Why you should modernize mobile payment technology in-store

Smartphones are upending the traditional methods of shopping, including how customers pay for their purchases.

This is true online; the trend can also be seen with in-person buying. If you haven’t yet integrated mobile payments into your retail operations, now just might be the time.

What are mobile payment transactions?

Mobile technology enables people to make purchases using only their smartphones or wearable devices. These are used to interface with a merchant’s Bluetooth card readers and associated infrastructure technologies.

Totally wireless, these processes take place thanks to innovations like near-field communication technology (NFC).

NFC technology enables buyers to complete their purchase simply by positioning their phone or wearable device within one to three inches of the merchant’s mobile card reader.

In other recent NFC trends, sellers have begun to use QR codes that buyers can scan, resulting in a link that directs them to a secure payments page.

How mobile payment technology works.

Although they look simple on the surface, mobile payments involve a few important steps. These include setting up a digital wallet, initiating a payment, transmitting the transaction, processing the payment, and payment completion.

The phones we carry today are nothing short of fully-functioning miniature computers, capable of storing details and interacting with downloaded and external technologies to perform numerous tasks. In order for funds to be successfully transferred from a customer’s account into that of the merchant, several steps must take place.

Before anything else can happen, customers need to do some work in advance by downloading a digital wallet app such as Apple Pay or Google Pay. They then input their payment details, which are tokenized and securely stored to prevent access by unauthorized parties.

When a shopper wants to make a purchase, they open this pre-established digital wallet. Their identity is authenticated with either facial or fingerprint recognition or by inputting a PIN.

Next comes the process to accept payments in-store. With NFC, the shopper simply places their phone or NFC-compatible wearable device near the merchant’s similarly equipped reader. Details are communicated safely and securely and are screened for funds availability and fraud risk by the attached gateway software.

In the case of a QR code, the shopper either scans the one provided by the business, or allows the merchant to scan theirs. This code contains either a link to the payment information, or the information itself.

The transaction is then processed, with payment data being sent to the store’s point of sale system, then to the payment processor or acquiring bank. Security risk is often minimized with tokenization or a one-time security code.

Once the customer’s bank is contacted, the token is verified by the bank or card issuer, who also checks for sufficient funds and approves or declines the transaction.

Details of the transaction’s fate are then sent to the business in the form of an authorization or declination code. The store’s POS provides confirmation via printed receipt or email to the customer, often automatically applying loyalty points or discounts.

The information is then recorded in the shopper’s digital wallet app, as well as in the company’s POS, and at the card issuer’s bank.

The benefits of incorporating modern mobile technology into your physical store.

Adopting a modern mobile payment solution brings many advantages to stores like yours. They include boosted customer satisfaction, affordability, easier reconciliation, better analytics, security, and an omnichannel experience.

Physical stores are rapidly incorporating modern mobile payment technology into their operations – and for good reason. Customers receive a faster and more convenient payment experience that allows for personalization and loyalty rewards.

Although there are processing fees associated with mobile payments, they can lead to more affordability because of their other features. Reconciliation is secure and fast. Sophisticated analytics provide insights into customer behaviors and transaction patterns, in an ecosystem that promotes high-level security and choice in how to pay and on which channels.

Customers are increasingly leaving cash and plastic cards behind in favor of making purchases on their smartphones and wearable devices.

Those stores that meet this rising demand by integrating modern mobile payment technology into their operations, can reap the rewards now and far into the future.

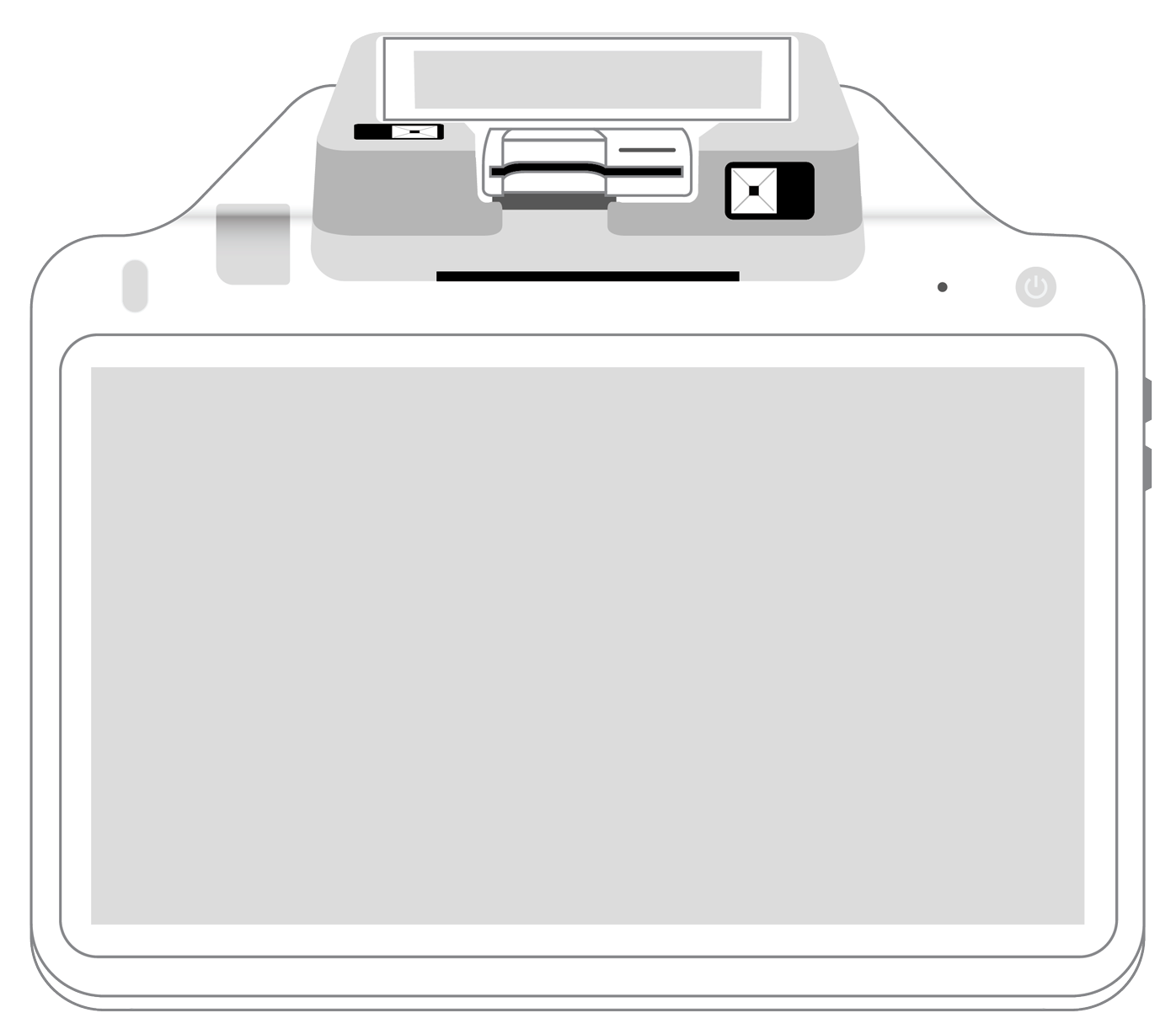

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||