What are payment links? And why they can be a game changer

Offering maximum payment choice and flexibility is vital for today’s businesses. Learn how to incorporate payment links into your operations, and you will quickly recognize the many benefits.

Payment links defined.

Getting paid, that final step in the buying process, is often the most problematic part.

This is particularly true in the digital ecosystem. Fortunately, payment links provide businesses and customers alike with a convenient way to resolve invoices, securely and seamlessly, from anywhere.

Also known as checkout links, payment links are unique URLs that let the customer make a payment by interacting with the link. They can come in the form of “pay now” buttons on an ecommerce site, in an email or text message, or on a social media page.

Once the customer activates the URL, they are taken to a secure payment page where the transaction can be completed. In some cases, customer details can be pre-filled, making the process even faster.

Behind the scenes, the payment link process works like this:

You generate the link through your payment platform, entering all relevant transaction details. You then determine which channels you want to use to distribute the link: email, text, social media, via your website, etc.

Upon receiving the link, the customer clicks on it and is taken to the checkout page. After choosing their preferred payment method, they enter all the requested details. Upon confirmation, both you and your customer are notified that the payment went through successfully.

Benefits of payment links.

Payment links are great for merchants and customers alike. They can be sent and received without the need for a great deal of technical expertise, or complicated merchant accounts.

The process is streamlined and convenient. Customers can resolve their bill in just a few clicks. By the same token, the streamlined checkout process helps merchants to receive the funds they are owed in full and on time, with fewer delinquent payments and shopping cart abandonments.

All the while, data remains protected. Stringent security protocols, encryption, and tokenization mean that information is shielded from hackers throughout the funds exchange.

Payment links can be customized by you, the merchant. For instance, you can accept payments from multiple users for the same product. Product details and discount offers can also be placed on the checkout page, and you can maximize credibility by including your logo and other brand details.

In addition to allowing for multi-split payments, links can be tracked in real time because they are connected with your merchant point of sale system. As a result, you can create reports, monitor transactions, analyze data, and conduct accurate bookkeeping.

In a nutshell, payment links give you a great way to track and consolidate your financial operations, making everything from daily accounts reconciliation to tax preparation exponentially easier.

Business applications for payment links.

Are you now wondering whether this innovative yet simple way to take customer funds is right for your business? Perhaps you’d like to know if companies like yours are already using them.

Here are just some of the many real-world applications of this digital invoicing solution.

Ecommerce stores are leveraging payment links to allow customers to make easy payments directly from the merchant website or from a social media page.

Freelancers, contractors, landscapers and other service providers are using them to send invoices as soon as a service has been rendered, markedly increasing the likelihood that the customer will provide quick payment.

Events coordinators and fund-raising entities are also realizing the benefits of payment links. With ease, they can accept donations, sell tickets, and take registration fees.

Standard retailers and those in the hospitality industry are using payment links every day to take payments, in person or online. The enhanced convenience and efficiency that customers experience leads to enhanced satisfaction and loyalty that could mean repeat business in the future.

Finally, individuals are using links to remit funds to each other. Whether they are splitting the cost of a meal or dividing vacation-related charges, this electronic funds transfer method is fast and easy, as well as traceable and trackable.

This makes record-keeping for all parties easier and more accurate.

Completing a purchase securely and seamlessly can happen when merchants can employ the flexibility and versatility to be found with payment links.

If you have not already taken steps to implement them in your business model, talk to your gateway or payment services provider today to get started. You and your customers will be glad you did.

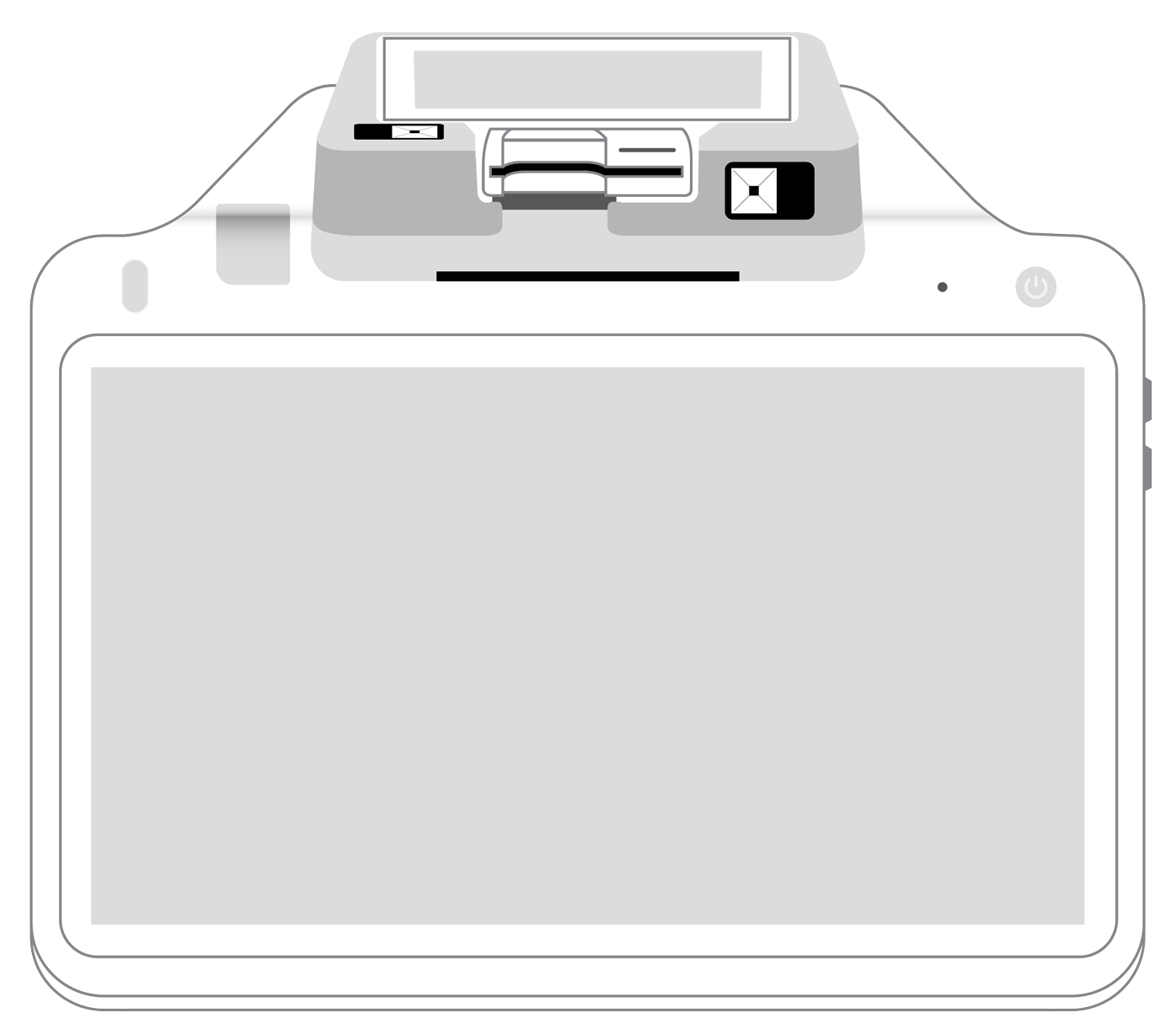

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||