Things You Should Know Before Starting a Small Business

Many would-be entrepreneurs are enticed by the call to start their own business, and who can blame them? Being your own boss means no more impossible-to-please supervisors, crazy office politics, and long commutes. Best of all, you could actually do something you love and are passionate about. However, before you tell your supervisors in no uncertain terms what they can do with your job, take a long, hard look at what goes into starting a business. If your new company is not built on a foundation of knowledge and careful planning as well as passion, it is doomed to fail. Although this is by no means an exhaustive list, the following information can get you started on the right foot

Money Is Vital

It’s a no-brainer that you need capital to get your company off the ground. No matter how mind-blowing your product concept might be or how amazing your staff members are, a business without money is like a fancy sports car without gasoline. It looks good on the outside, but you’ll never get it out of the garage.

There are numerous methods to obtain the start-up capital you will need, and fortunately most of them don’t involve borrowing from your significant other or your parents. The Small Business Administration provides a gold mine of information for people who are starting a new business, and they also sponsor loans through a variety of financial institutions. Spending some quality hours looking over their website and attending Chamber of Commerce meetings in your town or city is certainly time well spent.

Keep in mind that no one is giving out checks for tens or hundreds of thousands of dollars without wanting to know how their money is going to be used. That means you need to do a good deal of work before you make your requests. If you can provide prospective lenders with a business plan including a concise statement describing your business, who your customers will be, what you will sell and how you intend to market your goods, your chances of success will increase. Note that you will also need to show these people that you are worth the risk and will pay back any loans without difficulty. To that end, demonstrating to them a strong credit history is very helpful.

Many new entrepreneurs make the mistake of underestimating the amount of funds they will need. Don’t just come up with a number based on what you will pay to open a brick-and-mortar location or to get your e-commerce site up and running. Think also about staff salaries, gathering and maintaining inventory and the cost of having an emergency fund if the worst should happen. As a rule of thumb, you should have at least six months’ worth of cash in reserve.

Money Is Important, But It Isn’t Everything

Your start-up capital represents the fuel that enables you to drive your way to business success. But what if you don’t really know how to drive, or you don’t have any idea where you’re going? As an entrepreneur, you need a solid, dynamic business plan to move forward.

Being the savvy entrepreneur you are, you probably already completed a high-level business plan in order to receive funding. However, you will never stop tweaking your day-to-day business plan. It grows and morphs right along with your company, and it keeps you honest and accountable to yourself, your investors and your staff.

Speaking of staff, one of your highest priorities is to seek, hire and train the best possible people who will help you grow your company and spread the word about your brand. There are only so many hours in a day, and you will find that you just can’t do it all on your own. If you treat your staff with respect, communicate openly and frequently, address their concerns in a timely manner, challenge them to stretch professionally, provide constructive criticism, and celebrate their successes when appropriate, the dividends you get in return will be incalculable.

Don’t Let Your Business Take Over Your Life

Particularly when your company is in its infancy, you will probably need to pour your heart and soul as well as countless hours into it. You might find yourself joking with family members about putting a cot in your office since you barely come home anymore. Equally bad, you could be tempted to mix your personal funds with those relegated specifically for your business. But giving up your personal life and intermingling your finances can have dire consequences.

While it is seen as a virtue in our society to put work above all else, this can be a recipe for stress, divorce, illness, burnout and even the failure of your company. If you don’t take care of your car with regular tune-ups, it will eventually break down, and you are no different. The best solution is to actually pencil in time for yourself on your calendar. That should also include scheduling activities with family members and friends so you can maintain and nurture your interpersonal relationships.

Do Everything You Can to Run Your Business Efficiently

Although you will never get to the point where your company will run itself, there are strategies you can adopt that will take a lot of the grunt work out of being an entrepreneur. As mentioned above, the most obvious is to gather a trusted group of staff members around you who can help lighten the load. You can assist them and yourself by also embracing some of the technological innovations that are now making the routine tasks of running a business easier.

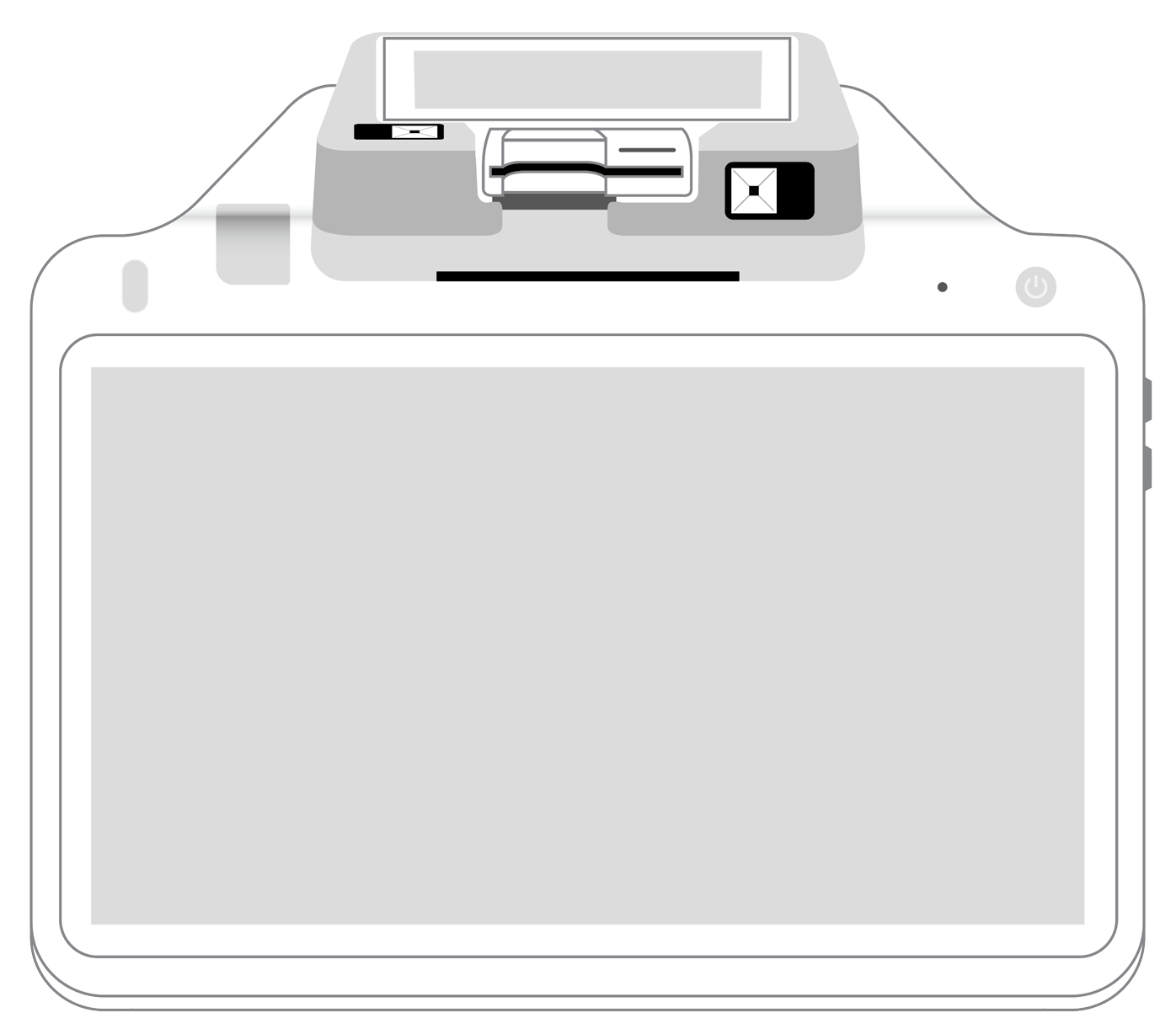

Perhaps the best example of this is your point of sale credit card machine. Although on the surface it might appear to be nothing more than a way to accept customers’ payments, it is actually a multi-tasking powerhouse. Whether you use a smartphone credit card reader or a stationary machine, the POS software included can help you with the following tasks:

- Keeping track of inventory

- Generating reports of past sales

- Projecting future trends

- Keeping a customer database that can be the basis of a lucrative loyalty program

- Sending out promotional emails

- Accounting and payroll

- Staff time tracking

- End-of-year tax preparation

When you first started down the road to entrepreneurship, you probably never guessed that one of the most important tasks you would be faced with was finding the POS solution that best meets your needs. Considering how much a POS can do for you, it makes sense to shop around before you make your investment.

Keep Debt to a Minimum

In our personal lives, most of us take carrying debt for granted. If you aren’t paying off student loans, a mortgage or monthly car payments, you either have a very large trust fund or are very frugal and fortunate. Because being in debt is the rule and not the exception these days, you might think it is equally fine to use the same philosophy when running your business.

The reality is that you will probably need to take out one or more loans during the lifetime of your business, and that does not make you a bad person or a poor financial manager. Just do your best to only borrow what you really need and at terms you can actually afford to repay. Don’t fall for the too-good-to-be-true promises of unscrupulous lenders. Also, keep your records organized – you will be glad you did if you ever get a dreaded audit letter from the IRS.

You Don’t Have to Do It Alone

Being a rugged individualist or standalone rebel is not the best way to run a business. Entrepreneurship should not be a solitary pursuit. Find friends who will shop at your store, contribute ideas and recommend your business to others. Also, find a mentor. This person ideally should be successful in business in their own right and willing to share some of the jewels of wisdom they have learned along the way. If things work out as you hope they will, you may find yourself in that very same mentor position one day.

But for now, take starting your business one small step at a time. Many mistakes can be avoided if you are patient, deliberate and willing to learn. The love for what you do is like the racing stripe on your beloved sports car. It will keep you smiling as long as you take care of the maintenance and driving fundamentals that lie beneath. Entrepreneurship is a long road, but you can master it one mile at a time.

Related Reading

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||