The digital wallet is here to stay.

Mobile technology is transforming virtually every aspect of buying and selling. If you are a business owner who wants to continue to succeed, it is in your best interests to learn what digital wallets are, what makes them so compelling, and why they are destined to be a permanent part of the retail landscape for the foreseeable future.

What do digital wallets do?

The concept of a digital wallet can be a bit difficult for novices to understand. To clear things up a bit, let’s first dive into what digital wallets do.

- They store customers’ debit and credit card information. Some wallets allow for direct payment from a mobile device such as a smartphone or wearable like a fitness tracker or watch, while others draw funds from a stored credit card, but pay from the service itself.

- They allow customers to pay in-store. The process uses the shopper’s smartphone or wearable device that communicates with the merchant’s reader. Both are equipped with near-field communication (NFC) technology that allows for secure, contactless payments.

- They enable customers to make online or in-app payments.

- They allow customers to store or hold cash for later use with security features that keep the stored information safe from breach.

In short, digital wallets can provide fast and safe payment experiences for customers and secure and affordable payment processing for small businesses.

Digital or ewallets consist of software that is built into customers’ devices. They simply input their credit, debit, or gift card data into the wallet in advance where it is securely stored for later use via tokenization.

Many digital wallets give buyers the ability to pay directly for items in-store. This happens via communication between the NFC chips in both the customer’s phone or wearable device and the merchant’s smart reader. Other wallets use QR or barcodes to send customer payment information to the reader. For information to be transmitted back and forth, the devices must be within three inches of each other.

Why customers are increasingly making payments with digital wallets.

Not so long ago, only the bravest of early adopters were regularly paying via digital wallets. However, this is no longer the case. Consumers of all ages and walks of life are foregoing tried-and-true tactics in favor of the speed, convenience, and security offered by ewallets.

The benefits of this new monetary transaction style are numerous. They include the following.

- Many digital wallets allow customers to make contactless payments. In an era when hygiene is more important than ever, this represents a big plus.

- Faster checkout. In just a step or two, a customer can place their device or wearable near a reader and provide identity authentication. Within seconds, the payment goes through with no fuss or muss.

- Convenience. Payments can happen with just a few taps and do not require fumbling for cash or plastic.

- Multiple layers of security keep information safe. Assurances include passcodes or biometrics to authenticate identity, encrypted transmission, secure data storage, and tokenization to prevent theft of credit card numbers.

With this impressive list of capabilities in mind, you may be better able to understand what continues to propel digital wallets ever higher in the preferred payments stratosphere.

The future of the digital wallet.

Are ewallets just another passing fad that gained prominence because of the coronavirus pandemic? In short, no. Even before COVID-19, consumers were slowly recognizing the benefits of digital payments; the virus simply accelerated the trend.

You can think of digital wallet adoption as a snowball rolling down a hill. The more customers demand it, the more stores will invest in the required NFC hardware. As the technology becomes available in a greater number of places, even reluctant customers will become less hesitant and more willing to take a leap of faith.

Even so, cash is destined to remain on the scene for the foreseeable future. Consequently, it is in your best interests to continue to accept coins and bills to accommodate the full range of your customers’ needs and preferences.

How to support digital wallets in your business.

Are you ready to jump on the digital payments bandwagon? If you are looking to augment your customers’ experience and your efficiency in this way, here are some steps you should take.

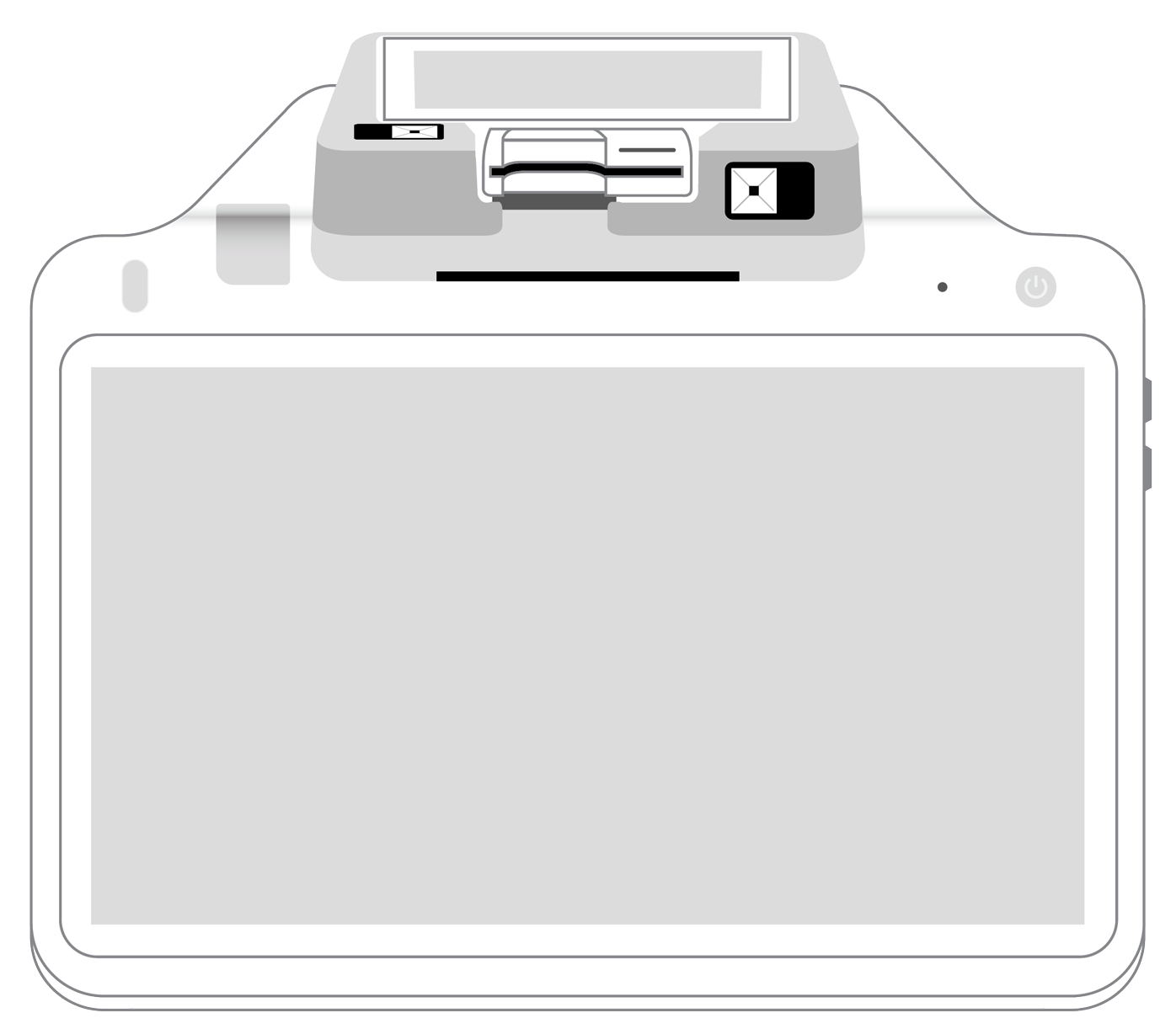

- Invest in credit card terminals equipped with NFC technology so that you can accept Apple Pay and Google Pay.

- Speak with your payment processing company to ensure that your equipment is compatible with accepting digital payments.

- Prominently post your acceptance of digital payments. This provides transparency and may even attract customers. You don’t even need to invest in promotional materials; the major digital wallet providers are happy to provide you with free signage.

Just by taking these simple actions, you can introduce digital wallet payments into your store, to your associates, and your customers.

Safe, easy, fast, and convenient: These are just a few of the qualities that have made digital wallet payments popular with customers and merchants alike over the past few years. This trend looks sure to continue well into the future. If you have not already incorporated ewallet payments into your business model, there is no time like the present.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||