The ultimate point of sale guide for business owners.

Table of Contents

What is a POS system used for?

What goes into a POS payment or credit card transaction?

The components of a point of sale system.

How to choose the best POS system for your business.

What is the difference between a POS system and a payment processor?

On-premises POS solutions vs cloud-based solutions.

The evolution of POS solutions.

What is a mobile Point of Sale (mPOS) system?

Choosing the right mobile POS solution.

Many savvy business owners loudly sing the praises of their point of sale (POS) systems and for good reason. This happy marriage of hardware and software can perform a stunning array of functions throughout your business's entire ecosystem. Take some time to learn what all of the fuss is about and you may soon be integrating this vital ally into your operations.

What does POS stand for?

POS stands for “Point of Sale” and refers to any place where a transaction may occur. Generally speaking, when we talk about a point of sale, we mean the area around the payment counter where a transaction takes place between a merchant and a customer.

What is a POS system?

At its core, a POS system is the set of physical devices and software that enable you to seamlessly and securely accept payments from your customers. That being said, the right POS system goes far beyond simply serving as a cash register alternative. Modern POS systems allow for the integration of the numerous customer-related and administrative tasks that entrepreneurs once performed manually at an extreme cost of time and labor ... or not at all.

What is a POS system used for?

Now that you understand its basic components, let's take a deeper dive into the functions the right POS system can perform. In many respects, you can think of it as a silent but extremely competent business partner who has a handle on virtually every aspect of your operations. Its many talents include the following:

- Handles all aspects of the payment process. A POS system is primarily responsible for ensuring that your customers can quickly, accurately, and securely make a credit or debit card payment. You may choose a traditional countertop system, a more portable solution, or something in between.

- Manages inventory. Thanks to its barcode scanner and accompanying software, your system should enable you to keep track of what is selling, what is not, what needs to be ordered, and what is slow to move off the shelves. Armed with this information, you can then make more informed forecasts and product purchases.

- Simplifies product returns. Your integrated POS solution can make this once annoying and often complex process both smooth and effortless. In a matter of mere minutes, you can use a smart POS system to record the return, remove the sale from your transaction list, and put the returned product back into your inventory so that it can be purchased again.

- Acts as your virtual Human Resources Department. Anyone who has been in business for any length of time can attest to the stress and hours that are involved in managing employees. Tracking hours, creating schedules, monitoring performance, and generating reports can be extremely time-consuming, particularly if you are conducting the tasks manually. Fortunately, a good POS system can take over the vast majority of these processes for you, offering access to clear, analytics-based data that you can use to streamline your internal procedures. With these tools in your hands, you can help your staff to become your ultimate ambassadors and increase your chances of retaining the best and the brightest among them.

- Becomes your detail-obsessed accountant. With the right POS solution in place, you no longer will need to spend long hours sorting through drawers full of receipts, invoices, and cashed checks. What’s more, tax time can be transformed from agonizing into quite manageable because all of your information will be accurately and securely stored in an electronic format, ready for immediate retrieval whenever you need it. You’ll just want to make sure your payments software is compatible with any accounting software you may already have in place (like QuickBooks).

Considering all of the skills that a POS system can bring to the table, most merchants soon find that they would never want to run their business without one.

Key features.

Any good POS system should perform a wide variety of functions that go beyond simply processing payments securely. These functions include:

- The ability to use a barcode scanner to facilitate the checkout process for different types of payments such as credit and debit cards, cash, and checks. In addition, your POS solution should generate printable or emailable invoices and receipts, while preserving the order for simplified customer, employee, and inventory management.

- Generating targeted sales reports and forecasts that can assist in staff training and future planning.

- The tracking and updating of inventory counts with every purchase.

- Making stock adjustments according to real-time inventory changes.

- Managing returns across all retail channels.

- Managing employee hours, scheduling, and staffing levels while enabling you to track staff sales performance.

A superior POS system will enable you not only to accept payments but also to elevate your efficiency and profitability as you gain insights into your customers and their buying behaviors. It is for these reasons that savvy business owners are increasingly choosing to invest in smart POS solutions.

Learn more about the top POS system features here.

POS hardware vs software.

Hardware.

As the name implies, POS hardware is the physical equipment that you and your customers see and touch. It makes the payment process possible and enables you to provide your buyers with a record of the purchases and product returns they have made. POS hardware consists of the following general categories:

- Visual display. This can either be allowed via a standard monitor similar to what you would see on a computer or through the use of an Android or Apple tablet or iPad. Regardless of what form it takes, the display enables you to have access to sales reports, customer databases, employee clock-ins and schedules, inventory lists, and so forth.

- Barcode scanner. This device enables you to quickly enter inventory into your system, thereby making it possible to automate the checkout process and drastically cut down on data entry errors. Once you incorporate a barcode scanner into your POS, you can keep a running total of all products sold, making it a breeze to reorder stock, long before it runs out.

- Receipt printer. This device enables you to quickly provide your customer with a hard copy printout that can serve as proof of purchase, or document when a return has been completed.

- EMV credit card reader. This piece of hardware enables your customer to insert or “dip” their chip-equipped debit or credit card to pay for their products. Unlike the magnetic stripe readers of years past, these devices enable the entire process to be completed without the card ever leaving the buyer’s possession.

- Cash drawer. Although cash is not the ubiquitous method of payment that it once was, the reality is that people still use it every day. Therefore, you may still need a safe place to store bills, change, and checks.

When all of these items work together seamlessly with the software that we will discuss below, they deliver a smoother payment experience for you and your customers!

Software.

If hardware is the physical structure of your POS system, your software is the brain that runs it and links all of its components together. In general, there are three different types of software:

- Native-based POS software. Because it is installed directly onto your POS hardware, this type of software gives you a great deal of leeway when it comes to customizing its features to meet your business’s unique needs.

- Cloud-based POS software. Instead of residing on your own equipment, this software lives in the cloud and can be accessed from anywhere at any time. In general, you pay for this Software as a Service (SaaS) on a monthly subscription basis. Because it is not physically linked to your other equipment, it is more secure and flexible, enabling you to safely do business on your terms.

- Hybrid software. This can be run either online or from the cloud depending on your needs.

Many POS solutions come prepackaged with the hardware and software linked together.

What goes into a POS payment or credit card transaction?

In one sense, a credit card transaction only takes a few seconds from start to finish. Yet there are several players and steps that must all work together seamlessly for the complex dance that is modern transactions to be accomplished successfully.

Among the cast of characters involved in credit and debit card transactions are the following:

- Cardholder. This is the customer and purchaser of the product or service.

- Merchant. This is you, the seller.

- Acquiring bank. This is your bank, responsible for receiving payment authorization requests from you, forwarding them to the issuing bank of the customer's card, and relaying the issuing bank’s response back to you.

- Merchant acquirer/payment processor. This company provides you with the hardware you need to accept credit cards from customers, transmit details of these transactions to the relevant parties, and send payment authorizations back to the acquiring bank.

- Credit card network. This network of companies, which includes Mastercard, Visa, Discover, and American Express, operates global credit card networks and sets non-negotiable interchange fees.

- Issuing bank. This is the institution that issued the customer’s credit card. It is responsible for receiving the card network’s request and accepting or declining the payment.

The transaction process occurs as follows.

- The cardholder presents their card at the point of sale or enters the information online into your shopping cart software.

- Details are sent to the acquiring bank wirelessly or over a phone line.

- The acquiring bank passes on the information to the card network.

- The card network clears the payment, requesting authorization from the issuing bank.

- The issuing bank validates the payment by checking the card number, available funds, address, and CVV number.

- The issuing banker determines the validity of the transaction (either approving it or declining it), and sends its response to you via the credit card network and acquiring bank.

- After the merchant receives confirmation of payment, a hold in the amount of the purchase will be placed on the customer’s account.

- You provide the customer with an emailed or physical receipt.

- You also send a batch of approved authorizations to the acquiring bank.

- The acquiring bank sends the information to the card network.

- The network routes each payment to the appropriate issuing bank.

- The issuing bank transfers funds, minus fees, back to you, the merchant.

- The issuing bank posts updated information to the customer’s account.

- The customer pays the bill.

In light of how many moving parts must cooperate in the credit card payment process, it makes sense that companies should carefully choose a POS system that is both easy to use and provides ongoing, live customer and technical support.

The components of a point of sale system.

The visible part of a POS system is its hardware, the physical equipment it uses. Many business owners choose all-in-one solutions that combine every part of the cash register into a unit. The basic visual display, card reader, and PIN pad can be augmented with peripherals customized to the business’s individual needs, including items such as cash drawers and receipt printers. Each POS terminal should feature its own separate power and battery backup. The external equipment is connected to a hard drive, a server, and a power source to enhance efficiency, security, and functionality.

In addition, several other peripheral devices are vital in streamlining a business’s array of tasks:

- Barcode scanners enable error-free entry of product information and assist in accurate inventory tracking and ordering. These can be short-range, long-range, or embedded.

- Cash drawer. This protects your stored cash, credit card receipts, and checks. POS software can include an automatic close feature to protect the contents of the drawer from theft.

- EMV and magnetic stripe readers that read information from customer debit and credit cards during the payment transaction.

- NFC contactless readers that allow customers to safely make digital wallet payments like Apple Pay and Samsung Pay.

- Receipt printers for receipts, purchase orders, invoices, etc.

- A touchscreen or keyboard that enables the customer to input information.

You should balance the lure of fancy bells and whistles against the need for adopting a POS system that is easy to use and explain to staff members at all levels.

View our components of a POS system infographic here.

How they work.

Simply put, a POS system is a combination of hardware and software that facilitates payments and coordinates administrative tasks. Transactions are processed at the front end of the system via a touchscreen or tablet. Business activities like report generation, as well as inventory and customer management, are conducted in a separate browser or application window at the back end.

The data held within these POS solutions can either be stored on-site or in the cloud. In the case of the former, information is placed on a business-owned server and it is your responsibility to purchase all licenses and take care of updates. Cloud-based systems use a provider’s remote servers to store data, which are then maintained and updated by the vendor.

The hardware involved in transacting payments can include the device for entering payment details (touchscreen, tablet, cash register), a cash drawer, receipt printer, barcode scanner, card reader, and a server network. These work together to allow for the secure transmission of a customer payment to all of the financial institutions involved in the process, as well as the safekeeping of invoice details that you can refer to in the event of product returns or chargebacks.

Regardless of which specific type of POS solution you as a business owner decide to use, security should always be a top priority. This can be achieved by performing regular updates of on-premises software, or ensuring that you choose a third-party provider that complies with PCI compliance requirements a.k.a. PCI DSS protocols.

Learn more about how POS systems work here.

Types of POS systems.

There are several different types of POS solutions, each with its own set of robust features:

- POS apps. These can be downloaded on iOS or Android devices and are affordable and easy to use. Because they’re cloud-based, they can be used anywhere as long as you have a wifi or cellular connection.

- Mobile POS (mPOS). This setup includes all of the features of the POS app combined with hardware such as tablets, card readers, printers, barcode scanners, etc. These systems are particularly useful for businesses such as restaurants that wish to offer tableside ordering and/or payments. Plus, retail stores that want to cut down on checkout lines by accepting payments on the sales floor or "line busting."

- Touchscreen POS systems. Whether they utilize iPad or Android tablets, or their own proprietary hardware, these systems are easy to use and are particularly helpful for businesses such as restaurants where customers may input their own order selections.

- Cloud-based POS systems. These wireless systems include hardware that enables customers to input payment information in person, with that data then being processed offsite in the cloud. As a result, information is readily accessible from any device, making cloud-based POS solutions especially useful for businesses with multiple locations.

- Open source POS systems. These are composed of software that businesses can customize for themselves, therefore requiring some technical expertise.

- Multichannel POS systems. These allow retailers to integrate the data from all payments accepted in multiple locations, including physical and online platforms. Because they can sync information across channels, these systems minimize the chances that stores will run out of stock.

Because there are many different types of POS systems (with varying features and price points), your job as a savvy business owner is to carefully determine your unique needs, asking questions until you get all of the answers you seek. Only then will you be in a position to choose a POS system that can help you achieve your current and future goals.

Learn more about the types of POS systems here.

Contact Payanywhere for information on our latest smart solutions

How to choose the best POS system for your business.

Once you have integrated a POS system into your business, you will find that it streamlines your operations, keeps your information and systems safer, and saves you time. The ideal solution will enable you to accept payments wherever your customers are, accurately track your inventory, record customer information to be used for marketing, and generate a wide variety of sales and staff-related reports. However, for all that to happen, you need to pick the solution that is right for your business.

Look for a system that plays nicely with the accounting software that you already have on board. If you are operating in cramped quarters, consider selecting a solution that works on a widely available Android tablet or iPad that you can accessorize with printers, barcode scanners, PIN pads, and other peripherals. Furthermore, think about the particular type of business you are running. In many cases, you can purchase industry-specific POS hardware that makes it easier for you to perform tasks such as food ordering, inventory management, and much more.

Learn more about how to choose the best POS system for your business here.

How much do they cost?

As you have probably already guessed, there is no single answer to this question. The amount you will spend for a POS system will depend on the size of your business, your sales volume, and the features you require.

- Sales volume. In addition to your monthly POS charges, most credit card processing companies collect a small portion from each sale. This often comes in the form of a percentage, plus an additional set amount for each sale.

- Register fee. You generally pay an additional charge for each extra register after the first.

For obvious reasons, you can also expect to pay more if you have multiple locations. After all, this requires more hardware.

Charges and fees explained.

In the business world, everything comes at a cost. Not surprisingly, that includes POS systems. If your solution is located on your premises, you may pay a higher cost at the outset. If you go with a cloud-based POS solution, you'll typically pay by the month.

In addition to these charges, most payment partners will also expect to shell out dollars for the following:

- A small percentage cost of each sale.

- A charge for additional cash registers.

- Extra charges if the number of users of your system goes above a prescribed cap.

- Fees for CRM equipment.

- Advanced POS features.

- Monthly lease of hardware such as your credit card terminal.

- Payment gateway charges.

- Monthly software-as-a-service (SaaS) charges.

- Fees to underwrite the cost of complying with PCI DSS requirements.

- Statement fees.

- Online reporting.

- Per-incident fees for chargebacks.

Of course, you will also be expected to pay the non-negotiable charges demanded by the card companies. As a savvy business owner, your job is to review all informational materials carefully before signing any agreements while negotiating all charges that are not set in stone or dictated by third parties. If you are stymied by the often confusing legal language and jargon that is frequently found in merchant accounts and POS contracts, reach out to the company. A good rule of thumb to follow is that if you cannot get a completely transparent answer during the introductory phase of your relationship, chances are good that this pattern will only continue. In that case, your best bet is to take your business to a different provider.

Learn more about POS charges and fees here.

Benefits and advantages.

Adding a POS system to your physical or online store involves an investment in both time and money. However, the advantages are numerous. They include the following:

- Improving the customer experience. Thanks to your modern POS with its faster processing, emailable receipts, and ability to accept numerous payment types, your buyers will find that their purchasing experience is smooth and fast.

- Customized to meet industry-specific needs. For example, your retail store can be fitted with a POS system that maximizes your ability to manage inventory, reward loyal customers, and generate sales reports. Or, your landscaping or home repair business can flourish with the use of a mobile POS that could be used to accept payments from anywhere.

- Enhanced security. Any POS system that you select should come equipped with multi-layered data security, including an EMV chip reader, certified point-to-point encryption and tokenization, and PIN code and fingerprint authentication for units that accept mobile payments.

- Integration with other business tasks. In addition to processing payments, your POS system should also make other administrative processes easier. This includes inventory management, accounting, and employee scheduling.

- Scalable to grow with your business. If your goal is to expand, look for a POS system that can evolve with you. In other words, pick one that can adapt to your changing needs without locking you into expensive, long-term contracts.

Business owners who put the necessary time and effort into searching for their ideal POS solution will ultimately be rewarded with a set of hardware and software that can carry their physical and ecommerce enterprises far into the future.

Learn more about the advantages of using a smart POS system here.

What is the difference between a POS system and a payment processor?

With all of this terminology flying around, it is easy to confuse language, potentially muddying the waters, and resulting in less informed decisions. Two commonly confused terms that fall into this category are POS systems and payment processors.

As we have already discussed in-depth, a POS is a solution that enables you to accept customers’ payments. It can be a modern software-enhanced cash register at your retail store or the payment section of your website.

On the other hand, payment processors are third-party vendors that assist merchants in transacting credit and debit card payments. In many respects, these processors act as middlemen, coordinating the flow of information, authorizations, confirmations, and declinations to the various actors involved. Perhaps the most important of the processor’s responsibilities is ensuring that all aspects of the payment process are secure and encrypted so that sensitive cardholder information is not compromised via a potentially reputation-damaging data breach.

For brick-and-mortar stores that have no plans to expand into ecommerce and don’t need employee, inventory, or customer management capabilities, a simple payment processor is generally sufficient. However, anyone who wants to do more than just accept credit and debit cards should take time to consider how the robust features offered by payment processors can enhance their entire business operations.

On-premises POS solutions vs cloud-based solutions.

Knowing your business’s unique needs can help you to determine if you should choose a POS system that is headquartered on your own servers (on-premises) or one that is hosted on the server of a third-party vendor, and is available anywhere, and at any time, via an internet browser. Although going with the latter may seem like a no-brainer, that is not necessarily true for all businesses.

There are several factors to consider when deciding between these two offerings.

- Pricing. In general, you shell out a fair amount of money up front for your on-premises hardware and license. Eventually equipment ages and depreciates in value since you may not easily be able to upgrade it. Cloud-based software usually requires a monthly subscription that never ends, however, your vendor is responsible for ensuring that it is kept up to date. Ultimately, you’ll need to figure out if you want to incur a larger expenditure of capital funds (on-premises) or operational monies (cloud-based).

- Security. Many business owners are skeptical about the prospect of entrusting their valuable data to a nebulous network “out in space.” They instead prefer to be responsible for accepting the necessary steps to protect their information. That being said, cloud-based POS systems are required to conform to Payment Card Industry Data Security Standards (PCI DSS), and vendors are generally quite receptive to audits that provide actionable data on their performance in this area.

- Customizability. When you have control over all aspects of your POS solution by having it on your premises, you can shape it to fit your specific needs. This has long been one of the cornerstone advantages of these systems. On the other hand, cloud-based POS solutions are more amenable to mobile access, a quality that is becoming a must-have for modern merchants who wish to line bust, accept payments in and around their store, or go truly mobile.

In the end, you are the best and only judge of which type of system will best serve your needs. Whichever route you decide on, it should provide you and your customers with the streamlined payment and business solutions you will need now and into the future.

Learn more about on-premise vs cloud-based POS systems here.

Integrating your POS system.

If you’ve just purchased a new POS system, think of it as a new pet that you want to successfully welcome into your household. Fail to introduce it properly and all manner of chaos and confusion could result.

If possible, make the transition to a modern POS system early in your business’s development. The longer you put off making the change, the more set in your ways you and your staff will become. Not to mention the more paperwork and legacy systems you will be forced to contend with. If you are in the enviable position of just starting out, consider investing in a tailored POS solution customized to meet your present and future needs before you even open your doors.

Regardless of when you integrate your POS solution, you’ll want to ensure it will seamlessly interface with your existing accounting software. If you fail to take advantage of these robust financial features, you may well suffer from the consequences of human data entry errors, particularly at tax time. Choosing a POS system that meshes with both your website and your accounting software is the best way to ensure that your financial house remains in order.

Finally, make sure to capitalize on your POS solution’s employee management capabilities. This will automate vital tasks such as staff access privileges and performance tracking, giving you the data you need without the hassle of hands-on micromanaging. As a result, you can optimize the performance of your valued team members while simultaneously finding time to focus on the many other important tasks involved with running your business.

In the end, your POS system should make your business run smoothly without breaking the bank. It should be easy to use, supported by a company that provides customer service that you can count on, and makes your payment transactions as secure and frictionless as they can possibly be. When all is said and done, your POS system should be the solution you never want to be without, the enhancer of both sales and customer relationships.

Learn more about integrating your credit card processing system here.

An example of a POS system.

Let’s take a look at just some of the features found in one of today’s most popular POS systems. Used by merchants both large and small, this well-known POS boasts the following advantages:

- Unlimited staff permissions (no user limits).

- Thorough and detailed report generation regarding sales, inventory, and staff performance.

- Ease of use.

Although each enterprise has its own unique set of priorities and goals, there is hardly a merchant alive who wouldn’t be happy to work with a POS provider that can provide this degree of customizability and flexibility.

The evolution of POS solutions.

The roots of today’s POS solutions date back to 19th-century Ohio where the first cash register was invented by a saloon owner named James Ritty. His brainchild simply recorded the number of sales and the amounts of each to detect thievery. Not long after, he sold his patent to the National Cash Register Company, which manufactured and distributed the first mechanical cash register nationwide, improving it over time and expanding its features.

With the 1980s and 90s came computers and their accompanying software, including touchscreen interfaces and the Microsoft operating system. The industry also added other important features, including signature capture, and automation. At this time, POS solutions began to resemble the ones we are familiar with today.

Now that the 21st century is in full swing, POS systems continue to evolve. They now allow for enriched capabilities that can assist you with tracking inventory, managing employees and customers, sending invoices, disputing chargebacks, and conducting business on a global scale. Although the POS system has already come a long way from its primitive cash register beginnings, it is certain to continue transforming as technology, business, and customer needs change.

See our infographic on the evolution of the POS system here.

What is a mobile Point of Sale (mPOS) system?

These days, tablets and smartphones are in the hands of the vast majority of both consumers and merchants. These items can now be equipped with payment processing software, plus peripheral hardware such as card readers, barcode scanners, receipt printers, and cash drawers. As a result, you can now process payments on these devices just as you would with a traditional cash register. All while also enjoying the numerous other benefits of an integrated POS system that we have cited above.

Furthermore, mPOS solutions allow you to enjoy the numerous advantages that come with portability. With a tablet or smartphone, sales associates can use hand-held devices to assist potential buyers as they ask questions about products, select what best meets their needs, purchase peripheral items that can augment their product experience, and make their final purchases. Best of all, thanks to the flexibility of a mobile POS, all of this can happen from anywhere in the store, drastically cutting long lines at the checkout counter and enhancing the customer experience.

The mPOS also enables you to take your business on the road. Trade shows, flea markets, and even customers’ homes become accessible without any hassle. All the while, you never lose your connection with integrated inventory and sales records that update your stock counts and other analytics-based reports in real time.

Choosing the right mobile POS solution.

Once you decide that a mobile POS solution is right for your business, you will soon discover that you have many devices to choose from. Instead of jumping at the first or cheapest option you see, use these suggestions to help guide your decision:

- The beauty of mobile transactions is their portability. However, some systems are not as easy to take with you as one would like. Be sure that the payments hardware you settle on is portable enough to meet your needs and equipped with a secure connection that doesn't only rely on wifi to process customer payments.

- Choose a system that offers same day funding. This feature enables you to maintain your cash flow by securely transferring your funds into your merchant account faster so you can maintain that all-important cash flow.

- Be sure the provider gives you a clear and transparent description of all charges, including what you’ll be expected to pay monthly for software licensing.

- Find a provider that offers live customer service and technical support day or night. You cannot afford to reach voicemail or a bot when your system goes down, as every minute of an outage is business lost.

- Pick software that integrates seamlessly with widely available hardware devices such as Android tablets, iPads, and popular smartphones.

- Require that your vendor of choice does not charge you more each time you add a new user. The more your trusted associates can use and benefit from the advantages of your mPOS system, the happier your customers will be, and the higher your profits will soar.

- Keep your business’s long-term growth and game plan in mind by choosing a flexible system that does not lock you into a contract or charge exorbitant licensing fees.

Taking this advice can help to ensure that the mPOS you choose is affordable, effective, and helpful to you and your customers now and for years to come.

Learn more about choosing a mobile POS system here.

Learn more about Tap to Pay on iPhone.

Understanding virtual POS systems.

A virtual POS is in reality, a web-based application that allows you to enter customers’ credit card information. Unlike payment gateways where buyers themselves input their own information, virtual POS terminals are operated by you, the merchant.

Virtual POS systems are particularly necessary for businesses that process orders that come in via phone or email, or that conduct sales at trade shows, farmer’s markets, and so forth. Highly versatile and portable, virtual POS systems only require that you have a computer or mobile device, and a cellular connection. With a virtual POS, bulky equipment is not necessary. Even an internet connection is not vital. Instead, you can simply accept credit cards as an offline transaction and process the payment later.

Adding virtual POS capabilities can allow you to:

- Accept payments any time, anywhere.

- Capture valuable customer information that you can use for future marketing and targeted sales initiatives.

- Gain the ability to set up recurring payments.

- Expand your business to customers who do not have internet access or prefer to order over the phone or by mail.

- Enjoy faster payments compared to checks.

- Update software quickly and easily.

- Have a backup system for your other POS solutions.

Although it might not be as fancy or have as many bells and whistles as your standard POS solution, a virtual option fills an important niche for nearly every type of business.

Learn more about virtual POS systems here.

How to choose the best virtual POS option for you.

Only you can understand your unique needs and customer preferences. That being said, think of the following qualities as must-haves as you look for the perfect virtual POS solution:

- Lets you generate reports on your sales and customer preferences that you can use to shape future marketing and inventory projects while providing the best possible service and targeted products to your customers.

- Its accompanying mobile app should be easy to use and provide features similar to the web version.

- Possesses automatic recurring payment capabilities. Your system should let you enter and save customers’ payment details and set the details of the payment cycle and duration to streamline the invoicing process.

- Offers reasonable rates. While you should assume that you will pay somewhat more for the privilege of accepting these card-not-present payments, many terms are negotiable. Do your research and read all literature carefully before committing.

Doing your due diligence before making this important purchase will allow you to reap the full benefits a high-quality virtual POS has to offer. Enhanced sales and a broader customer base are just the beginning of the opportunities that it can bring to your enterprise.

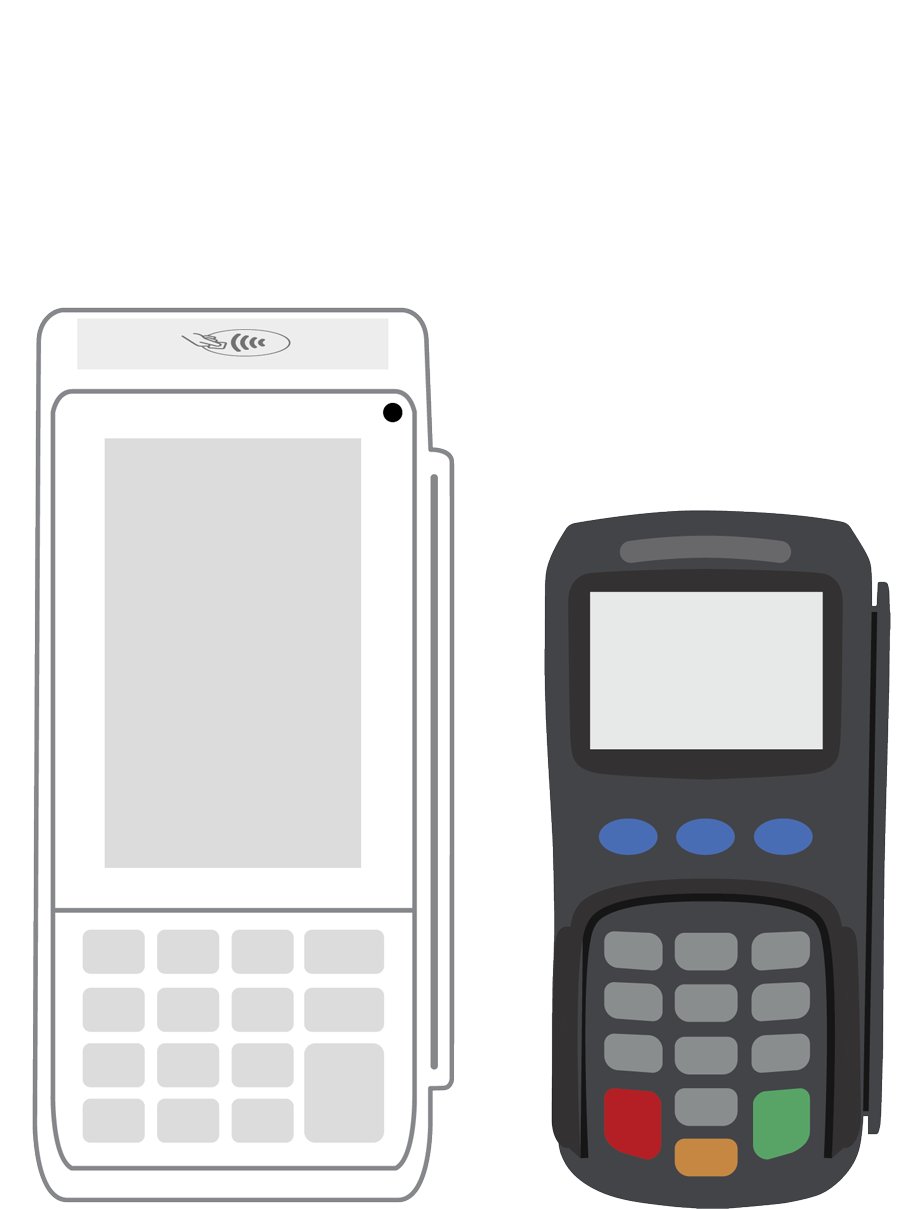

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||