Small Businesses Drop Health Insurance

In a survey of 1,600 small businesses conducted by Society for Human Resource Management, almost 3% plan to give subsidies instead of providing health coverage to employees. On January 1, 2014, policies were required to comply with the health care law, so when it is time for renewal, small businesses must decide whether or not they will purchase the new insurance.

In a survey of 1,600 small businesses conducted by Society for Human Resource Management, almost 3% plan to give subsidies instead of providing health coverage to employees. On January 1, 2014, policies were required to comply with the health care law, so when it is time for renewal, small businesses must decide whether or not they will purchase the new insurance.

Thanks to the Affordable Care Act, companies with less than 50 employees are not required to offer insurance.

Small business owner Monty Hagler realized it was not feasible to pay for employee health insurance coverage that complies with the health care overhaul. Hagler is the owner of RLF Communications, a marketing company in North Carolina.

According to Hagler, it is simply not sustainable – the company would have to change around its entire, current plan, and even then only the most basic of health plans could be chosen.

Hagler offered to give his 12 employees money to buy their own insurance starting in May 2015 as he judged it to be better than what he could otherwise offer them. More and more small business owners are choosing to compensate their employees for loss of benefit because coverage is not affordable. Wellpoint, a health insurance provider, lost 12% of its small businesses since 2013.

It is becoming clear to insurance brokers that people are losing health care coverage at work. The number of inquiries about individual coverage has increased. HealthMarkets Inc. has seen a 40% increase in individual insurance applications since March 31, 2014.

Providing coverage gives employers a competitive advantage, helping them to attract and retain the best employees. Some people can get a better deal with government health insurance. Coverage on exchanges for people earning no more than $45,960 can be subsidized by the government.

Many employers are bringing in insurance brokers to meet with employees and help them to find individual insurance coverage. Some brokers say employees can be at an advantage in this instance because they receive a stipend from their employers and a subsidy from the government. They may even end up with better coverage than before.

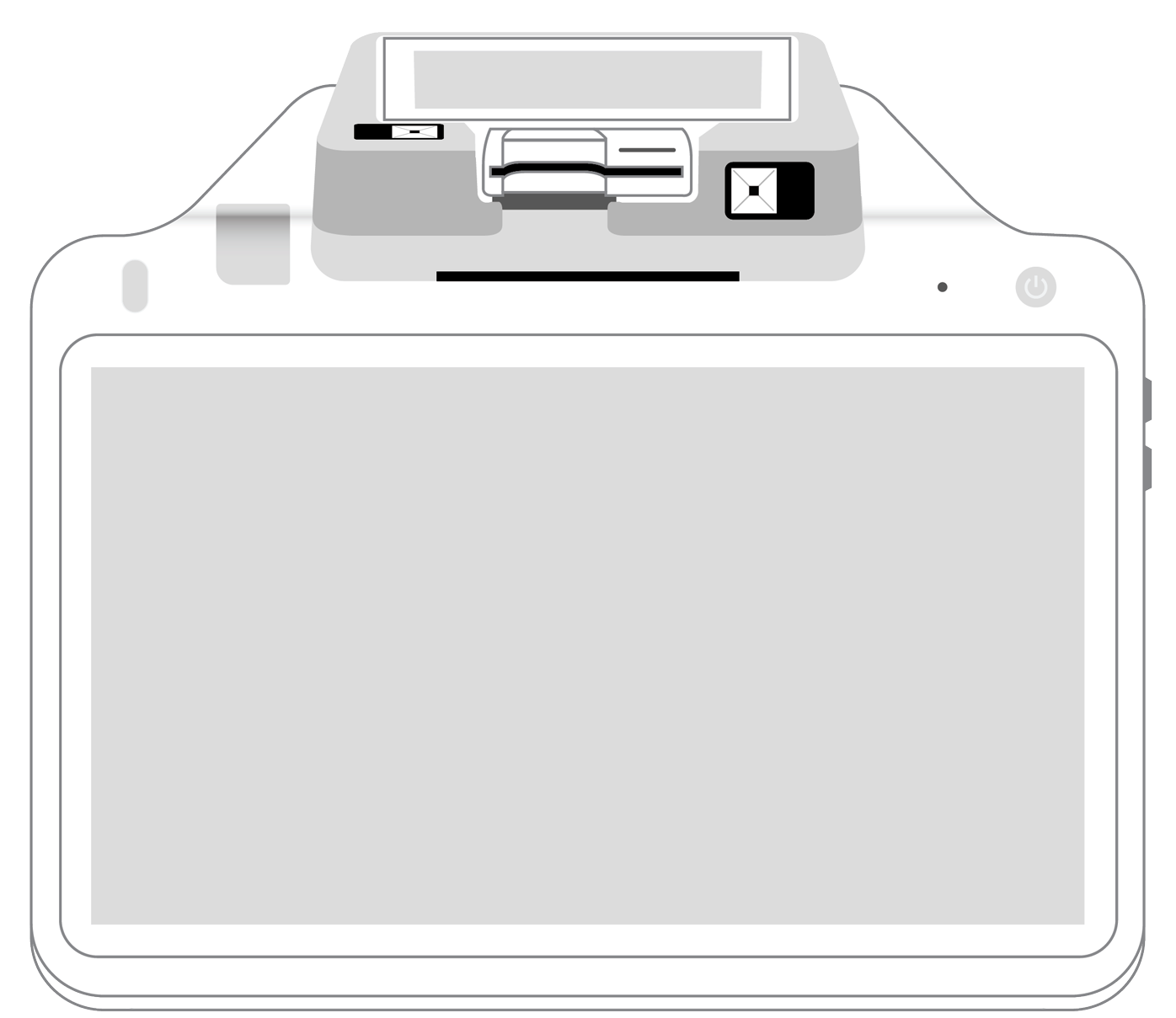

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||