When is it most appropriate to use a payment link?

The easier you make it for your customers to complete their payments, the more likely it will be that you get what you are owed quickly and in full.

Providing payment links to your clients allows you to streamline the process, boosting consistency and predictability for you, and enhancing the buying experience for your shoppers.

Payment links defined.

Payment links come in multiple forms: QR codes, URLs, and “buy now” buttons. Their function is to take customers to a secure checkout page in order to complete their purchase. Links can be accessed from a text message, web browser, social media post or email, and no extensive coding is required to create them.

Why businesses are embracing payment links.

When retailers elect to use a payment link, they are opening the door to a heightened shopping experience for their customers and more reliable cash flow for themselves.

Best of all, this type of invoicing does not require extensive technical knowledge and is usually included as part of your existing payment processing plan.

Payment links enable sellers to accept online payments even if they have no website at all. Companies who are in the process of building their ecommerce websites, but have not yet completed them as well as businesses that rarely need to process internet payments will find these QR codes, buttons, and links to be extremely effective invoicing tools.

Companies who engage in a great deal of SMS sales and marketing also benefit greatly from using payment links.

They enable these sellers to help their customers to complete purchases using the same vehicles they already employ in their relationship with the company.

Additionally, payment links are an excellent fit for stores with distinct groups of customers. If you communicate with these various segments by using targeted messages geared to each one, you can tailor unique payment pages to meet every segment’s unique needs.

Alternatively, let’s say you are collecting donations or engaging in other types of fund-raising. For customers wanting to make charitable gifts, it is even more important to create a credible and seamless checkout experience.

Any kinks in the process may result in losing the funds altogether. The streamlined simplicity of payment links makes them a perfect fit in these situations.

There may be occasions when you don’t have access to your mobile card reader or terminal. Without the ability to instantly generate a payment link that can be texted or emailed to a customer, you would most likely lose the sale.

Benefits of payment links.

As we have already stated, payment links are simple and easy to implement and activate. At the same time, they can be customized and integrated into unique payment pages for disparate segments of your customers.

Furthermore, businesses can send online invoices that contain these links. When clients receive everything that they need to resolve their bill with just a few clicks, they will be far more likely to make their payment as soon as the notification arrives.

For you as an entrepreneur, this minimizes the need to chase late payments and helps to create a friendly rapport.

Because payment links are so flexible, they will help to boost your conversion rates. This is because they allow you to target your existing segments and reach out to new audiences with streamlined payment methods that make purchasing a breeze.

Finally, payment links give you instant, low-cost ways for you to customize customers’ payment experiences. You might choose to tailor pages to appeal to different client demographics or modify them according to the campaign you are currently featuring.

It’s also easy to include your specific branding and even to auto-fill details the customer has already provided to you so that the payment procedure can be even faster.

One of the main causes for shopping cart abandonment occurs when clients become frustrated with their checkout experience.

Once you integrate payment links into your daily operations, you will be able to create a flexible and very diverse journey that can be customized to maximize appeal and inspire trust. Best of all, your chances of receiving your funds in a timely manner will improve exponentially.

Do you want to integrate payment links into your company? Simply talk to your payment processing provider, who can furnish you with everything you need to know to get started quickly and without having to hire a web developer or IT specialist.

Before you know it, the funds will be rolling in faster, and your customers will be impressed with their upgraded buying experience.

Related Reading

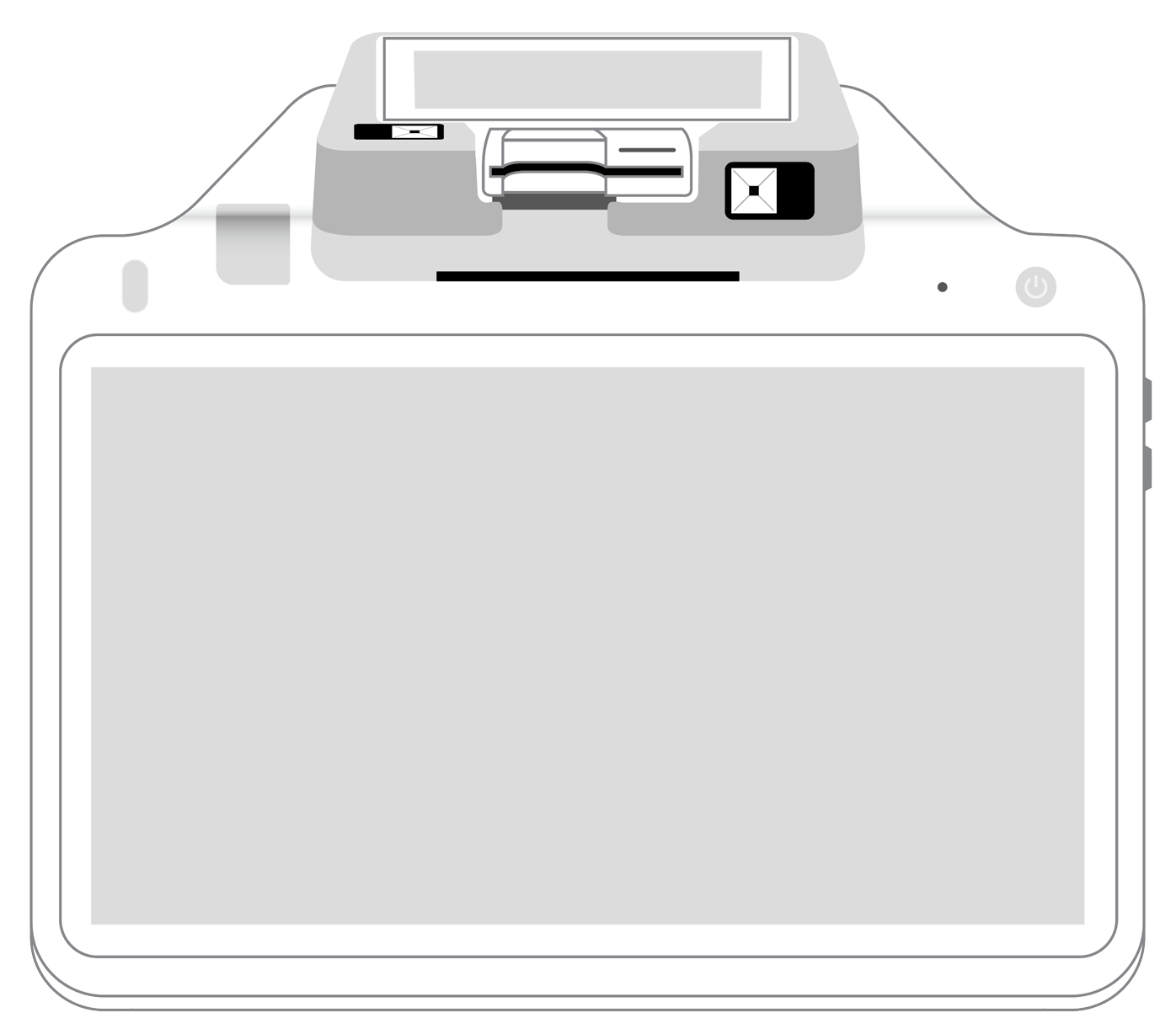

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||