We've embraced tap-to-pay cards and phones, but are we ready for contactless jewelry?

In recent years, innovations in technology have revolutionized how consumers pay for products and services. People can make purchases from across the globe, buy online and pick up in-store, put gifts on layaway from their mobile phones, and utilize their native currency even if the retailer hails from across the pond. Furthermore, buyers can now make in-person mobile phone and credit card payments without ever coming into contact with the merchant’s hardware thanks to the contactless card reader.

How do traditional contactless payments work?

The secret lies in something called near-frequency communication technology (NFC) that is embedded in the cards and mobile phones of consumers as well as in sellers’ readers. It enables a shopper to transmit their payment details simply by bringing their card or smartphone near the retailer’s compatible reader. Within seconds and with top-level security, all the relevant information is transmitted, anti-fraud and other safety measures go into effect, and the payment is either accepted or declined.

The introduction of contactless payment jewelry.

Sellers who want to accept all types of payments now have a new invention to wrap their minds around: Contactless payment jewelry. The trend may have started in 2015 when fashion house Lyle & Scott partnered with card issuer Barclaycard to introduce a contactless payment jacket. The wearer needed only to place their tech-activated sleeve near the reader terminal to initiate the transaction process.

Since that day in 2015, contactless payments have become more and more popular. In addition to utilizing smart chip-enabled credit cards and mobile phones, buyers are now waving smart watches and all manner of contactless payment jewelry such as rings and bracelets to complete a purchase.

The future of contactless payment jewelry.

No doubt, the onset of the coronavirus pandemic in 2020 helped to transition contactless or “touchless” payments from what might have just been a temporary fad into a popular and potentially permanent payment type. In the first half of 2021 alone, research firm International Data Corp reported that 35.3 million contactless payment wearable devices were sold. 68t percent of that number were smartwatches, which have definitely come to be used broadly in recent years. However, the remaining 32 percent consisted of other items such as wristbands, standard watches with built-in contactless payment tech, and even fashion jewelry.

Clearly, there still seems to be a market for all manner of contactless wearable devices. However, many of the original sellers have taken a step back, deciding not to take their products beyond the prototype stage. Even so, there remains a path for contactless payment pins, rings, bracelets, necklaces, etc., with larger corporations and even smaller companies that want to embed branded technology with payment capabilities.

Will contactless payment jewelry become ubiquitous when it comes to providing secure payments? There’s no way to know for sure, however, it appears likely that it will continue to exist alongside their less flashy and more widely available card and smartwatch contemporaries.

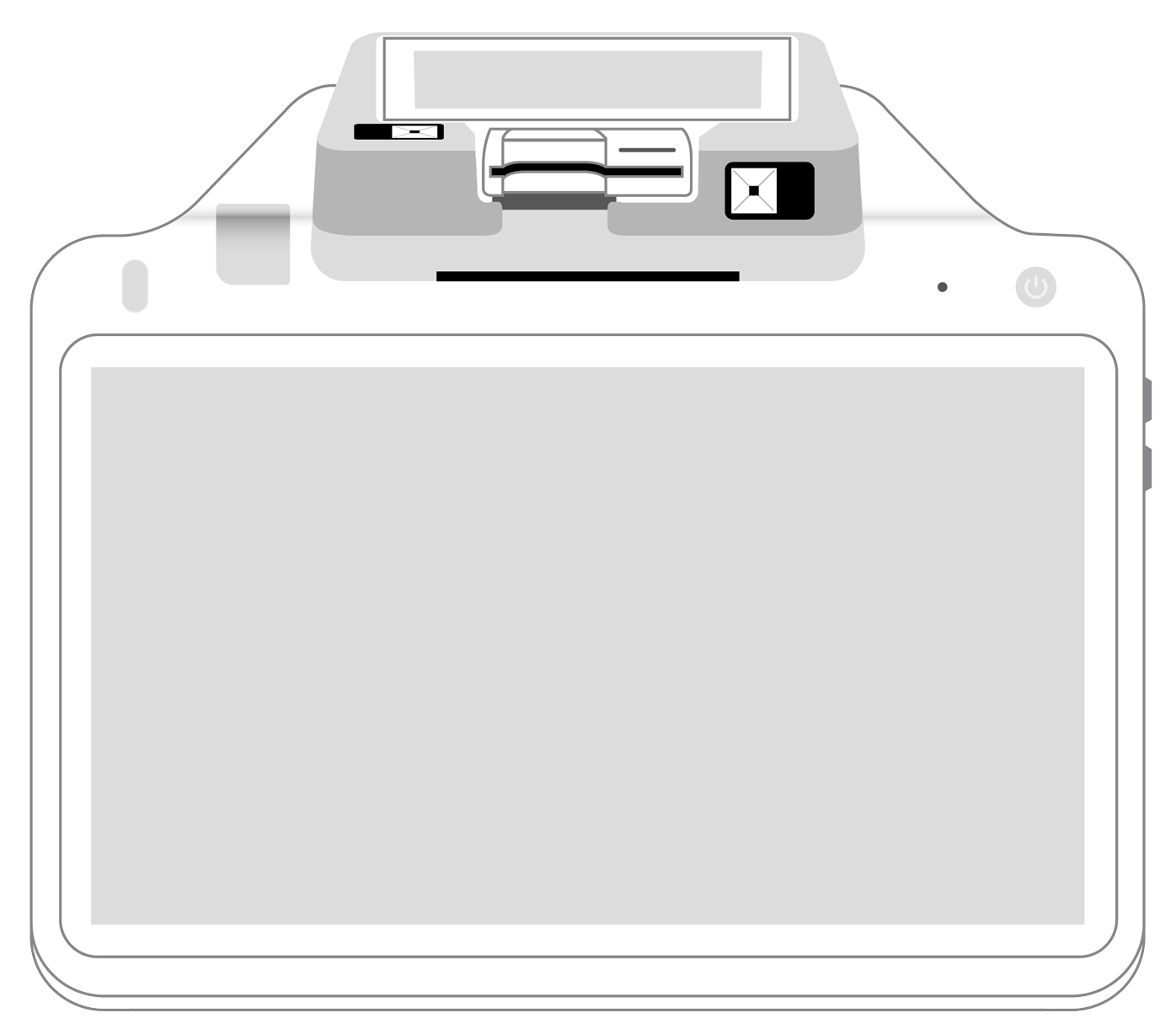

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||