Six ways contactless payments offer a safer and more efficient payment alternative.

Together with naturally occurring shifts in consumers’ shopping behaviors, the coronavirus has resulted in permanent changes to the way people shop. What’s more, their paying styles will never be the same again. As you consider incorporating contactless card reader technology into your retail business, keep in mind that touchless transactions bring a host of advantages to everyone involved in the purchase process.

What are contactless payments?

Before we delve into their many upsides, it makes sense to first explain what contactless payments are and how they work. In simple terms, this type of transaction allows customers using a specific type of credit card, a smartphone, or a wearable device such as an Apple Watch to make a purchase.

By interfacing with a reader equipped with near-field communication (NFC) technology, these types of payments allow for sensitive payment information to be passed quickly and securely between the customer’s card or device and the seller’s POS system. The details are securely encrypted and verified for authenticity and are ultimately passed on to the customer’s bank. Within a matter of seconds, the funds appear in the seller’s merchant account.

Contactless payments are hygienic.

Even before everything changed in 2020, some consumers recognized that bacteria and viruses were easily spread during the shopping and purchasing experiences. For many, a thorough hand wash was a matter of course as soon as they got back home. In short, these consumers recognized that coming into direct contact with items in the environment, including the cash and card readers they touched, could literally make them sick.

Fast forward to this past year and the importance of that fact became all too clear. As a result, buyers began to embrace the idea of waving their smartphone, smart card, or wearable device near a merchant’s NFC reader instead of touching a potentially virus-ridden surface themselves. Ultimately, customers were happy because they believed themselves to be at lower risk. Meanwhile, sellers breathed a sigh of relief in the knowledge that staff and buyers were safer.

Contactless payments are faster.

Anyone who has stood impatiently in a long checkout line as a fellow customer fumbled for cash or the correct credit card knows how frustrating the purchase process can be. At times, it is irritating enough that some people will actually leave without ever buying the items they have chosen.

By way of contrast, contactless payments can be conducted in an extremely fast and streamlined way. Buyers can simply whip out their smartphone, wearable, or card, wave it near the reader and verify their identity with a fingerprint or facial ID. In just seconds, the payment will be accepted or, in occasional cases, declined – all with no need to search for coins, count change, or wait while buyers enter a PIN. You can even set your point of sale (POS) system to email receipts, accelerating the checkout process even more.

Contactless payments help both you and your employees.

When transactions are fast at the checkout counter and customers are happy, your staff will also have a much more positive outlook on their jobs. Meanwhile, you’ll have greater leeway to delegate important tasks to employees who may once have been stuck exclusively behind the register. After all, enhanced efficiency could allow you to reduce the number of checkout lines, reassigning those staff members to work that might be more challenging for them while simultaneously helping you to grow your business in new ways.

Contactless payments are more secure.

In the past, many a customer’s credit card information was compromised during the few seconds when the plastic was put into the hands of unscrupulous merchants or cashiers. Before buyers knew it, their card numbers and security codes could be stolen and used to rack up bills in the hundreds or thousands of dollars. The introduction of “smart” EMV chips embedded in cards helped to reduce the risk of fraud, but both merchants and consumers still experienced it frequently.

Contrast that to today where, simply because of the nature of touchless payments, another layer of security has been added to the checkout process. Since cards and devices never leave the possession of their owners during contactless transactions, the likelihood of theft is significantly decreased. In addition, the chip technology used in this form of payment is more secure.

The key to the added payment security is found in the one-time tokenization that takes place each time a purchase is initiated. During this process, the customer’s sensitive payment data is replaced with a unique set of numbers. Since the original digits are never transmitted during the transaction, it is extremely unlikely that these details can be used to carry out fraudulent activity. Consequently, both merchant and customer are protected from financial loss.

Although specific tokens are initiated for one-time-only use, businesses can leverage tokenization technology to streamline their checkout process for their regular customers. This is because tokens for repeat customers can be stored securely. Should the same buyer want to make an additional or recurring purchase in the future, the encrypted data can be retrieved and a new, unique numerical sequence generated for that specific transaction. As a result, the purchase process can be both fast and safe for everyone involved.

Contactless payments are affordable.

Considering all of the advantages that these touchless transactions will bring to your business, you might be wondering how much more they cost. The good news is that you won’t be expected to pay any more to your payment processor for contactless transactions than you do for standard ones!

Contactless payments are easy to set up.

Thanks to the skyrocketing popularity of contactless payments, you can assume that the company that processes your payments and provides your POS will have already embraced these payments and can get you set up for them quickly.

As an entrepreneur, you juggle a host of important priorities. One of the most vital of these is to provide a positive customer experience that will keep people coming back and spreading the word about your business. Offering contactless payments enables you to emphasize the physical safety of shoppers while simultaneously focusing on providing a speedy, secure, and individualized customer experience. When all is said and done, touchless transactions help create a better experience for everyone involved.

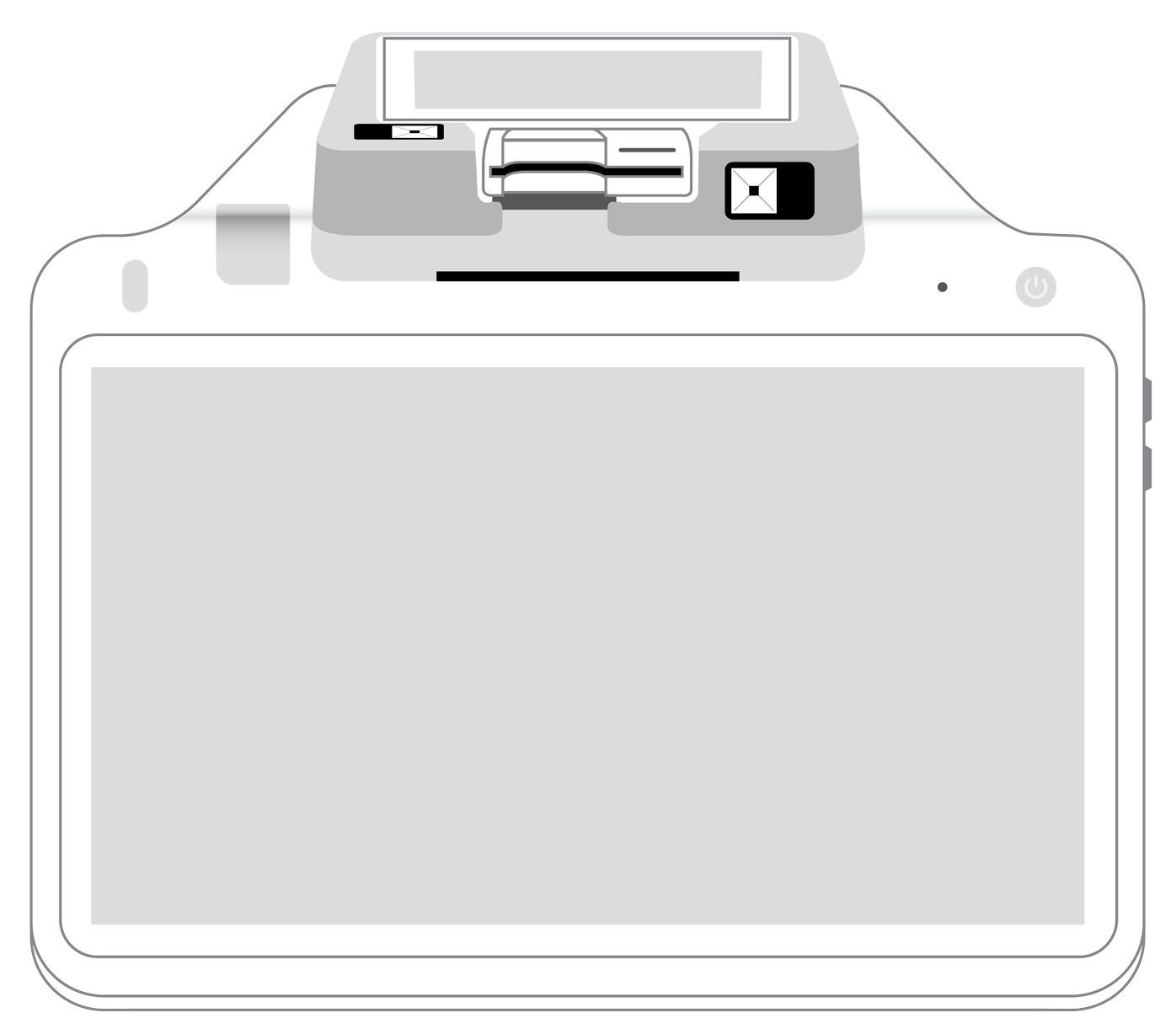

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||