Which Credit Card Reader is Right for Me?

Choosing the right credit card reader is simply a matter of determining and recognizing your small business’ unique processing needs. Readers can vary from traditional terminals that are usually found in storefronts, to virtual terminals for an online business.

Choosing the right credit card reader is simply a matter of determining and recognizing your small business’ unique processing needs. Readers can vary from traditional terminals that are usually found in storefronts, to virtual terminals for an online business.

Here are a few things to help you determine which terminal is best for your business:

Traditional Terminals

If your business involves face-to-face contact with your customers, a traditional terminal will best fit your needs. From retailors to restaurant owners, traditional terminals allow for “card present” transactions to be completed. This is when the cardholder and the credit card are both present at the time of the transaction. A countertop card reader enables you to swipe customers’ credit cards through the reader to process the transaction. To process debit cards and EBT cards, a PIN pad can be added or included in most terminals. Traditional terminals also have the ability to connect to printers to provide you and your customers with receipts.

Wireless Terminals

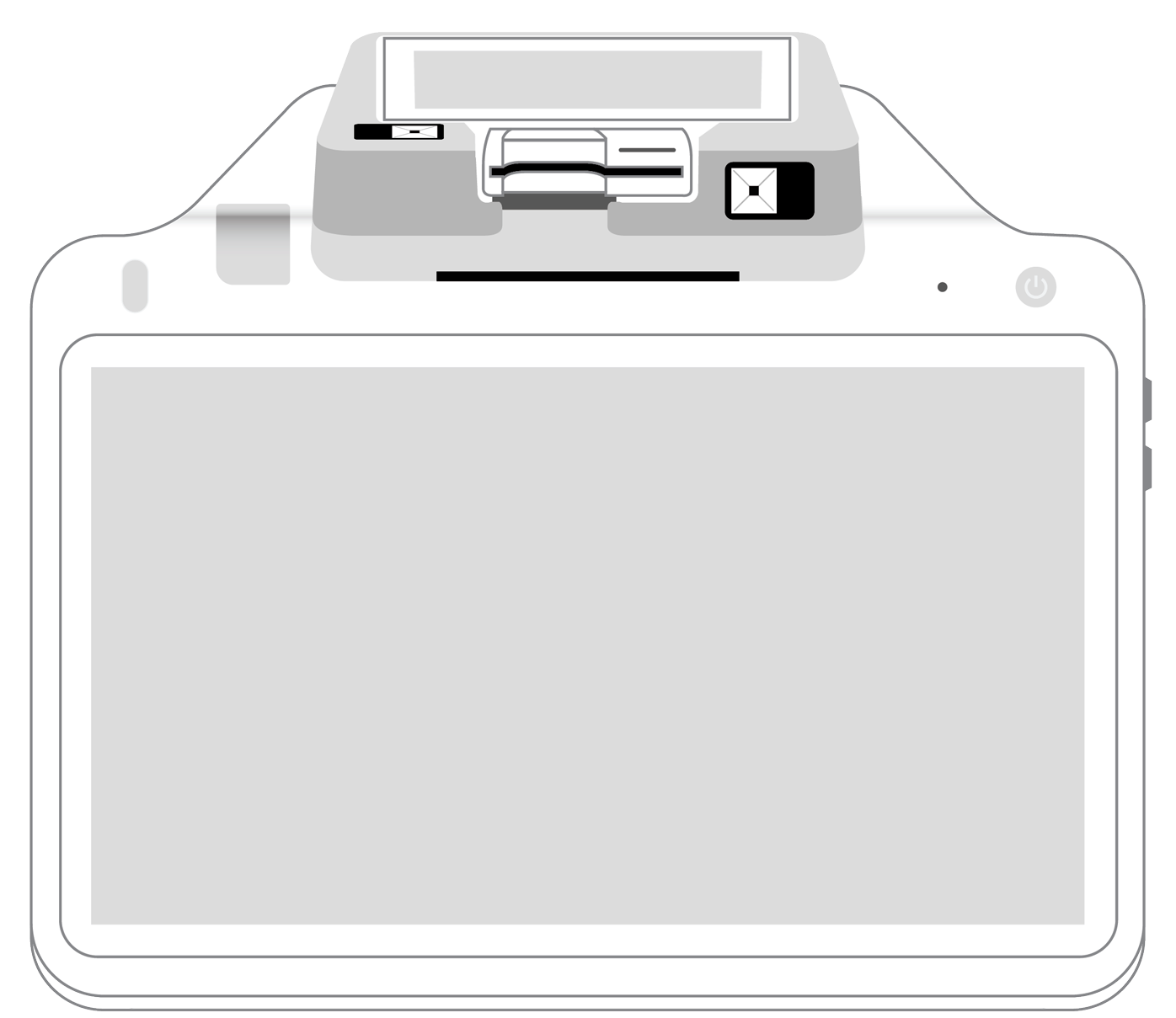

Wireless credit card readers are perfect for businesses that are always on the go. Mobile point of sale (mPOS) systems give you the opportunity to process transactions at any location, any time. These are great for companies and employees who travel a lot. Turning your smartphone or tablet into a credit card reader is quick and easy with the portable terminal and compatible integration applications. Things to consider when choosing a mobile card processor are weight, durability, compatibility and battery life.

Virtual Terminals

Online terminals can help improve cash flow and attract new customers for e-commerce businesses. Virtual terminals allow for businesses to process card-not-present transactions (CNP) online or over the phone. With virtual terminals, there is no need for a physical card terminal since the online software processes the transactions. All you have to do is enter the credit card number and the software will handle the authorization and processing from there.

When choosing a credit card terminal, make sure to consider which features and options will work well with your business’ specific needs. Your merchant account service provider, like PayAnywhere, can help you determine the right equipment to help your business function flawlessly.

Related Reading

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||