Three trends in contactless payments and how they can better your business.

We live in an era of supreme symbiosis between sellers and their customers. Increasingly, buyers are demanding a personalized shopping experience, curated product offerings, and maximum flexibility. Contactless payments are important because they help to facilitate the efficient, consumer-centered journey that shoppers of all ages have come to expect.

What are contactless payments?

The pandemic got a lot of merchants and their customers thinking about physical touch. Even after science demonstrated that the coronavirus was not believed to spread primarily via encountering contaminated surfaces, people continued to be squeamish. Why should they put themselves at even minimal risk when technology has provided other options?

A brief guide to contactless payments seems relevant at this point in our discussion. These so-called touchless transactions were exactly what buyers and sellers were looking for throughout the pandemic. That’s because they enable consumers to complete their purchases without ever touching a credit card reader or passing grimy cash back and forth.

Through the use of near-field communication (NFC) innovations, the buyer needs only to bring their digitally-equipped card, smartphone, or wearable device within two to three inches of the seller’s reader. Thanks to the digital wallet that the customer has pre-loaded with their payment details, data is encrypted, tokenized, and exchanged with the compatible technology in the reader. In a matter of seconds, the response comes back as to whether the payment was accepted or declined.

Now that you have learned about the speed, security, and efficiency contactless payments offer, you may be wondering where the industry is heading in the years to come. Innovations are coming on the scene at a rapid pace. Here are just a few of the enhancements you can expect very soon.

Increased use of biometric authentication.

If you have a modern cell phone, you may already be required to provide your fingerprint or place your face within view of the phone before you are allowed to unlock the device. This added security measure is destined to become a part of the contactless payments experience as well.

For this to happen, merchants’ readers will need to be equipped to accept all data that is based on a customer’s physical and structural characteristics. In the future, these devices will likely not only be capable of fingerprint and facial recognition, but may also even conduct vein mapping, iris scans, and heartbeat analysis. Considering the prevalence of identity theft and other digital crimes, this makes a great deal of sense.

Reduced use of physical credit cards.

Contactless payments can be conducted using wearable devices like fitness trackers, mobile phones, and physical plastic cards. Even though these cards may appear similar to what a customer might have carried two decades ago, they are actually quite sophisticated. A chip that is embedded into the card securely stores all relevant data, potentially even biometrics.

Even so, consumers are increasingly leaving their cash and card-filled wallets at home. Why tote around these bulky encumbrances when everything is securely available on a smartphone or wearable device? As a result, it looks like plastic will be taking more and more of a back seat, driven by the popularity of contactless payments.

Expanded use of mobile point of sale.

Not all that long ago, purchases were concluded at the checkout counter in the majority of instances, with some others occurring over the phone or by mail. However, the upsurge of smartphone use and the wireless technology that is behind it has single-handedly untethered the buying process.

Mobile point of sale (MPOS) systems are secure, light, and portable. Associates can use them to provide information about products to customers on the sales floor and to accept contactless payments from a credit card, smartphone, or wearable device from anywhere. Just as technology is making it easier to securely transmit purchase details, it is also allowing the process to take place anywhere: throughout the store, across town at a farmers market, or on a different continent.

Believe it or not, contactless payment technology was in use years before COVID-19 wreaked havoc. However, it wasn’t until the pandemic that customers and the merchants who served them fully came to recognize its potential. Without a doubt, the continued need to focus on convenience, security, and personalization will further drive the contactless payments industry and bring about developments that we cannot even imagine today. Whatever they may be, however, they are sure to reduce the compact of fraud and crime, make the payments process even faster and safer, and help to increase the profits of businesses both small and large.

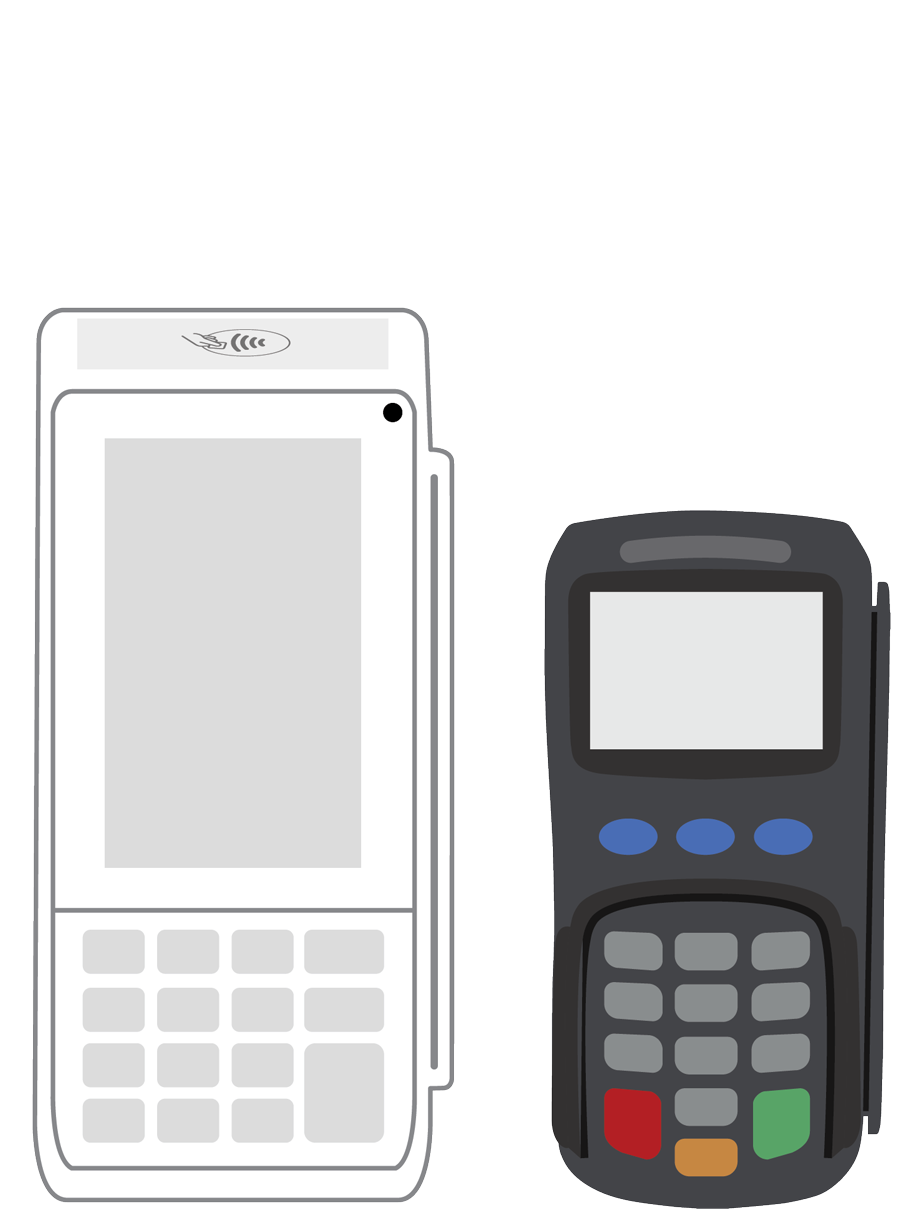

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||