly with other tools in the QuickBooks ecosystem. As a result, you can look forward to accurate payroll, time tracking, point of sale systems and payment processing.

How to integrate Quickbooks into your system.

If you want to bring this bookkeeping powerhouse into your own business, the process is simple. First, decide whether you want to use a third-party payment gateway or QuickBooks’ own application programming interface (API).

Then, sign up for an account and obtain your credentials. Next, conduct testing to be sure that everything is working smoothly. Finally, get started in real time by updating the configuration to a live API interface, continuing to perform testing to ensure quality.

Once you find a good payment processing platform and integrate it with QuickBooks, virtually every aspect of your business will operate more smoothly.

You will have a complete system that meets your current needs and those of your customers while also possessing the flexibility and expandability that every growing business needs.

Related Reading

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||