The difference between POS, mPOS, and mobile payments.

The payments universe has expanded exponentially since the days when the cash register, bills, and coins were the status quo. Thanks to the marriage that has taken place between the credit card industry and technology, electronic and digital transactions can now be processed much faster and more securely than ever before. For modern business owners like you, it is essential to understand the distinctions between your point of sale system (POS) as a whole and how it relates to the various types of mobile payments made possible by today’s innovative mobile POS (mPOS) solutions.

Definition of a POS system.

You can think of your POS system (assuming it’s a modern one), as the central hub of your entire business operations. This combination of hardware and software consists of the main terminal, card readers, peripherals such as receipt printers, cash drawers, and barcode scanners, and the software that runs the system. Once you get one up and running, today’s smart POS solutions can do a great deal more than simply accept customers’ credit and debit card transactions. Its capabilities include the following.

- Recording, tracking, and managing inventory. Just catalog each item with your barcode scanner when it arrives from your supplier, and enter it into your POS solution’s database. Once you do, you can keep your eye on each piece of merchandise until it leaves the premises in a customer’s hands or online shopping cart.

- Creating reports. The sales and shopper data you collect and store in your POS system is a gold mine. With just a few clicks, you can generate customized reports that provide you with crucial insights about sales numbers, buyers’ habits, employee performance, and profits and losses. Making accurate forecasts and projecting long-term goals will no longer be a combination of guessing game and prayer when you back them with concrete, verifiable facts.

- Relating to your customers. Your POS system should come equipped with everything you need to build a robust loyalty program. Because most people love to get things for free and are happy to exchange gifts for tidbits of information about themselves, you can quickly gain insights into your best customers’ preferences while simultaneously incentivizing them to return more often and bring their friends.

- Managing your employees more effectively. Everything from tracking your timesheets and payroll to gauging workers’ performance can be addressed by the right POS system. Further, scheduling and making changes in real time become a breeze. Finally, improving morale and staff performance are a lot easier when you can see at a glance who is exceeding performance expectations and who may need additional instruction or a change in responsibilities.

After getting a sense of the multiple talents that come pre-packed into your POS solution, it probably should go without saying that if you aren’t doing so already, you should modernize your back office to include this easily integrated set of tools.

POS vs. mPOS solutions.

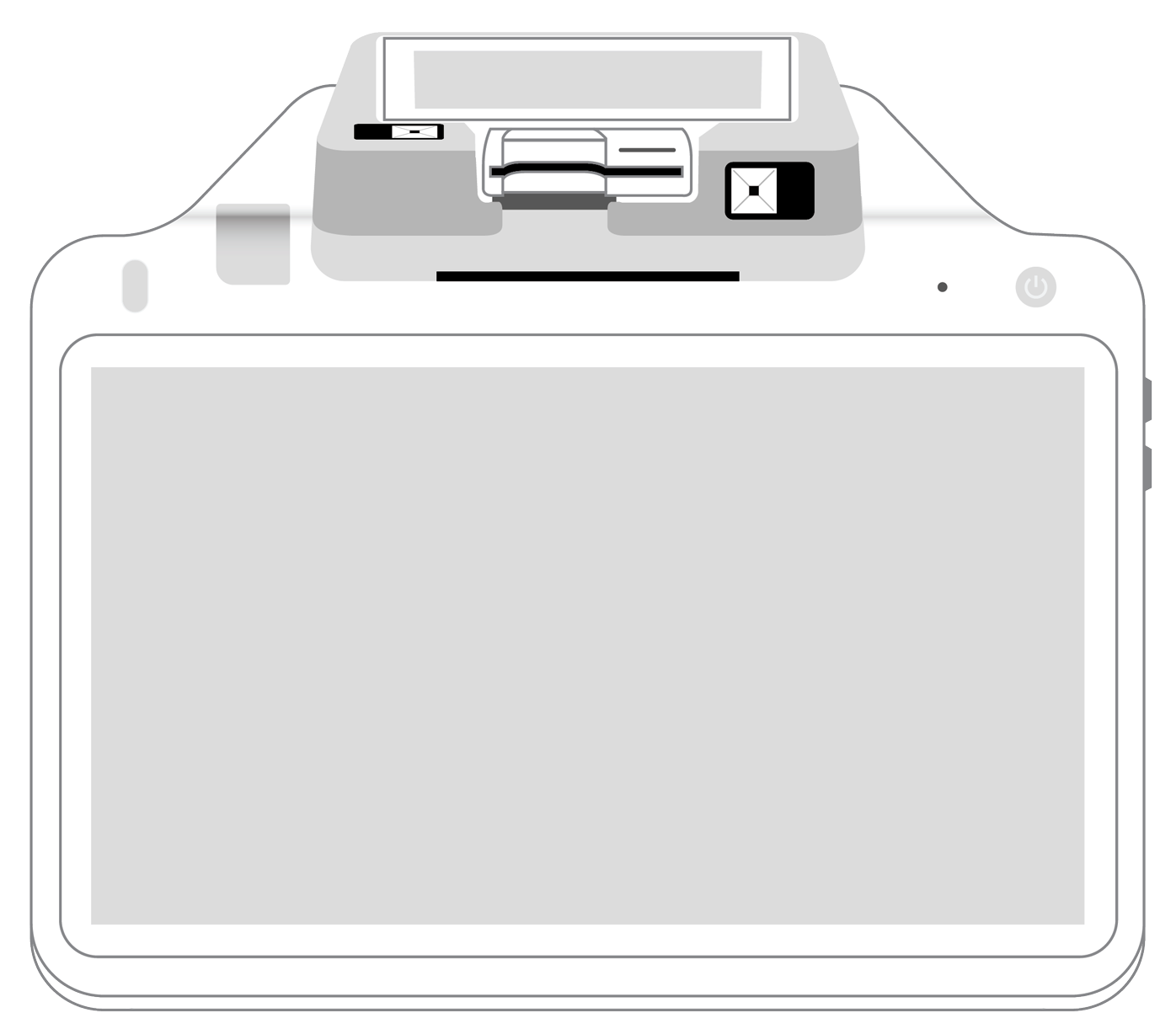

Although it may seem like an either-or situation, mobile POS (mPOS) solutions are often integrated into a larger standard POS suite. As the name implies, mPOS systems are portable and are designed to work with wireless tablets and smartphones as opposed to a standard wired terminal. As you might guess, there are several benefits of using a mobile POS system. These include the following.

- Portable. Because an mPOS is not connected to anything by cables or wires, it can be carried anywhere. Consequently, customer payments can be accepted anywhere throughout the store, curbside, at a customer’s home or office, or across the country at a trade show.

- Enhanced customer experience. In addition to their portability, mPOS systems can accept various types of mobile payments, including debit, credit, and gift cards, as well as contactless options. This high level of flexibility and choice helps to create a positive buying experience that customers will remember long after the purchase has been completed.

- Easy integration with your conventional POS. Even though your mobile POS might be small, it should communicate seamlessly with your overarching system. As a result, you will always be able to take full advantage of the numerous operational tools you have come to rely on.

- Speed, security, and safety. Thanks to today’s mobile POS systems’ flexibility and ease of use, long lines at the checkout counter will become a thing of the past. That’s because purchases can now be completed in a matter of seconds — from anywhere! Best of all, you will continue to have the same degree of security that keeps your employee and customer data safe from hackers.

Customers in the 21st century are embracing all types of mobile payments. The most popular include digital wallets, using internet browsers on their smartphones, and even QR codes at the point of sale. An updated POS solution or its mobile counterpart can effortlessly process all of these, providing shoppers with the secure and customized buying experience they have come to expect. If you have not already taken advantage of the wide array of rewards a modern POS system and/or mobile POS system can bring to your business, talk to your payment processor today about jump-starting your productivity and customer relations via a systems upgrade today. You won’t be sorry you did.

Related Reading

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||