So you received a 1099-K from us, now what?

At PayAnywhere, we appreciate your business and thank you for the opportunity to serve you as your mobile point of sale provider. With that, we are here to inform you of some recent updates to PayAnywhere's tax requirements.

As your merchant services provider, we are required to file an annual information return with the IRS and provide each merchant with a corresponding Form 1099-K which will report both monthly and annual gross sales. The information return and 1099-K for your transaction activity will be provided for your personal tax records. In addition to providing the 1099 form, the IRS requires PayAnywhere to compare each merchant's Tax Identification Number (TIN) and legal business name we have on file against what is on file with the IRS. Incorrect information can lead to funds being withheld. To avoid disruption in receiving your deposits, please visit the secure portal below and update your record https://www.irstincheck.com.

The login screen will require you to enter:

- Username: Merchant Identification Number (MID)

- Password: The last 4 digits of the primary account holder's Social Security Number

To update your account with the correct information, please indicate:

- Your type of business (Corporation, Partnership, Sole Proprietor, etc.)

- The legal business name of your company as it appears on your tax form

- Tax Identification Number (TIN) (The 9 digit number you use on your tax forms - either your Employer Identification Number (EIN) or if you are a sole proprietor it may be your Social Security Number)

If we do not have a valid TIN on file that matches the Tax Filing Name the IRS has on file, per Section 6050W, we may be required to begin backup withholding.

PayAnywhere thanks you for taking the time to comply with this federally-mandated reporting requirement.

We encourage you to reach out to our live customer service team at 1-855-649-2633 with any questions you may have.

More from News

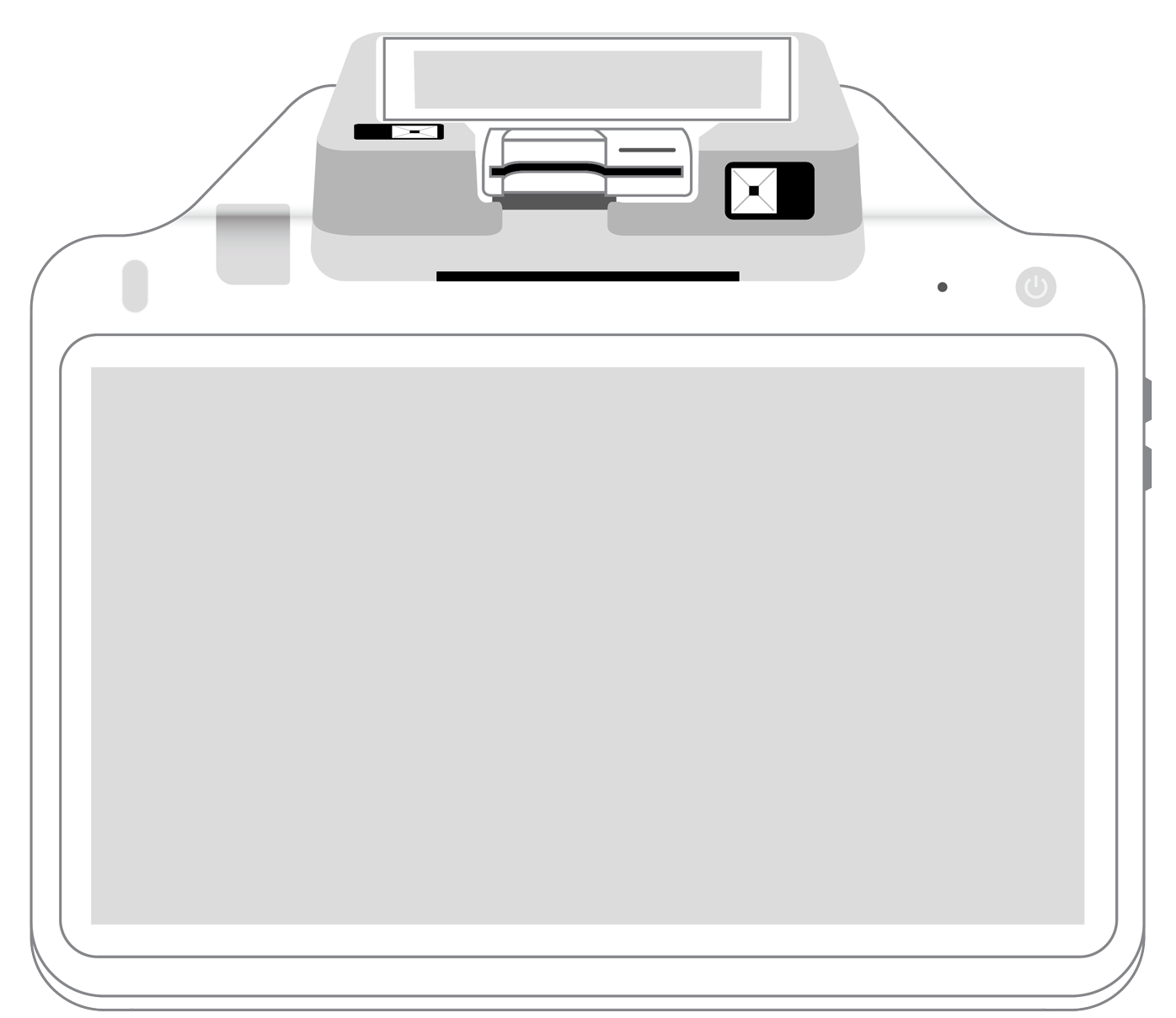

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||