Why next day funding is so important for your business.

If you’re going to accept credit, debit, or ACH payments from your customers, you have no choice but to do so through a payment processing company. The problem is that while this entity provides you with added security and streamlined transactions, it also means that you may need to wait for days to get your hands on the money you’ve earned. At last, Next Day Funding provides a solution.

Why the hold-up?

Before we go any further, let’s be clear about one thing: Payment processing companies are not holding up your payments just to be difficult or uncooperative. Before they send you the proceeds from your sales, they first assess the legitimacy of every transaction. After all, they are in business to make a profit just as you are. In the end, their caution can sometimes catch fraudsters before their criminal activity can do any lasting damage to your wallet or reputation.

How does next day funding work?

In recent years, however, the industry concluded that it could still protect itself while simultaneously getting funds to you much faster via next day funding. Here’s how it works.

• Your payment processor sets a cutoff time, such as 10 p.m.

• Any payments made to you before the cutoff are eligible for next day funding.

• The funds appear in your account on the very next business day.

How next day funding can benefit your business.

You want your money to be in your pocket as quickly as possible. That just seems like the right way for things to be, doesn’t it? However, there are other clear advantages that next day funding can offer your business.

• Easier and faster access to your cash. A steady flow of money allows you to perform vital tasks like paying your staff, purchasing inventory, and taking care of emergencies. It’s also nice to have this cash should an unexpected, time-sensitive opportunity present itself.

• Allows for more efficient account settlement. Having available funds means that you can pay off your creditors in a timely fashion. In some cases, vendors may even offer you incentives for paying early which could result in significant savings.

• When charges can be recorded in close proximity to when they were processed, you may be better able to spot irregularities that could be red flags signaling criminal activity. Identifying fraud can cut down on chargebacks and could save you a great deal of time and money.

With next day funding, you can have the best of both worlds. You still leverage the security and credibility that comes when you work with an established payment processor. At the same time, your profits are transferred into your bank account much more quickly – increasing your cash flow.

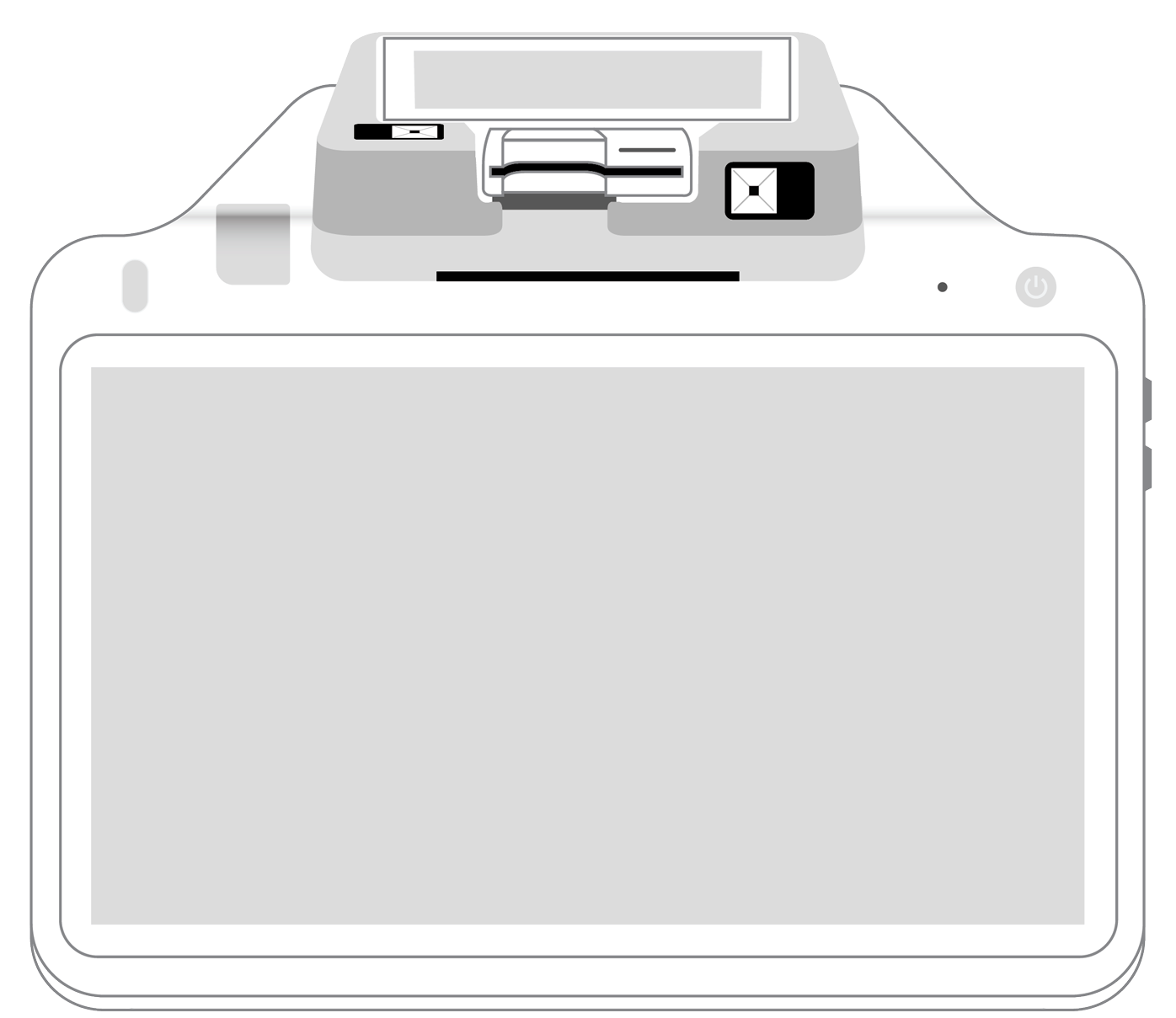

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||