What is CLV, how to achieve it, and why it's important for your retail operations

Entrepreneurs have numerous quantitative measures that they can employ to gauge their company performance and make predictions about future goals.

One of the most overlooked of these is customer lifetime value (CLV). Learn how to calculate and leverage this crucial number, and watch it work to your store’s advantage.

Defining CLV.

CLV is a simple concept. In basic terms, it can be defined as the value a customer represents to your company over a period of time. When you determine this number, you can use it to figure out how much you should spend on acquiring new shoppers.

On the surface, calculating CLV is straightforward. Just multiply the average annual customer profit by the average duration of customer retention.

Why using CLV is important for your business.

First and foremost, CLV helps you to get a handle on what you spend on your clients. Don’t stop with how much it costs to acquire a new shopper; what you actually should do is to use CLV to learn how much someone is bringing in over their lifespan as a customer.

When you create lasting relationships with buyers, you can look forward to a revenue stream that keeps flowing for months or even years.

Generating a CLV for each customer might seem like overkill, but it will help you to separate groups of buyers into smaller groups that can provide you with valuable insights. Doing so enables you to provide highly personalized offerings that match each sector’s preferences.

For instance, CLV can show you who your MVP high spenders are. After you identify them, you can curate premium experiences that furnish them with even more incentives to keep coming back and spending more.

It can also let you know who the buyers are who are bringing less money into your business so that you can modify your offerings and harness analytics and feedback to learn what they really want.

When you incorporate tools to monitor customers and their preferences, you can see your CLV numbers begin to climb in response. Create reports at regular intervals to give you snapshots and then use them to motivate yourself and your staff to excel.

How to Increase your average CLV.

There are four key performance indicators (KPIs) that combine to determine your CLV:

- average order value (AOV)

- purchase frequency

- gross margin (GM)

- churn rate (CR)

AOV = total sales revenue/total number of orders. Purchase frequency = the total number of orders/number of unique customers. GM, your profit percentage minus all direct costs of the products you sell, is calculated by subtracting the cost of goods sold from your total sales revenue/total sales revenue.

You will also need to calculate churn: number of customers at end time period-number of customers at beginning of time period/number of customers at the beginning of time period.

Now that you know what your KPIs are and how to determine their values, work to maximize each of them.

Do this by using the instruments you already have at your disposal. Your point of sale system comes equipped with retail payment solutions that can assist you in analyzing your sales data on the granular level.

Specifically, you can raise your AOV by sending personalized product recommendations to customers via text, email, or social media. If they purchase online, use your POS customer relationships management tool to create a loyalty program that encourages spending and frequent visits.

Boost product frequency with targeted emails and multi-channel communications. Divide buyers into segments, targeting people who have not bought anything from you for a while.

Enhance your GM by paying attention to inventory data. This will enable you to intelligently order, reducing waste and increasing efficiency and customer satisfaction. You might also focus on marketing products that yield a higher profit margin, using a price optimizer to determine the ideal selling price.

Reduce churn by boosting loyalty. Offer incentives for repeat customers, send personalized emails based on individual buying histories, communicate seamlessly across all channels, and use your POS to create a fun and engaging loyalty program.

With CLV calculations in your back pocket, you can optimize your profits and please your customers.

Regularly making this calculation can help you to segment your patrons, attract high-value customers, determine future VIPs so that you can cultivate them, prevent churn, and minimize your weak areas. If you aren’t already making the most out of the vital CLV statistic, there is no time like the present to begin implementing it for your company.

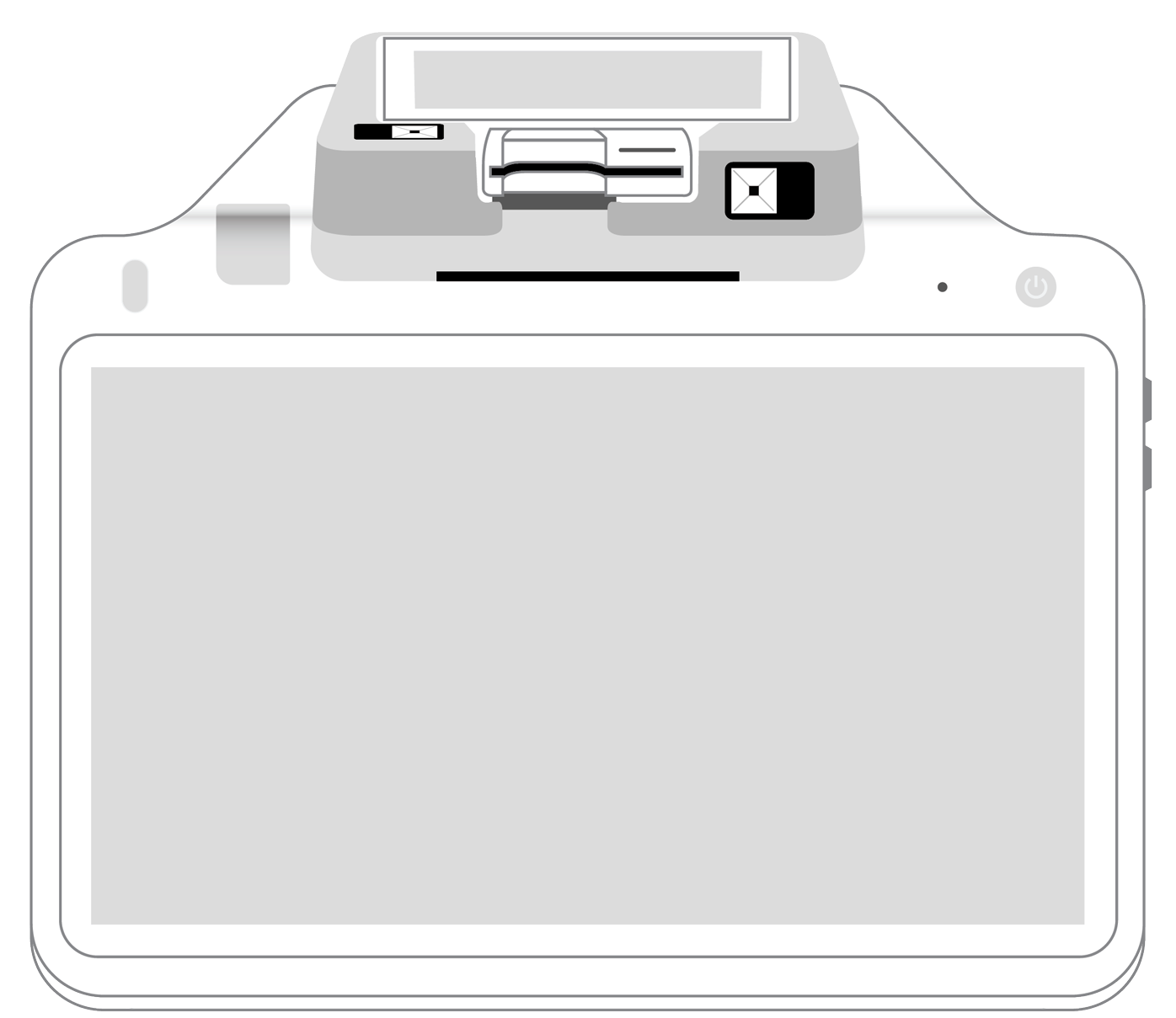

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||