Why switching to a smart payment terminal might make sense for your business.

Smart terminals are one of the latest options in point-of-sale (POS) systems and can change the way you manage your company. With business technology advancing at mind-bending speeds, how do you decide if an upgrade is worthwhile?

Smart terminals explained.

POS systems have come a long way. It wasn’t so long ago when a merchant’s only point of sale option was a manual cash register — a clunky machine with the single purpose of ringing up customers’ purchases. This machine changed over time, taking on capabilities previously limited to computers, before it started to be replaced by electronic and mobile POS systems.

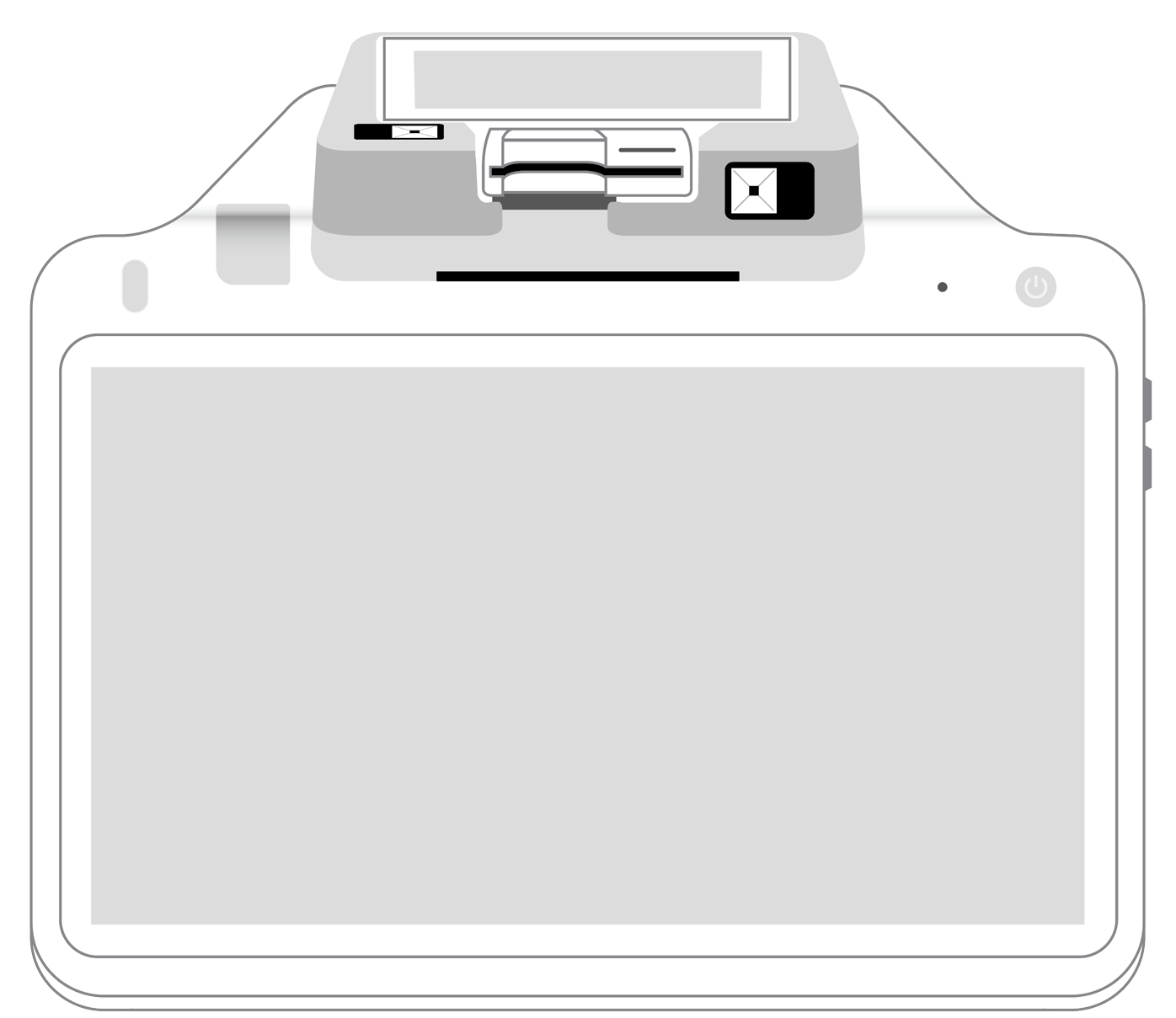

As the next evolution in POS, the smart terminal broadens the functionality of traditional payment devices, packing a surprising number of features into a single compact terminal. High-tech and streamlined, the smart terminal combines seamless payment processing technology with valuable business management tools. With one or more of these devices powering your business transactions, you can accept multiple payment types, handle business tasks, run sales reports, and scan barcodes for easy in-store and offsite sales.

Can a smart payment terminal help your business?

Silos and bottlenecks are the enemies of efficiency in business. Even with the best integrations, a regular POS system or payment gateway only allows you to initiate and process transactions. You still have to go to your computer or mobile device to handle tasks like accounting, employee management, and setting up recurring invoices. Delays can affect your company’s potential for growth and hold you back from reaching your goals.

The right smart terminal gives you access to everything you need to streamline your operations and grow your business in one place. Using an innovative combination of hardware, software, and an intuitive touchscreen design, smart terminals take care of:

- Scanning items and tracking inventory.

- Sending invoices and setting up recurring payments.

- Both traditional magstriped and EMV chip card payments.

- NFC contactless and RFID transactions.

- Electronic signature capture.

- The printing and emailing receipts.

- The reporting of sales information.

Collectively, these functions have the potential to replace the crazy assortment of software and apps you’re using right now and make some of your most cumbersome business tasks easier.

When it’s smart to make the switch.

If you need your POS to do more than ring up purchases and spit out receipts, a smart payment terminal is probably just what you’re looking for. You know it’s time to upgrade when you:

- Want to expand the payment types you accept.

- Want to track customer activities.

- Are sick of switching between apps and devices to manage your business.

- Require a solution to unify online and offline customer experiences.

- Can’t wait to take your sales to the next level.

You don’t always need the “latest and greatest” in business technology to fulfill these functions, but the perks of a smart terminal make it an investment well worth considering. If upgrading allows you to meet your customers’ needs better and can streamline the way you manage basic operations, switching to a smart terminal is probably a wise move.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||