You've got money: Mobile payments in the era of a cashless future.

Not that long ago, consumers had to be careful to make sure they knew how much money they planned to spend before they went out shopping. The reason for their concern was that they paid with cash. If they ran out of bills and coins, they simply could not purchase all of their items.

The introduction of credit cards went a long way toward solving this problem. Plastic enabled people to spend more than the cash they had on them without needing to run to an ATM or borrow from a friend. Even so, they still needed to carry a wallet or throw their plastic in their purse or pocket.

Today’s mobile payment options have made it easier and more convenient than ever to pay. Using a smartphone or wearable that customers already automatically carry with them, this innovation involves instant, secure payments from anywhere, with no cash or plastic necessary. Welcome to what may be the dawn of a cashless future.

What are mobile payments?

In short, mobile payment technology gives customers a new way to purchase products and services. Instead of paying with cash, checks, or physical credit cards, they can do their shopping digitally. This same technology also facilitates payments between individuals (peer-to-peer) popular with some small business owners.

Generally speaking, mobile payments utilize digital wallets that are built into customers’ devices. These repositories encrypt and store payment information such as credit card numbers, expiration dates, and CVVs, which are then securely sent to the merchant’s payment processing company at the time of purchase. Only the phone’s owner can initiate the sale since the wallet is only accessible with the person’s fingerprint, numerical PIN, or facial ID.

Mobile payment processing also requires buy-in from the merchant. You’ll need a card reader equipped with a technology called near-field communication (NFC). This technology allows communication between your card reader and your customers' NFC-ready wearables and smartphones during the purchase process.

Although the devices must be very close to each other — usually two inches apart or less — they do not actually need to touch. These so-called “contactless” or “touchless” payments have gained tremendous popularity in recent years, particularly during the coronavirus pandemic when concerns about hygiene and safety were at an all-time high.

The most popular mobile wallet companies.

There is no doubt that mobile wallets are the vehicles that have jump-started the use of mobile payments among customers and merchants alike. There are two main mobile wallet providers every merchant should be familiar with.

- Apple Pay. This works on the iPhone and Apple watch. The customer inputs credit card information into their device’s built-in digital wallet. Then, at the time of purchase, the customer simply places their device near the merchant’s NFC reader and verifies their identity with a fingerprint or facial ID. Another way you can accept Apple Pay transactions is by placing a “pay with Apple Pay” button on your website or app.

- Google Pay. This is available on all NFC-enabled Android devices. To initiate a Google Pay transaction, the user simply unlocks their phone and holds it over the merchant’s NFC reader.

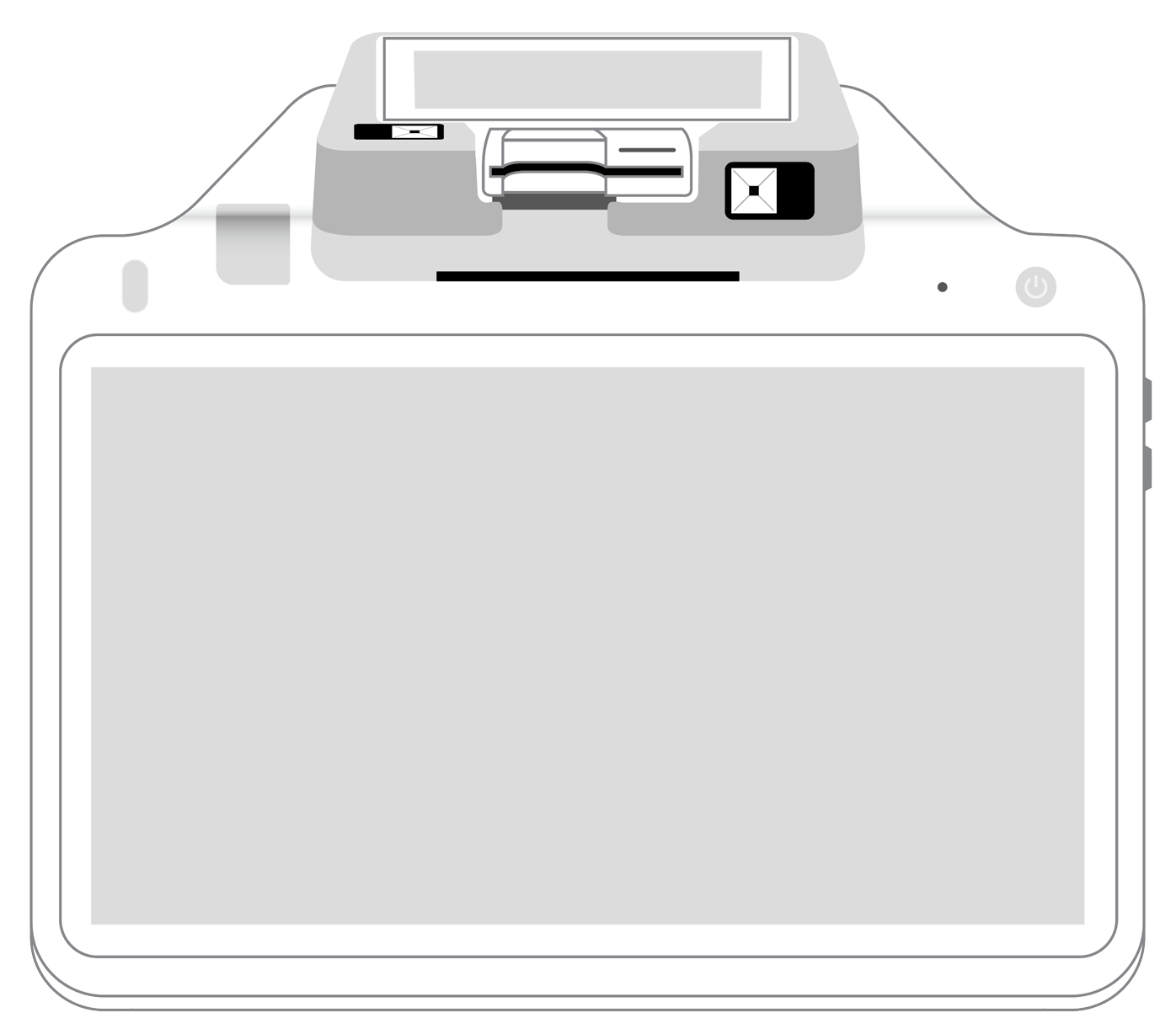

In addition to these payment options, most business owners should become familiar with mobile card readers. These diminutive devices can be attached to a tablet or smartphone, providing you with a wireless mobile payments solution that you can take anywhere: throughout your store, across town at a local fair or farmers market, or directly to the homes of your customers.

How mobile payments can jump-start your business in our new cashless era.

To say that there will soon come a day when no one uses bills and coins to buy goods or services would probably be stretching the point too far. At least for the foreseeable future, there will be a sizable number of people who will prefer, either sometimes or always, to pay with cash. However, there is also no doubt that integrating mobile payments into your business ecosystem will bring a robust set of benefits to you and your customers. Take a look at just a few of these upsides.

- Mobile payments make security a top priority. Whenever this type of transaction is processed, the sensitive customer information involved is encrypted and tokenized. In other words, data is converted into code, and credit card numbers are transformed into random sequences of digits that can only be used once. This prevents hackers and cybercriminals from being able to use this information for their own devious purposes.

- Mobile payments are fast. Lines at the checkout counter can move more quickly than ever b when fewer customers are fumbling for wallets or cards. Most will simply wave their phone or smartwatch near the NFC reader and wait a couple of seconds for their payment to be accepted.

- Mobile payments lead to increased satisfaction. Workers and guests alike will appreciate the enhanced efficiency of your checkout lines. Meanwhile, you’ll be able to accept payments from your customers anywhere in your store.

- Mobile payments lead to better record-keeping. Because your mobile card readers interface directly with your point of sale (POS) system, you can keep track of every purchase. This makes for seamless inventory management that ensures you will never run out of the products your customers want. Moreover, you can generate sales reports that can help you to grow your business.

- Mobile payments are flexible. Wireless mobile options allow you to accept customers’ money anywhere, including curbside, at their homes, or any other location. This increased ability to meet people where they are is particularly useful as we begin to move away from pandemic-related lockdowns and restrictions. No matter what health-related mandates might be in place, mobile payments can accommodate customer and merchant needs.

Although the use of cash might be receding, consumers still have an ongoing, ever-increasing need to purchase products and services. Mobile payments make it possible for shoppers to make purchases quickly, securely, and conveniently — at any time and from anywhere without the need for coins, cards, or a physical wallet. The use of cash might not be dead, but mobile payment technologies are offering consumers a very compelling alternative that looks like it’s here to stay!

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||