Tips for tax season: Buried in paper receipts?

Here's a simple solution.

Nothing can make a cold shiver of dread go down your spine faster as a business owner than the idea of tax time. The mere thought of sorting through and organizing the thousands of paper receipts scattered throughout your domain is enough to make you want to crawl under the covers, never to be heard from again. But wait: There is great news in the form of the humble point of sale solution that you probably already use for taking customers’ in-person and online payments.

Unlock the potential of your POS system.

In addition to the hardware and software that reads customers’ credit card information and passes it on to your processing company to transact a purchase, your POS system is a vast repository of additional talents. These include the following.

- Database capabilities that allow you to gather, store, and retrieve customer information such as contact details, preferences and shopping behaviors, and histories.

- Customer relationship tools that let you set up and maintain dynamic rewards programs that keep people coming back.

- Inventory management tools that help you keep track of every piece of merchandise from the time it enters your store until it leaves in your customer’s hands. Additionally, your system likely has an easy invoicing solution that automates the majority of your billing. You can even set it to send payment reminders and to thank your customers when you have received their funds.

- Employee management systems that keep track of workers’ hours, generate timesheets, and allow you to communicate schedules and make changes on the fly.

Today’s smart POS systems are more than just glorified cash registers; they’re smart terminals that can revolutionize the way you interact with customers and sell your products.

When tax time rolls around.

Just as your POS system can be an excellent ally that makes all aspects of your day-to-day operations run smoothly, it also can transform your financial back office. With your POS solution handling the vast majority of your payments, you can have all of your purchases recorded electronically and stored securely off-site in the cloud. Moreover, you can rest assured that the pricing and discount information is correct and free from human data entry errors.

When the time comes to gather all of your profits and loss and sales details for Uncle Sam, you should be able to employ your POS solution’s reporting features to retrieve and put together your data in a format that you can use when filling out your federal forms. The days of poring over stacks of receipts are over once and for all when you make your systems electronic.

Let’s face it, paying taxes is never fun, and there will always be a part of you that wishes the whole process would just disappear. However, we all know that isn’t going to happen anytime soon. Thanks to ever-vigilant and efficient smart point of sale systems, however, sending Uncle Sam his share of the pie has become a much less stressful undertaking.

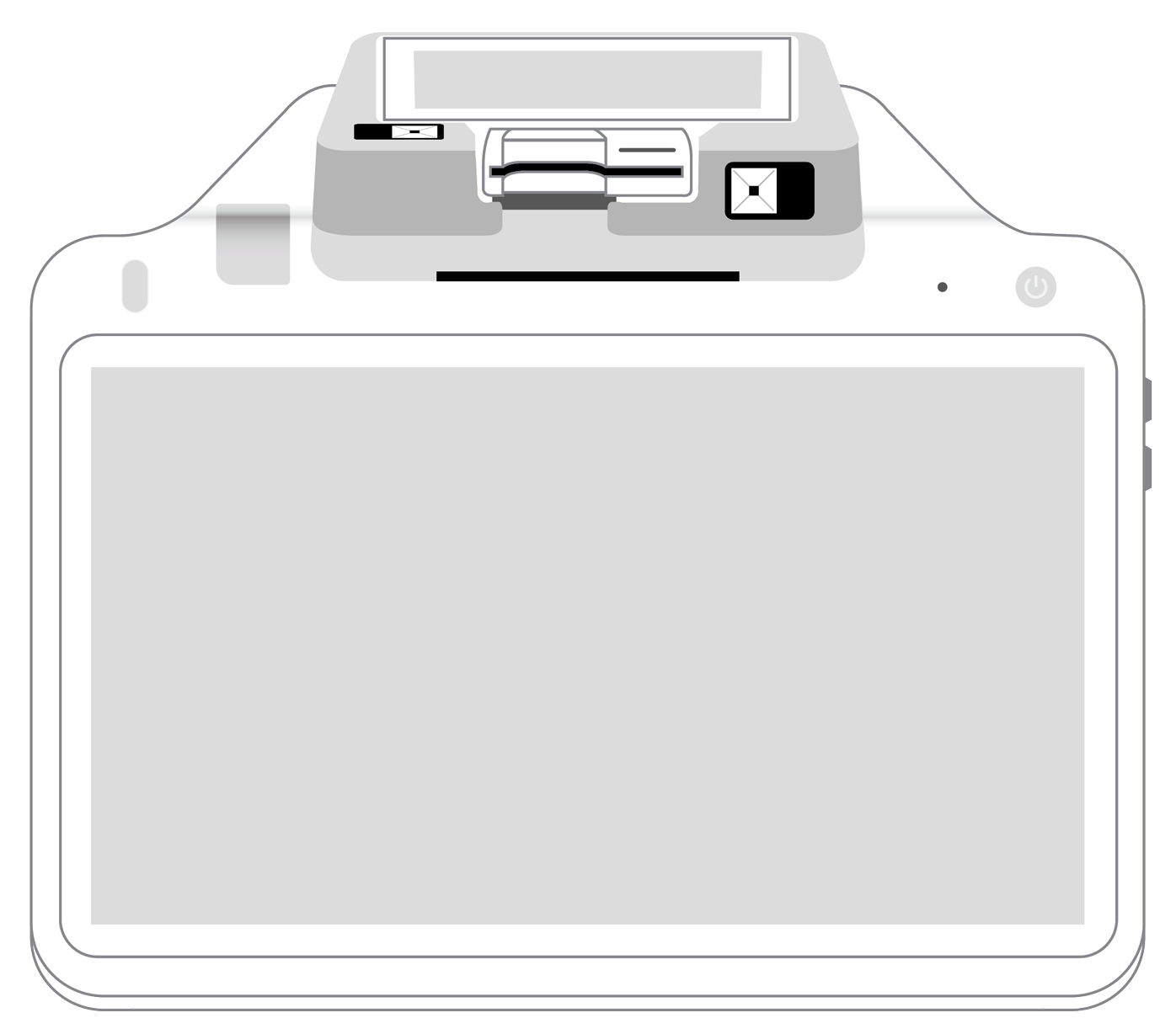

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||