The rise of digital wallet payments and how your business can benefit.

Coming as a standard feature of today’s smartphones, digital wallets are totally transforming the payment experience. Customers and merchants alike love the security, speed, efficiency, and flexibility that this innovation offers. Isn’t it time to learn how your business could benefit?

How digital wallets work.

Think of the digital wallet as a safe repository for electronic information, including credit card and other payment details. Your customer enters the data ahead of time into the app, which then encrypts and safely stores it for later use. At the time of purchase, the buyer simply opens the wallet, verifies their identity with a face ID, a PIN, or a fingerprint, and then places the phone near the merchant’s near-field communications (NFC) technology-equipped smart terminal. Within a matter of seconds, as long as the account information and funding checks out, the payment goes through.

Although the process is lightning quick and easy, don’t be fooled. The technology found in the reader and smartphone is designed to ensure that the transaction is just as secure as it would be if it were performed on a standard terminal. Considering this host of benefits digital wallets offer, it should be no surprise to learn that their use is rising steadily and shows no signs of stopping.

Why upgrade your systems to allow for contactless digital wallet payments?

Over the past two years, the Retail sector has been decimated. As a result, businesses quickly learned that if they were to survive through and beyond the pandemic, they needed to be nimble. Incorporating touchless payments via smartphones and wearable devices was one of the pivots that enabled savvy store-owners to promote hygiene and safety while continuing to sell their products. Since it seems that COVID-19 will be with us in some form for the foreseeable future, it makes sense to give health-conscious buyers a touchless and safer way to pay.

In addition, there is no question that the smartphone is everywhere. Consumers would be far more likely to leave home without their wallets than they would their mobile devices. This is especially true now that the digital wallet is having its moment. After all, why carry credit cards or cash when you can simply buy whatever you need with your phone?

As a business owner in today’s market, one of your highest priorities should be offering shoppers maximum choice and flexibility as part of the second-to-none service you provide. When they see that you have gone the extra mile to offer them greater flexibility while promoting their health and safety, it will place your business in a positive light.

Finally, we have saved the best news for last: Accepting contactless payments via consumers’ digital wallets is simple and affordable. The point of sale system you already have may actually be equipped to offer this payment method. Just contact your merchant services provider to see what you need to do to upgrade and jump-start the service. Before you know it, you too will be profiting from the efficiency, convenience, safety, and popularity of digital wallet payments.

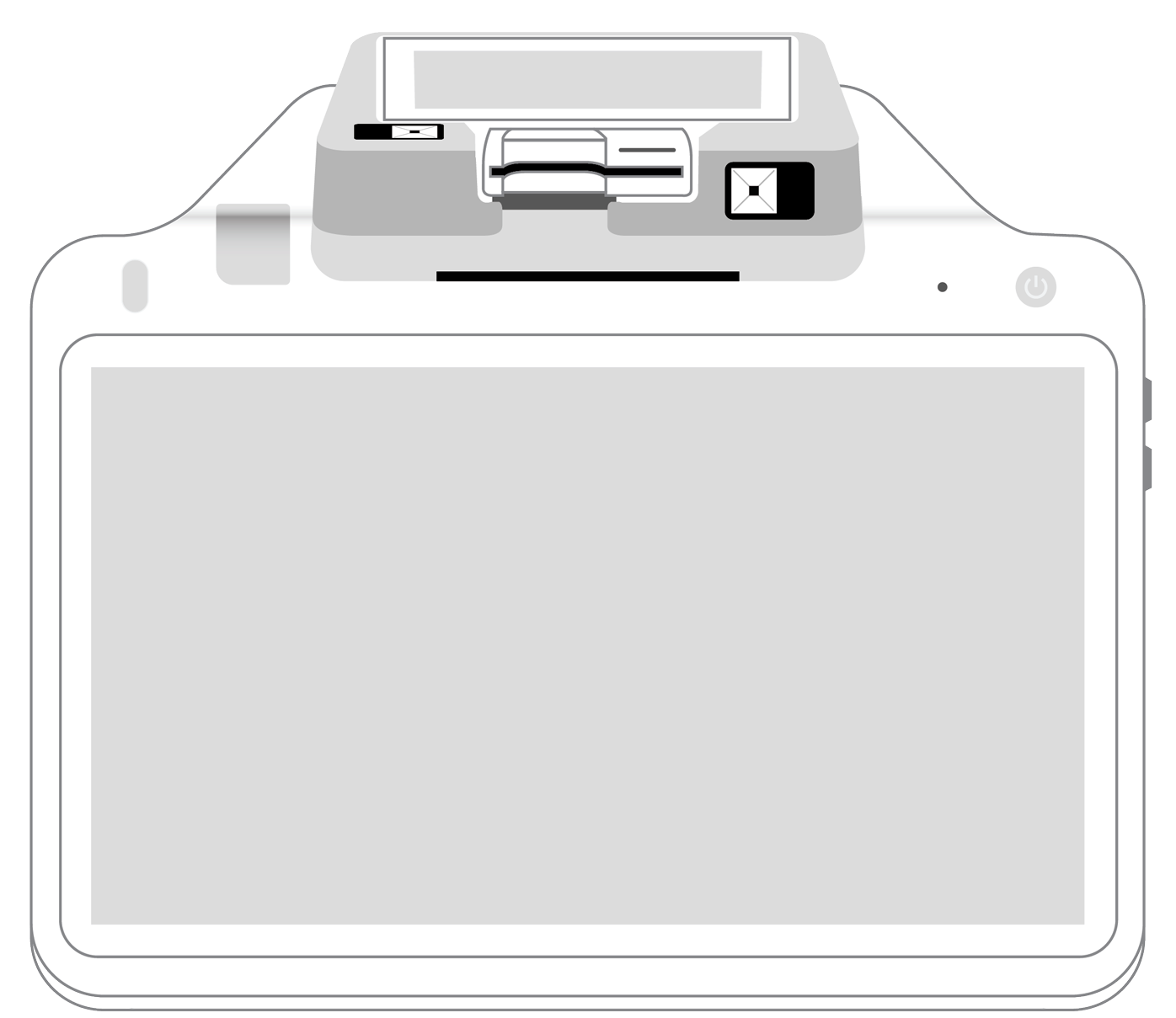

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||