Why mobile payments aren’t as risky as you think.

More consumers and business owners are embracing contactless mobile payments as a growing number of smartphones become equipped with near-field communication (NFC) capabilities. Although the technology isn’t without its security concerns, several characteristics of mobile payments may make them more secure than other options.

Confirmation of identity.

Prior to making a mobile payment, consumers must authorize the transaction using one or more forms of authentication, including PINs, fingerprints, and/or facial scans. Some devices use two-factor authentication (2FA), which requires two different identifiers to be presented before the payment will go through.

Bypassing credit card numbers.

Payment apps from top manufacturers don't use credit card numbers to complete NFC transactions. Instead, a unique code or token is generated for each payment that is only good for one use. This protects sensitive information from theft during transmission. Even if a hacker does manage to grab a code, it expires after the payment is made. That means it can’t be used to go on a spending spree using card information stored on the device.

Additional safety measures.

Google’s smartphones have a feature called SafetyNet, which is designed to detect deviations from the normal state of the device. If the phone has been rooted, is running a custom Android ROM, or is infected with malware without the owner's knowledge, the payment app won’t work.

Remote tracking.

Both Android and Apple devices have a feature users can rely on to find lost phones and prevent malicious activity. As long as that feature is enabled, the owner can locate the device via an online platform and either lock it or wipe its contents, rendering it useless to anyone who may decide to try and gain access to credit card information or other personal data.

Safer terminals.

The transaction time for mobile payment processing is much shorter than that of chip card transactions. Mobile terminals are also more difficult to compromise. Unlike with online payments, the information from the transaction isn't stored at the point of sale, so hackers can’t get any information from an internal system. However, because there are still ways to compromise NFC transactions like Apple Pay, business owners should always partner with POS vendors using strong security protocols.

Proximity

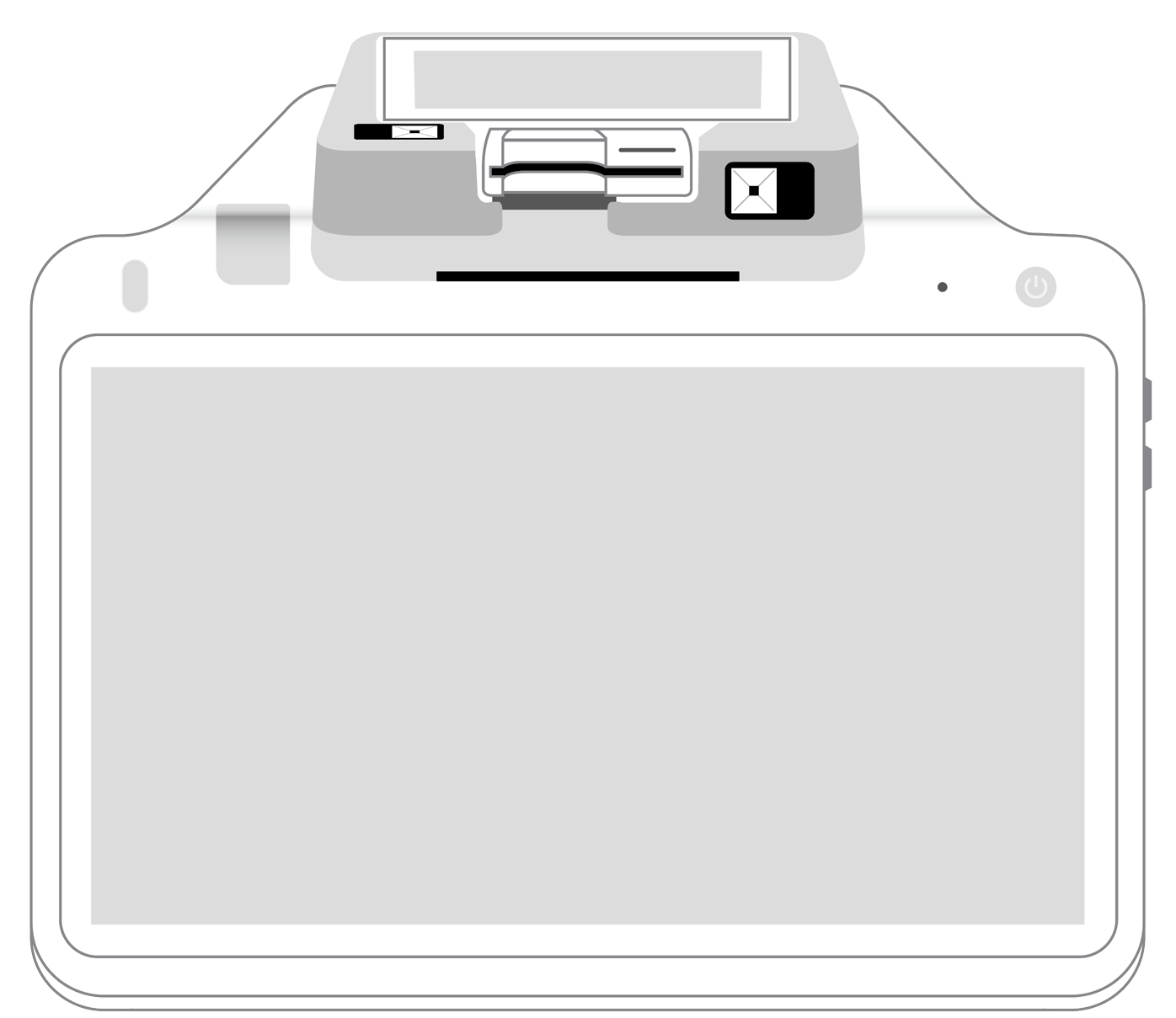

NFC payments require devices to be very close to the terminal, hence the “near” in near-field communication. To steal information, a hacker would practically have to be standing on your foot. In addition, some NFC-enabled POS systems are mobile, like the Payanywhere Smart Terminal and can be brought right to customers regardless of where they are in a store or restaurant. This makes it harder for hackers to predict where and when transactions will take place.

Whether paying with your phone at your favorite store or adding contactless payment processing to your shop’s POS system, you can rely on these security measures to help keep sensitive information safe. As contactless payments continue to increase in popularity, new security measures should arise to continue to improve the safety of the technology.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||