Small Business Tax Facts

Taxes are a part of running any business, and though they occur annually, the process can still be difficult for small business owners. Business owners need to be knowledgeable about health care credit, payroll tax debt, retirement plan penalties, home office simple deduction, and unemployment taxes that can cause increases in paid taxes.

Taxes are a part of running any business, and though they occur annually, the process can still be difficult for small business owners. Business owners need to be knowledgeable about health care credit, payroll tax debt, retirement plan penalties, home office simple deduction, and unemployment taxes that can cause increases in paid taxes.

”It can be challenging for a small business owner to remain compliant and stay on top of ever-changing tax laws,” SurePayroll vice president of service delivery Jamal Ayyad said in an article on Accounting Web. He added that it is especially difficult when the focus is on sales and not tax season.

Through the Affordable Care Act, small business owners get a break when they have less than 25 employees with average income of $50,800 or less. They can offer health insurance through the Small Business Health Options Program.

When business owners owe $25,000 or less in tax, interest, and penalties, an installment plan over a period of up to 24 months is available to them when they have filed all of their returns. If more than $25,000 is owed, the business must pay the difference in order to qualify for the program.

Retirement plan penalties can be as high as $15,000 if a business owner does not sponsor retirement plans and fails to file with the Form 500 series. Department of Labor programs can help to cut down or remove penalties when a fine is outstanding.

Home office deduction is also an option available to small business owners, and there is a nine-point checklist which compares the simple method to the regular method. The lists only have two items in common. “Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes” is one of the items in common, and a $5 deduction per square foot applies.

Unemployment taxes are expected to increase in some states. States with a loan from the Federal Unemployment Trust Fund for payment of unemployment benefit liabilities must pay it off in a two-year debt period. If not, the state becomes a credit reductions state and will face a cutback in credit against the full tax rate. Employers then would owe more in taxes on Form 940.

Though taxes seem to be a major stress factor for most small businesses, they are an inevitable part of the business. By staying informed and up to date with the current tax laws and options available, owners can hopefully then view taxes as just another major aspect of their business.

The information contained on this website does not constitute legal advice or tax advice. The information contained within this website is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional tax planner or attorney. Its authors make no claims about its accuracy, completeness, or up-to-date character and that applies to any site linked to this website as well. No author or owner of this website is acting as your attorney. Legal rules and tax rules change frequently, therefore, we cannot guarantee that any information on this web site is accurate or up to date.

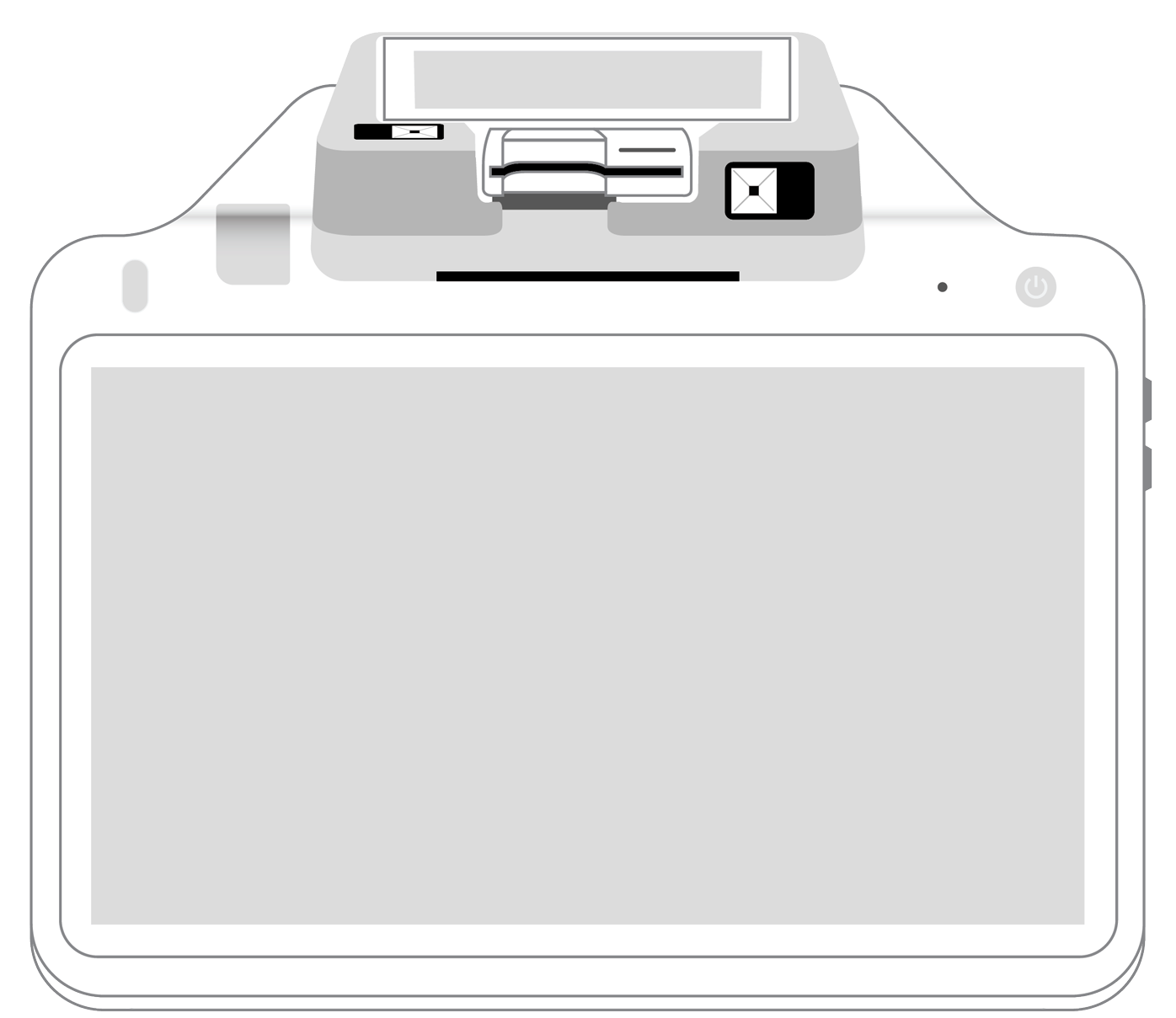

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||