The Benefits of Mobile Payments

Mobile payments have become big news over the last few years, especially since Apple released the iPhone 6 with Apple Pay in 2014, as the first major mobile phone manufacturer to have an integrated mobile payment system. Since Apple Pay came on the market, Android Pay and Samsung Pay have joined the party, and there is talk that handset manufacturer LG is developing its own NFC payment system.

Mobile payments have become big news over the last few years, especially since Apple released the iPhone 6 with Apple Pay in 2014, as the first major mobile phone manufacturer to have an integrated mobile payment system. Since Apple Pay came on the market, Android Pay and Samsung Pay have joined the party, and there is talk that handset manufacturer LG is developing its own NFC payment system.

Even financial institutions like Chase have released, or are developing, their own digital wallets. Despite the growing popularity of mobile payments, the United States has been much slower to adopt than other countries. Apple Pay adoption has been much faster in the United Kingdom, due in part to agreements with merchants that allow consumers to spend as much as they want on their Apple Pay accounts.

So why is using a mobile payments system better than paying for goods and services with credit cards or even cash? The popularity of smartphones is one reason. According to a 2014 Pew Research Center survey, 64 percent of Americans have a smartphone, which is a significant increase over 2011, when only 35 percent had them. Smartphones have become such an integral part of many American’s lives that there’s actually a term for the panic felt when one realizes the phone has been left behind or missing, is out of battery juice or in a bad reception area – nomophobia. Plus, there are apps that already do everything imaginable, basically turning our smartphones into pocket-sized personal assistants. Integrating our physical wallets with our phones simply makes sense, and for many of us, gives us less stuff we need to carry everywhere we go.

Secondly, mobile payments are very safe and secure. Sure, at first it feels kind of strange to wave your phone over a payment terminal to pay for that new pair of jeans, but knowing that the transaction is more secure than any other should soothe any fears you may have had about using your phone to pay. Despite that only 23 percent of consumers believe mobile payments are secure, they are much more so than other forms of payment, including the new EMV cards. New EMV payment terminals are also equipped to handle near-field communications (NFC), which is the system on which most mobile payments work. NFC-enabled terminals encrypt and tokenize all card information that passes through the device, rendering the data useless to data thieves like those that stole millions of consumers’ information from companies like Target and Home Depot in recent breaches.

Additionally, mobile payments generally require a PIN number or fingerprint for payment authorization. Plus, if your device is lost or stolen, you can remotely change your password or wipe it clean, if necessary. With credit cards, while the chances of cloning have been reduced thanks to EMV, a card thief can still use the card to make online purchases until it is shut down. And if cash is stolen, it’s just gone.

Mobile payments are fast and convenient, for both merchants and consumers. Time-crunched consumers like quick, in-and-out shopping experiences. The mobile payment process is generally a seamless one, allowing consumers to make payments anywhere at any time with their smartphones, as long as there is a cell phone signal or internet connection. The Secure Technology Alliance says, “Chase has reported that customer time at the POS is reduced by 30-40%, and American Express has reported that contactless transactions are 63% faster than cash and 53% faster than using a traditional credit card. MasterCard found the most significant time savings were realized in the drive-through environment where 12-18 seconds were shaved off the purchase time as compared to cash. Merchants implementing contactless payment have confirmed that there are indeed time savings.”

As more merchants begin to accept mobile payments, it will be much easier for consumers to utilize their mobile payment system of choice – or even more than one, if they choose to use a proprietary system like Apple Pay and a financial institution system, such as the one from Chase. Merchants benefit from mobile payments, too, as not only does accepting them give consumers more options for payment, it also provides the flexibility to test new markets with pop-up shops or reduce checkout times in a store. Mobile payments are a win-win situation on both sides of the payment terminal.

Related Reading

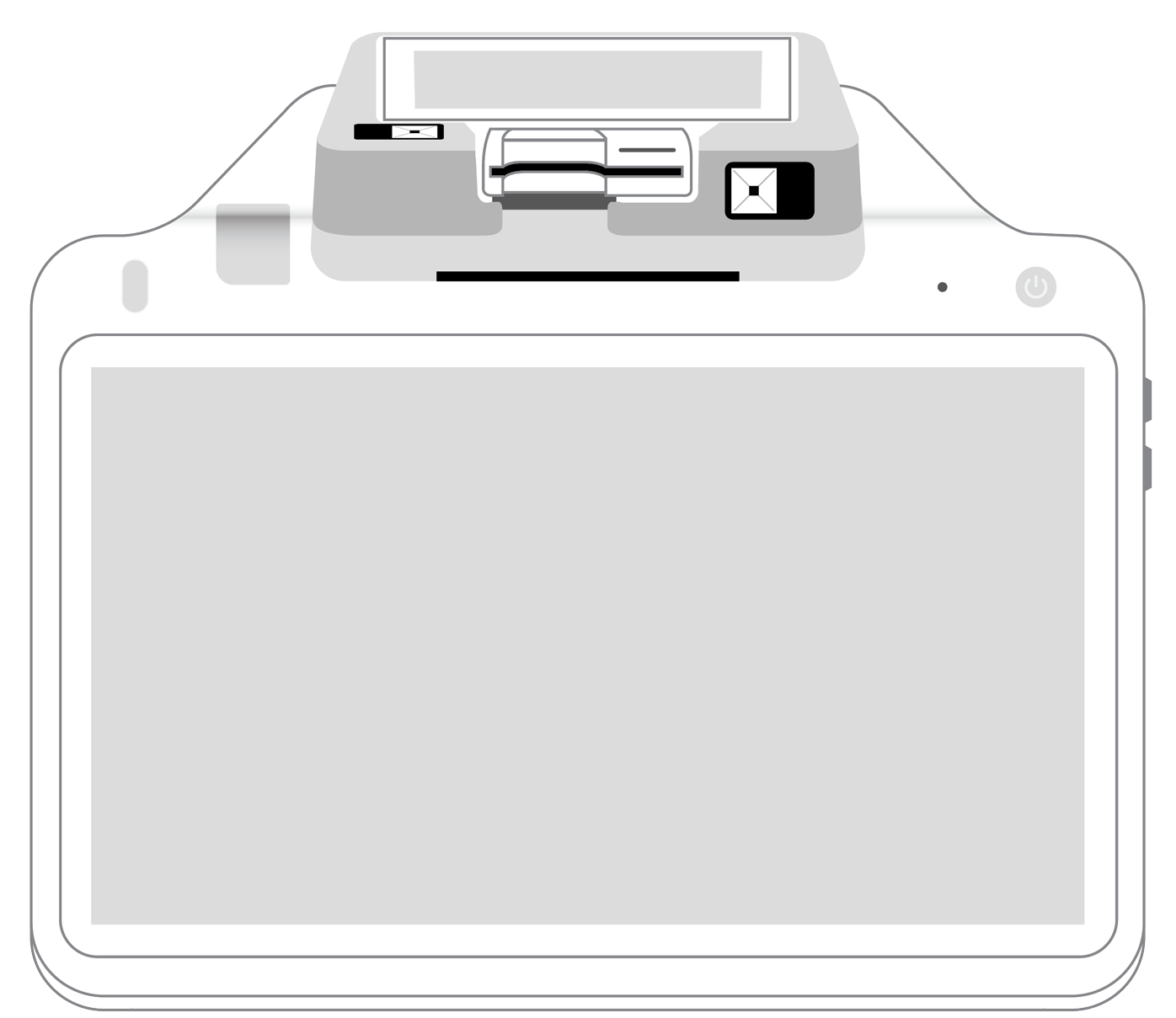

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||