The pros and cons of accepting credit card transactions.

In an era when carrying cash is becoming increasingly rare among customers, most merchants have chosen to accept credit and debit cards. If your business is one of the last holdouts that has not, now is an excellent time to explore the advantages and disadvantages of expanding your payment options.

The pros of accepting credit cards.

For one thing, paying with a credit or debit card is now the rule rather than the exception for the nation’s buyers. When you consider that almost 3/4ths of B2C purchases in the United States are now made with methods other than cash, that puts cash-only retailers at a distinct disadvantage. In a culture that values ease and convenience, loyalty is often sacrificed. For sellers that do not take cards, that can translate into numerous lost customers.

One of the reasons that consumers have embraced the credit card is it enables them to go beyond the boundaries set by the finite amount of money they have in their wallet at any given time. While the sky may not necessarily be the limit with plastic, buyers certainly have more leeway to make:

- More extravagant purchases than they had originally intended.

- Impulse buys that, by definition, are impossible to anticipate.

The knowledge that there is added flexibility will often increase the number of items that people buy. This is great news for you as a merchant while it simultaneously benefits your valued customers.

Paying with plastic also offers the benefit of convenience. Instead of needing to make trips to the bank or ATM, people can simply carry a card or two that will be accepted at most stores and eateries. Customers who want to split a bill among several people at a restaurant can do so without the endless back-and-forth discussions that often occur at times like those.

When retailers upgrade their POS solutions to also accept payments from digital wallets, the situation becomes even more seamless. After all, few people ever leave home without their phones these days, even if they forego carrying cash or a physical wallet.

Credit cards also provide an extra layer of safety for customers. No longer do they need to worry about being robbed of cash; instead, they can simply notify their issuing bank if loss or theft occurs. Furthermore, security advantages also extend to the payment transactions themselves. Should issues arise, a customer can dispute the charge and will not be held responsible for paying the full amount.

If your store takes mainly cash and checks, you may frequently experience delays in your cash flow. Waiting for checks to clear and handling bounced ones is a hassle that accepting credit cards can allow you to minimize. With plastic, the proceeds of your sales can be in your hands and available for you to spend within a day or two, instead of weeks later.

If you are operating a small business, your profit margin can be razor-thin, and your local and online competition fierce. If you want to have a real chance of succeeding in this cutthroat marketplace, credit card acceptance puts you on the same level as even your largest big-box rival. As a micro company, you can also provide buyers with a degree of personalized service and customization that not even the most cutting-edge CRM software can mimic.

The cons of accepting credit card transactions.

Despite the many advantages of accepting credit cards, it probably comes as no surprise to learn that there are downsides as well. Perhaps the most obvious is the cost that accompanies the added profit, safety, and convenience. In addition to having to shell out money for the hardware and software involved, businesses must also pay a variety of fees to their payment processing company for the ability to take payments. These charges also help to ensure that the entire process meets the payment card industry’s data security standards (PCI DSS) while also allowing your merchant account provider to turn a profit as well.

Cost is not the only pitfall of taking credit cards. Although customers can breathe easier due to not needing to carry large amounts of cash, you as a merchant can become vulnerable to criminal activity in new and ever-changing ways. For instance, failing to upgrade your systems to accept EMV chip cards can leave you liable for paying the full costs should a data breach or fraud occur.

If you operate an ecommerce platform, you are also vulnerable to unscrupulous customers as well as bad actors who steal legitimate card information and make unauthorized purchases that the defrauded customer ultimately disputes. Although it is impossible to totally avoid these disturbing issues, you can keep them to a minimum by ensuring that your hardware and software are up-to-date and in compliance with industry data security standards. Furthermore, you can learn about the red flags that you and your staff should be on the lookout for. These include unusual consumer behaviors such as buying large amounts of the same item, sending purchased products to a different place than the payment address and many more.

There is also the ongoing concern around chargebacks. When a customer requests a refund after paying for a product or service with a credit card, you are required to comply. In the event that you ultimately win the dispute, your money may be returned. However, the chargeback process is time-consuming and protracted, and you may never get the actual product back.

Keeping fraud to a minimum is a constant battle, but one well worth fighting. If your systems are not properly upgraded or in compliance with requirements, you could find yourself paying out sizable penalties. That’s just one of the reasons why it’s so important that you partner with a reputable merchant services provider like Payanywhere. We can ease the burden of keeping you compliant with our PCI Plus program, which even offers qualified merchants breach forgiveness. Plus, we offer chargeback mitigation tools, and more. Our expertise can not only save you money and provide you with something even more priceless: peace of mind.

priceless: peace of mind.

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.

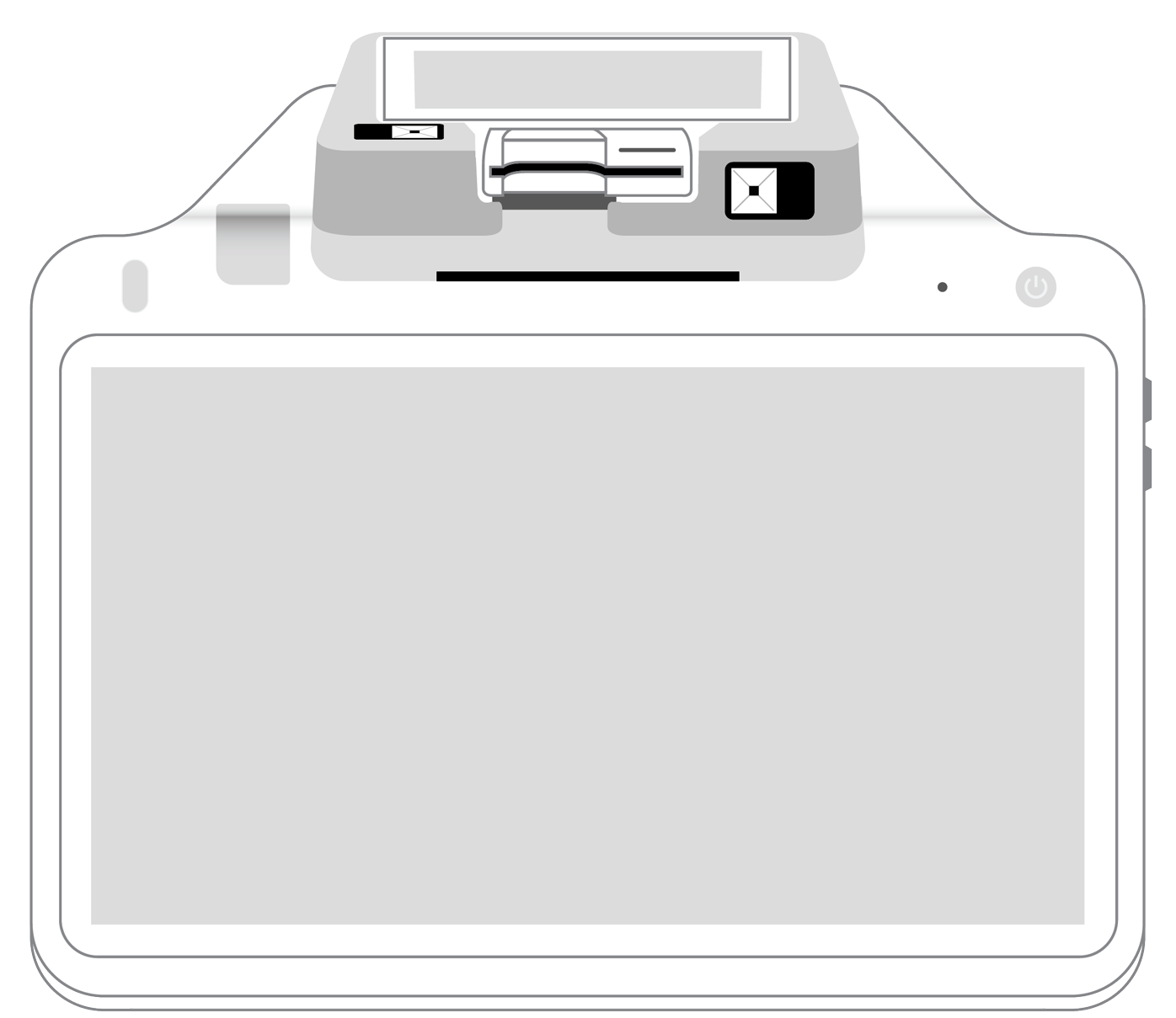

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||