What are mobile payments and how to use them

Mobile devices such as phones and tablets seem to be taking over virtually every task we perform, including how consumers pay for goods and services.

If you have not already spent time learning how to accept mobile payments in your store or online business, there is no time like the present to get up to speed.

Once you do, you will streamline your operations while pleasing your customers in the process.

What are mobile payments?

Mobile card processing is an umbrella term that refers to any transaction that is conducted through mobile technology. There are four basic types.

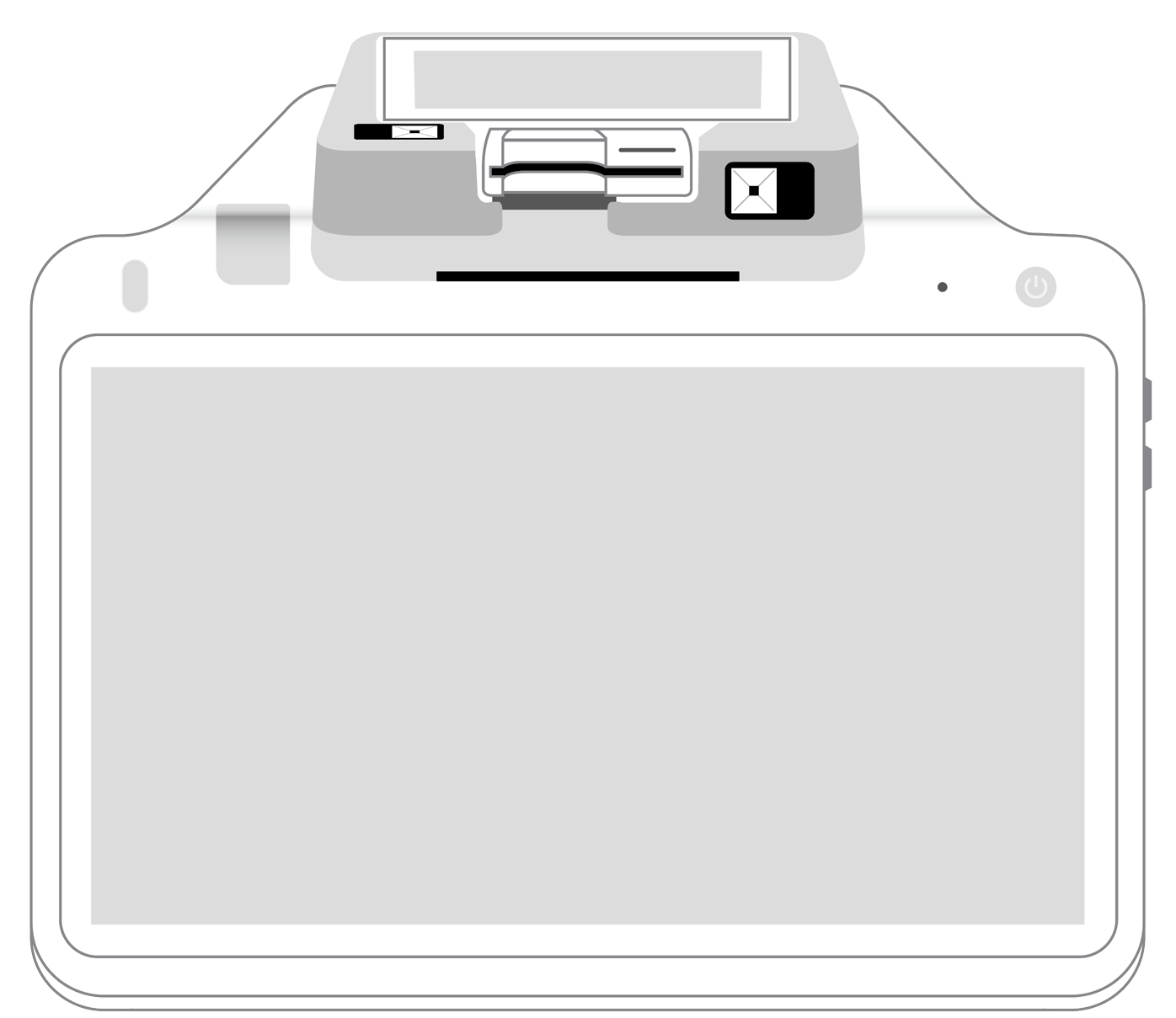

- Mobile card readers are the most common kind. In reality, the term can refer to either hardware that connects by Bluetooth or wire to the smartphone as well as a payment processing app that has been downloaded into the device.

- Mobile wallets are another method that is gaining increased popularity with every passing year. Any time someone uses a contactless card reader to make a payment, digital wallets are being employed. Payments are processed through apps such as Apple Pay, Samsung Pay, Google Pay, and PayPal to resolve the bill without the need to show a physical credit card.

- Another method that is frequently used is known as mobile ecommerce. This takes place when a customer makes a purchase from an ecommerce store via their mobile phone. In this case, the vendor completes the transaction using their virtual terminal.

- Finally, peer-to-peer (P2P) payments are no longer just being used between friends. Many businesses are using Venmo, PayPal, and other vendors to let their customers pay for goods and services.

Finding the right provider.

Now that you have learned the scope of mobile payments, you may be ready to bring them into your business right away. Before you do, however, it’s vital that you find the right payment processing company.

Begin by making sure the vendor can provide you with hardware equipped with near-field communications (NFC) technology. It is this innovation that makes contactless payments using wearables, phones, and credit cards possible.

Then, require that your provider take pains to comply with every aspect of the Payment Card Industry Data Security Standard (PCI DSS).

That must include following every rule dictating how cardholder information is stored, managed, and transmitted as well as the need to partner with a secure gateway to facilitate all payment transactions.

Next, be vigilant about pricing. Although transaction fees are set by credit card companies and cannot be negotiated, there are many other charges that will vary according to a number of factors.

Keep elements in mind such as the size of your business, your sales volume, and the features you need in order to accomplish your specific sales goals.

Additionally, be sure the software from your processing company can easily integrate with the third-party applications you are already using. This usually includes programs such as QuickBooks, Hubspot, Slack, etc.

Finally, be sure your vendor provides reliable, effective customer support. You cannot afford extended business interruptions that can happen when technical help is not accessible. Pick a company with multi-channel assistance that has received positive reviews from satisfied customers.

How to integrate mobile payments into your business.

Start by determining your needs. What types of payments will you take? Which inventory management, invoicing, recurring payments, etc. software will you be using? How quickly do you need payments to get into your account? What are your long-term business growth scenarios?

The answers to these questions will guide you as you choose a payment processing platform. Next, set up a merchant account. Talk to your processor about the best hardware and software to use.

Choose mobile card readers that allow you to take a diverse set of payment options, including credit and debit cards, mobile wallets, gift cards, and more.

Then come up with ways to advertise the various options you offer to your customers to raise their awareness.

Finally, after your systems have been up and running for one to two months, use the analytics tools built into your point of sale system to measure your transactions.

With this information, you can learn what merchandise has sold successfully as well as sales trends that change over time. These details will help you to make intelligent orders and develop insightful marketing campaigns to cement your future.

Customers and merchants alike value the speed, efficiency and security that mobile payments bring.

To add to their appeal, they represent an extremely affordable and flexible solution that can evolve with your business no matter where it takes you.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||