Top seven reasons smart terminals beat traditional credit card terminals.

Creating, launching, and running a business is not for the faint of heart. Unless you are willing to repeatedly put your nose to the grindstone and perform a mind-numbing array of tasks such as marketing, product selection, employee management, accounting, customer service, and so forth, your operation is likely doomed to failure. In light of this undeniable fact, why should you also be concerned about the nitty-gritty details of how you accept payments?

Believe it or not, the payment options you offer your customers can make a huge difference. The options available to you provide a choice between old-school vs. innovative, vulnerability vs. security, slowness vs. speed, rigidity vs. flexibility, and single- vs. multi-capability. Because there is so much at stake, it makes sense to dive deeper into the choices you have when it comes to securely and seamlessly accepting your customers’ payments.

Payments – a brief historical perspective.

If you are of a certain age, you probably remember the old-fashioned cash register. This clunky instrument took up a great deal of counter space and performed just one function: Ringing up sales. Customers were then furnished with a written receipt at the end of the transaction.

As time passed, cash registers evolved and improved. Merchants were eventually able to use them to keep track of the sales totals for the day and their footprint became somewhat smaller.

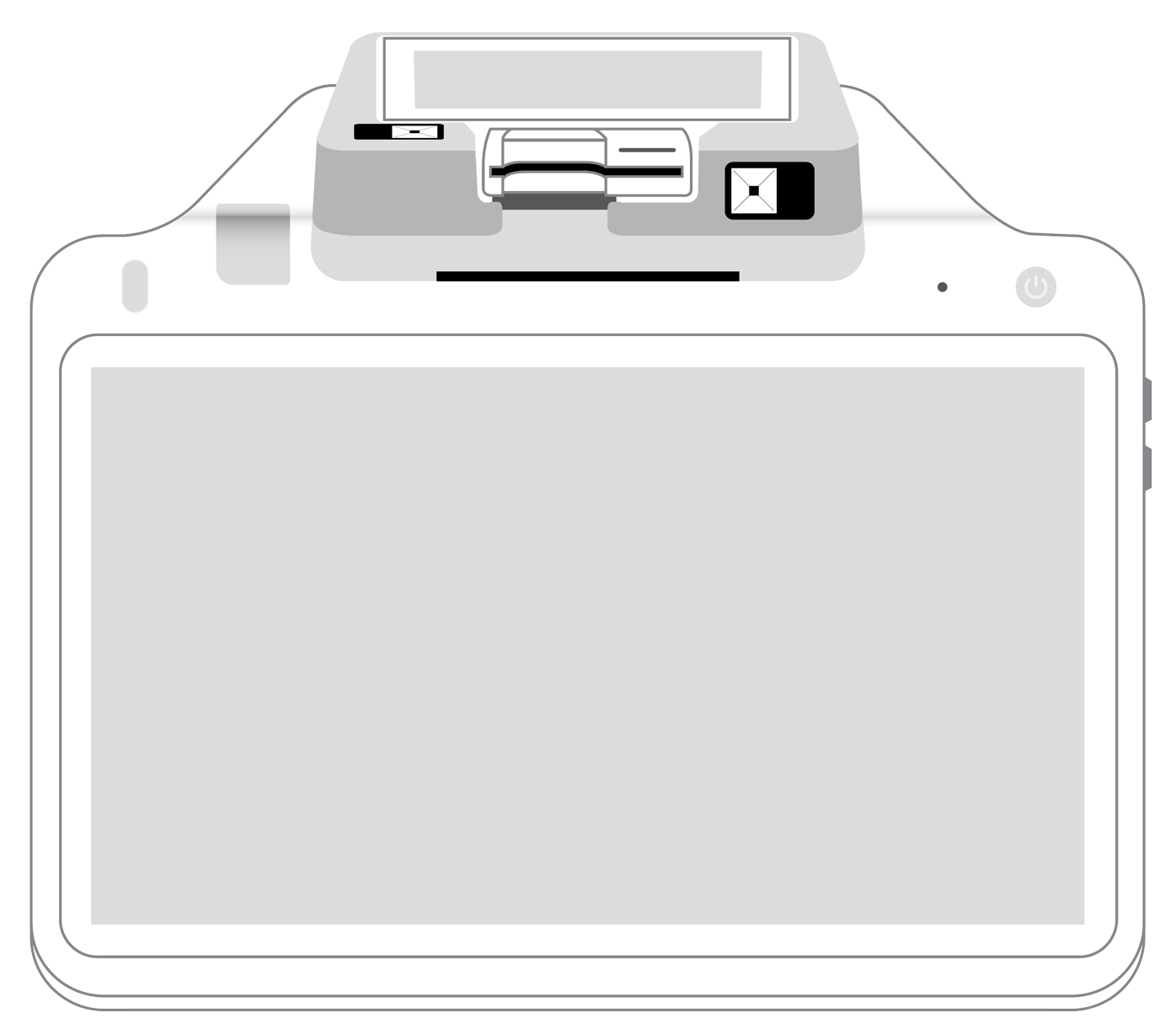

With the continued march of time and the advent of computers came the point of sale system (POS). Initially tethered to the counter and connected to the internet with the use of wires, these systems allowed customers to swipe their cards in a reader which then passed their payment information on to the payment processor and the customer’s bank for approval. These updated solutions gained portability when they became wireless. Today’s so-called smart terminals are the latest iteration of intelligent POS systems, and the technology they contain can truly help take your business to the next level in several substantial ways.

1. You can accept multiple payment types.

Your customers have many choices, both locally and globally. That’s why it’s up to you to make your ecommerce or brick-and-mortar store as appealing as possible. One of the best ways to accomplish this task is to give buyers what they want, including the payment methods they prefer to use.

When we say that smart terminals are intelligent, we mean that their software is equipped to provide ever-increasing flexibility when it comes to payment types. No longer is it simply a choice between cash or charge. Modern shoppers have cash, credit cards, debit cards, gift cards, and electronic checks. Some may prefer to pay in increments while others may love a monthly subscription.

2. You can accept international payments.

Have you dipped your toes into the global market? One of the best ways to endear yourself to buyers overseas is to let them pay using the native currency they are comfortable and familiar with.

Luckily, today’s smart terminals can integrate seamlessly with your shopping cart software to show customers exactly what they will be charged in their country’s currency. All you need to do is determine which specific currencies you want to support. As a side note, you will also need to do your homework in terms of local regulations and taxes and will want to carefully research who your customers are, as well as their cultural buying behaviors.

3. You can get a better handle on inventory management.

Your products are the indispensable lifeblood that courses through your business. Without a reliable selection of the particular items your customers want, you run the risk of losing sales. By the same token, the over-ordering of goods that are not moving off the shelves can tie up cash and prevent you from making efficient use of your floor space.

One of the most amazing benefits a smart terminal can provide is inventory management capabilities. You can think of your software as a hyper-efficient silent partner who constantly keeps track of what is selling and what is languishing on your shelves. With the aid of a barcode scanner, these modern marvels can track the progress of a product from the moment it is stocked until it is sold.

When you have ready access to this vital information, re-ordering and pivoting to address changes in customer behavior become second nature. As soon as your system detects that a hot-selling item is running low, it can add it to your next order. After creating a report and seeing the goods that are not grabbing customers’ fancy, you can make decisions about how to move them out of your inventory: free giveaways, mark-downs, etc. to clear the way for the products your customers are clamoring for.

4. You can send invoices automatically.

Gone are the days when you need to hand-write invoices and keep track of late payments with a printed calendar and spreadsheet. Once you have a smart terminal at your side, you can pass the job on to its software, instructing it to send bills and generate payment reminder emails automatically. Yes, there will be times when the personal touch is an important part of working out late payment arrangements, but these days, most of the routine work can be done by your smart terminal.

5. You can set up recurring payments.

Not so long ago, only a handful of businesses offered the option of recurring payments to their customers. Today, things are a lot different. Merchants of all types are now jumping on the bandwagon that had formerly been occupied by health clubs and daycare centers. As the name implies, recurring payments allow you and your customers to agree that a set amount of money will be withdrawn from their bank account on a prescribed day.

Once the recurring payment details have been entered into your stationary or portable smart terminal, both parties can relax and let the process take over. You no longer need to contend with the aggravation of chasing down late payments. Meanwhile, your customers have a firm idea of exactly how much cash will be coming in each month. Consumers can “set it and forget it” with the knowledge that they can expect a continuous flow of products or services.

6. You can accept contactless payments.

Smartphones have revolutionized numerous parts of our lives, including how and where we make purchases. The digital wallets that are built into the phones’ operating systems allow consumers to securely store sensitive credit card information that can later be used to securely make purchases. This occurs simply by placing the smartphone near a reader that is equipped with near-field communication (NFC) or radio frequency ID (RFID) technology. Within just two or three seconds, cardholder data is encrypted and tokenized, authenticated, and passed on for approval and processing.

In an era when coming into physical contact with credit card readers has given many customers and merchants pause, touchless payments are quickly becoming the preferred standard. Fortunately, most smart terminals are up to the task and can even allow you to take your business on the road. All you need is a portable smart terminal, some creativity, and the staff to support your pop-up store, fair, or farmers market presence to accept payments.

7. You can create actionable sales reports.

Your smart terminal should be a whiz at keeping track of numerous pieces of information about your products: what you have on hand, what was sold, and when and which staff member was responsible for the sale. To access these invaluable nuggets of data, all you need to do is make a few clicks to generate a customized sales report. With the real-time results right in front of you in a clear format, you will be in a much better position to make decisions about how you plan to move forward. That includes determining which items you should buy more of and which you no longer need to stock, which employees deserve a promotion and which need additional training, and so forth.

In many ways, incorporating a smart terminal into your business is at least as good as hiring a genius human partner. These ingenious devices allow you to accept many different payment types in multiple settings while maintaining compliance with payment card industry standards. Indeed, with the proper smart terminal on board, you can even streamline and automate numerous aspects of running your retail establishment. In the end, that leaves you with more time to do what you do best: Managing and growing the small to mid-sized business you’re so passionate about.

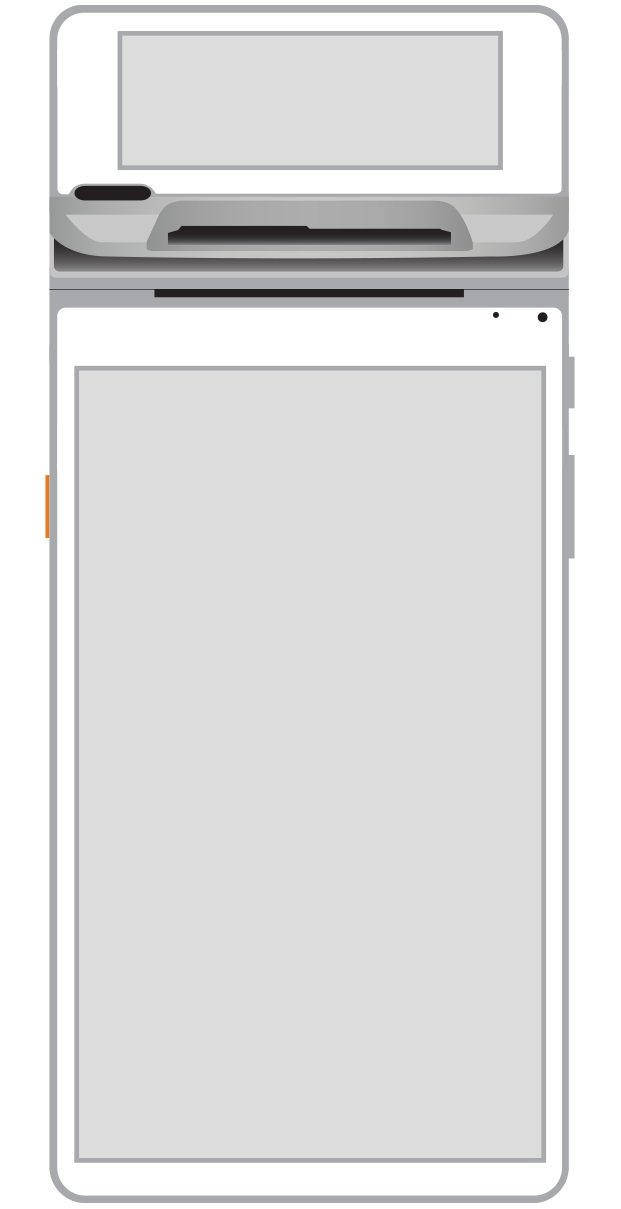

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||