What is a smart terminal and how does it work?

Innovations in technology have transformed traditional credit card-reading hardware and software into more intelligent, flexible, and portable options. Much to the joy of satisfied customers, merchants of all types and sizes are now using these innovations to provide a more seamless checkout experience.

Smart terminals defined.

For decades, shoppers with credit cards have been accustomed to paying for goods and services through a reader attached to a countertop terminal. They simply swiped their card and waited while the machine read their payment information and sent it on for verification and processing. In just a few seconds, word would come back as to whether the transaction was accepted or declined. The funds were transmitted out of the customer’s account, to the payment processing company and ultimately to the merchant.

Smart terminals continue to provide this service, allowing for conventional swiping or card insertion in the case of EMV payments. However, they also offer customers a great deal of added flexibility when it comes to the methods they use to pay. For instance, these upgraded models also facilitate NFC contactless transactions. With this technology, a customer pays with either a card that has a special chip or via the digital wallet that is built into their smartphone. Especially in an era when hygiene and data security are top of mind for virtually everyone, these capabilities are even more important and appreciated by all parties. Since many smart terminals are wireless, entrepreneurs can take them anywhere they want their business to go, from farmer’s markets to pop-up stores. Of course, smart payment devices not only make secure and diversified transactions possible, they also have numerous built-in capabilities that can aid in the overall running of the entire business.

Smart terminals do so much more than payment processing.

Given the range of capabilities that are built into these streamlined business accessories, it is no wonder that they’ve become so popular. Analytical data can be an invaluable guide to any business owner. It provides accurate information about who customers are, what they are buying, and even what products they are rejecting. Since smart terminals can interface smoothly with the other software you already have installed, processes such as accounting and payroll can be streamlined. Your smart terminal can drastically reduce instances of human error, not only from your cashiers but in your bookkeeping.

After a long day supervising the sales floor or serving behind the checkout counter, you are probably exhausted and mentally burned out. Your smart terminal can take over the compiling of your all-important batch reports, reducing input mistakes and enabling you to seamlessly upload documents into the cloud where they can be securely stored.

Your smart terminal is also a whiz at grabbing customer signatures and authenticating identities. Because it links to your processing company, a customer’s information can be instantaneously verified, minimizing instances of fraud that could cost you both time and money. As soon as a transaction is approved, you and your customer have a choice.

You can continue to provide paper receipts to people who want them. However, your terminal can also maintain an email database for customers who agree to give you their information. Once you have this electronic address, you can offer to send their receipt right to their in-box, a solution that saves paper and lets buyers keep records of their purchases in a centralized location instead of struggling to retain small slips of paper. Once you possess customers’ email information, you can also send newsletters and promotions that will entice them to return to your store.

Keeping a running total of every item in your inventory is daunting even for the most organized entrepreneur. Luckily, by partnering with the right merchant services provider, you can leave this important responsibility to your payments software, which can track the precise amount of each item in your stock, alerting you when specific products are running low so that you can re-order. By the same token, you can easily generate reports that show what is not selling well, enabling you to reduce the quantity you order in the future or eliminate that product altogether in favor of something new.

How does a smart terminal work?

If you want to integrate a smart terminal into your business, first explain your specific needs to your merchant services provider. Conducting a little research on the types of smart terminals available before you have this discussion will help you to better understand your options.

Once you get your payment device set up, it will be connected to your merchant services provider since this company will act as the middleman between you and your customer to securely process any electronic payments.

When the customer swipes, taps, or waves their card in or near your terminal’s reader, their unique information will be read and submitted to the merchant services provider. The provider, in its role as intermediary, will securely send the data to the customer’s bank, who determines whether the shopper has sufficient funds in their account to make the payment.

If all is well and the customer is who they claim to be and has enough funds for the purchase in their account, the payment will be accepted. The proceeds will be sent immediately to the merchant services provider, who will deduct their fee and funnel the remainder into your merchant account.

Wireless terminals can process payments in multiple ways.

Wireless smart terminals offer numerous advantages to merchants who choose to incorporate them into their businesses. They even offer flexibility in how they are connected. Sellers with stable internet connections often opt to link the terminal to their existing wifi network. This strategy offers both stability and added security. Furthermore, it allows for roaming between multiple access points, making it ideal for accepting payments in larger areas.

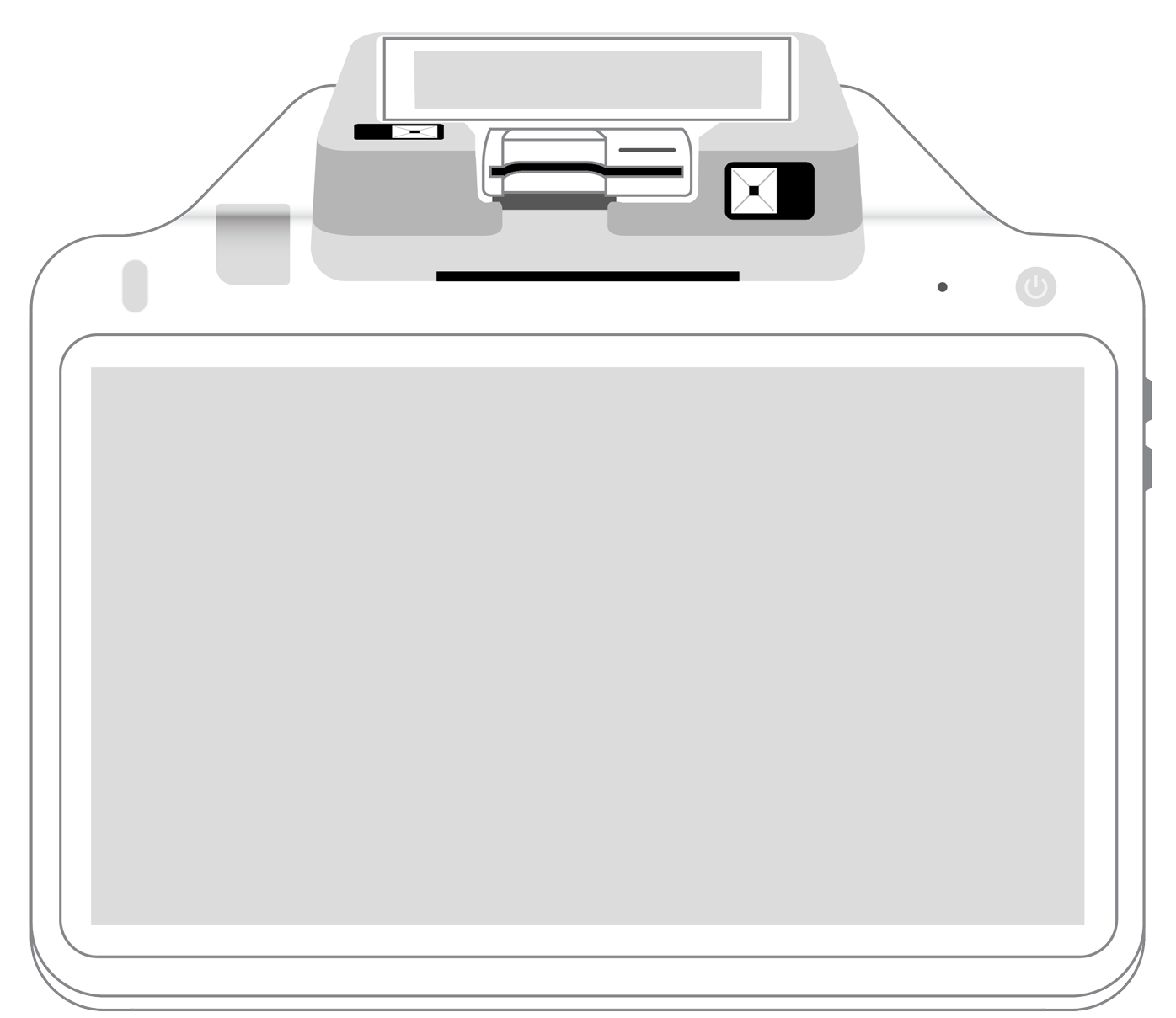

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||