Top Three Reasons Cash Will Soon Be Obsolete

Over the last few decades, cash has gradually fallen out of favor amongst consumers at large. Currently, two-thirds of the public prefer to make payments via credit and debit cards. In the near future, another form of payment is set to further squeeze cash right out of the loop.

The method is mobile payments, which allow customers to tap products via store-specific apps on iPhones, iPads and Androids. For customers, the benefits of going mobile are innumerable in terms of both convenience and safety.

For businesses, mobile payment solutions offer countless benefits. With purchasing apps and card-processing capabilities, retailers broaden their consumer appeal. Mobile solutions allow merchants to expedite sales and fund transfers with much greater efficiency, while keeping all monies safe from loss, theft or fire. The following three examples demonstrate how digital currency trumps physical cash as the payment method of the future.

Digital Payments are Faster

In busy shops and department stores, speed and efficiency of service are integral to customer satisfaction. Mobile payment solutions allow merchants to speed up lines and process sales with far greater speed, which can maximize business during the busiest hours of the day. The ability to accept payments in digital form not only courts a broader range of customers; it also induces people into spending more than they otherwise would if limited only to cash.

Digital Payments are Safer

Mobile devices provide the safest means for carrying money, period. Whenever a smartphone or pad is stolen, sensitive data can be removed via third-party apps, allowing users the piece of mind in knowing that all money is safely stored beyond the reach of potential thieves. And when it comes to organization, apps eliminate the hassle and confusion that stems from sorting through cash and coupons inside of purses or wallets.

Digital Payments Offer Greater Mobility

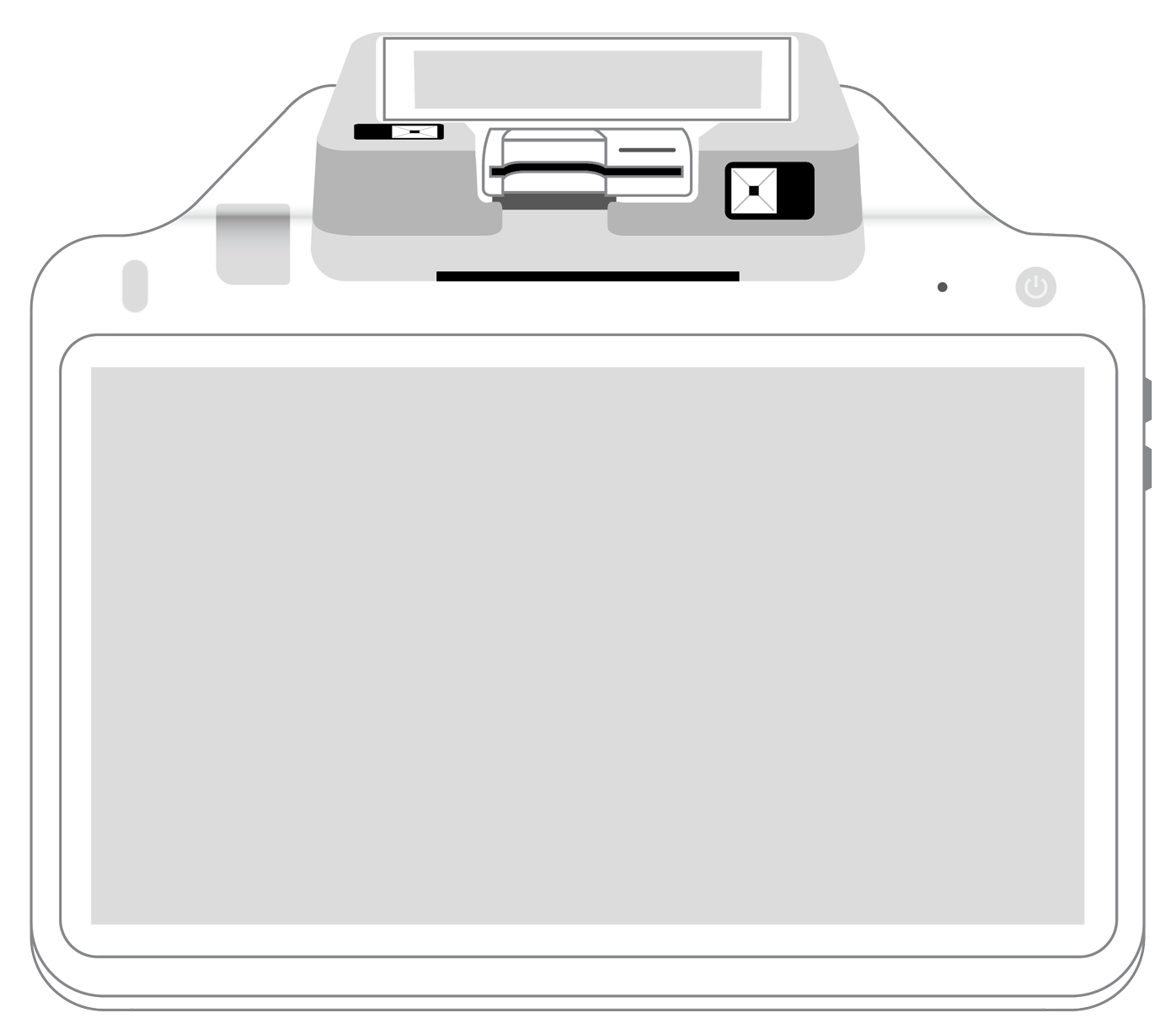

Outbound merchants have long had trouble accepting anything but cash Ð until recently. Thankfully, wireless credit card swiping units like the PayAnywhere reader have changed the face of POS at tradeshows and country fairs. The lightweight unit that plugs into the audio jack allows for greater ease of card acceptance, minus the excess baggage of terminals and registers. With the PayAnywhere credit card reader and app, merchants on the go can process sales quickly and safely, with no fear of money being lost or stolen while on location or out on the road.

More from News

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||