Why the right point of sale system is a must for CPAs during tax season.

Running your own successful CPA business involves numerous moving parts. That’s true whether your customers are individuals or other companies, and it is the case year-round. However, no place on the calendar is more stressful or that necessitates more attention to detail than tax time. This is when a point of sale system truly shines.

Point of sale systems defined.

You are probably well aware of these hardware-software combinations, perhaps mostly from your experience as a consumer. In general, the point of sale (POS) solution consists of several components.

- Payment processing and business management software.

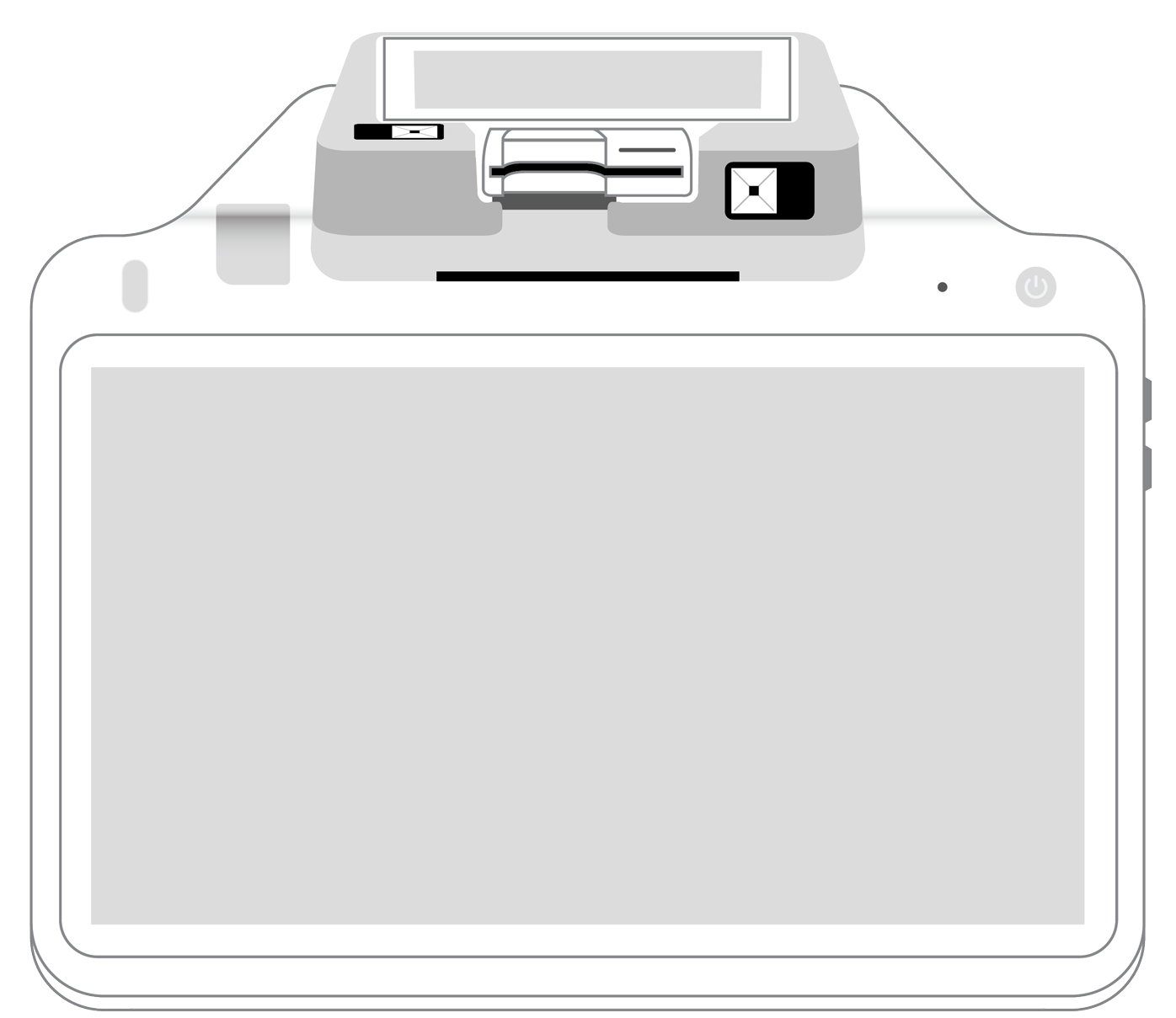

- A stationary terminal or wireless tablet the software is stored on.

- A credit card reader that accesses the information on a customer’s card or mobile device.

- Peripherals, including barcode scanners and receipt printers.

On the surface, a POS system is ideally suited to accepting customers' payments for products or services. Its software communicates seamlessly with the payment processing company, which communicates with the other players in the procedure. Within a matter of seconds, the customer knows whether the transaction has been accepted or declined.

A deeper dive into POS systems.

Some providers of services, including a fair number of CPAs, mistakenly believe that a POS system is only really helpful to retail stores and restaurants. After all, why not just use a simple cash register or pared-down “dumb” credit card terminal to accept payments, especially during the hustle and bustle of tax season?

There are several aspects of a modern POS solution that set it high above a uni-functional credit card interpreter.

- Reduced human errors. As an accountant, you are well aware that every detail counts. Failing to register one receipt or document can negatively affect your entire report, compromising its accuracy. However, when all information is entered into your POS system, you don’t need to reckon with the vagaries of human data entry, and the likelihood of overall accuracy increases.

- Better customer service. During tax time, it’s all too easy to fail to record a service. Worse still, a regular customer might fall off your radar entirely, leading you to forget to follow up and encourage them to get their documents in on time so that you can process them by the deadline. With a modern POS solution on your team, you can automate tasks like customer reminders so that no one falls through the cracks.

- Streamlined invoicing and late payments management. During this busy time of the year, there are probably days when you have all you can do to put out the immediate fires that flare up in your face. That means that necessary tasks such as sending out invoices and reminding customers about a late payment fall by the wayside. As someone who is trying to keep your own cash flow humming, this situation is anything but optimal. Put your POS system on the case, however, and many of these jobs can be handled behind the scenes, leaving you to tend only to the ones that require your personal attention.

- Ongoing communication with customers. Asking for money owed is only one aspect of a strong communications strategy with your customers. Tax time represents the most lucrative part of the year for you but you may be missing out on business if you aren’t sending promotional emails to your customers a few weeks before the deadline. These emails can encourage customers to bring their information to your office for prompt, accurate filing. Many times, this is all that is required to prompt a procrastinator to act, and it could mean a nice influx of cash into your coffers in the long run.

- Secure payments. We have spent some time touting the bells and whistles of today’s modern POS solutions but we can’t end this article without returning to what your system does best: Safely and securely accept payments. With an updated POS system in place, you can count on state-of-the-art security and anti-fraud protection that not only ensures that the payment goes through but also protects your business and your customer from a data breach. When you consider how important the reputation of your CPA firm is to your present and future success, nothing in the world makes more sense than doing everything you can to safeguard the sensitive data that is your bread and butter.

As the operator of a CPA firm, tax time will always be one of the most stressful and lucrative periods of the year for you. However, with the able assistance of your POS solution, much of the redundancy and guesswork can be taken away once and for all. That adds up to better outcomes and a higher profit margin for your business.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||