Which Credit Card Reader is Right for You?

Credit card processing is always evolving, and the product choices can be overwhelming. From hand-held credit card readers to all-in-one tablets that offer more functionality than the space station’s first computer, you have your work cut out in selecting the right credit card machine for your business. That’s why we at PayAnywhere have taken the time to break down the different types of machines available to you.

Credit card processing is always evolving, and the product choices can be overwhelming. From hand-held credit card readers to all-in-one tablets that offer more functionality than the space station’s first computer, you have your work cut out in selecting the right credit card machine for your business. That’s why we at PayAnywhere have taken the time to break down the different types of machines available to you.

Here’s what you need to consider when determining which credit card processing machine is best for your business:

Traditional Terminals

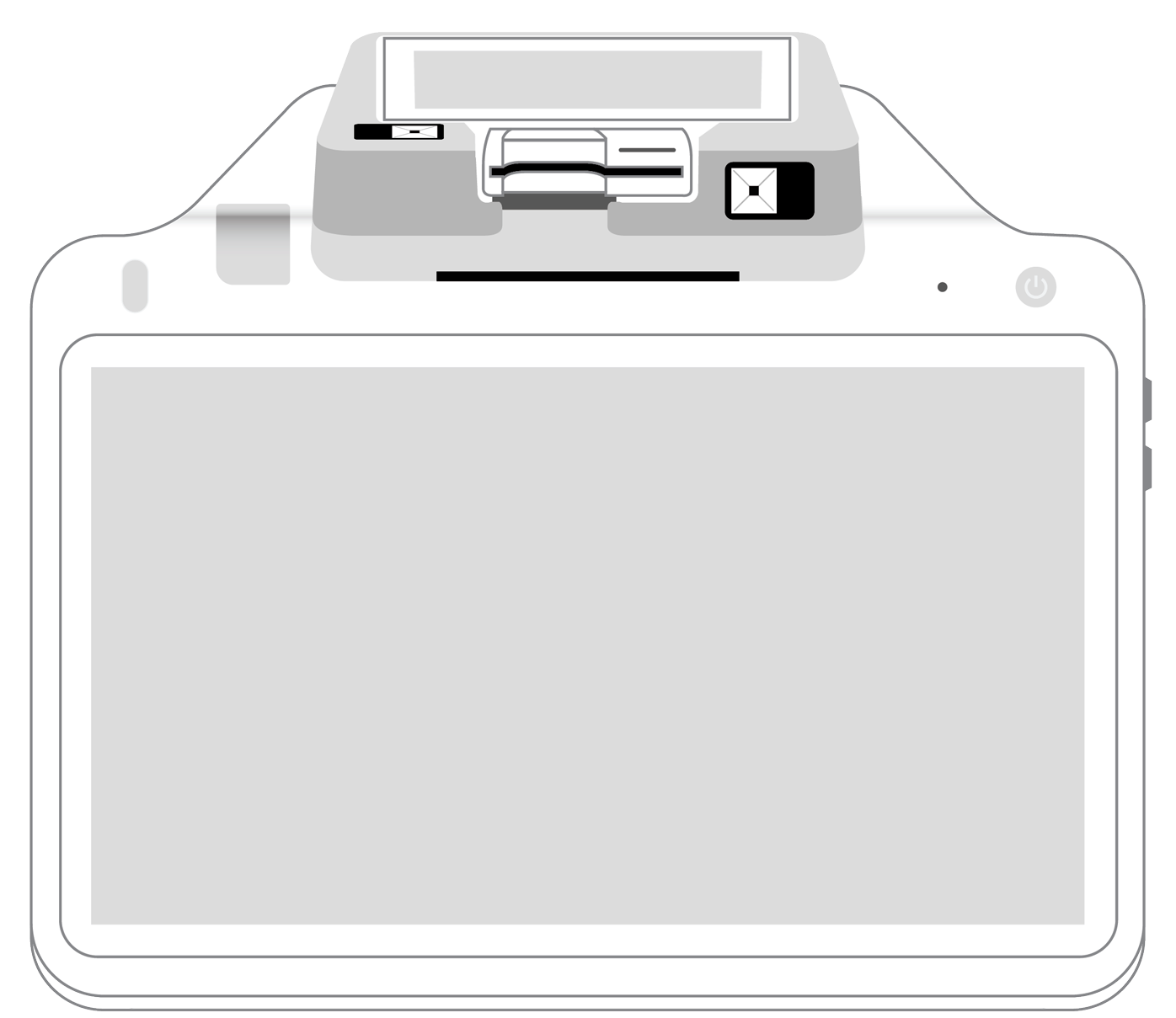

If your business involves face-to-face contact with your customers, a traditional terminal might best fit your needs. From retailers to restaurant owners, traditional terminals allow for “card present” transactions to be completed. This type of transaction is when the cardholder and the credit card are both present at the time of the transaction at the merchant’s brick and mortar location. A countertop card reader (another term for traditional terminal) enables you to swipe customers’ credit cards through the reader to process the transaction. PayAnywhere Storefront allows you to accept Visa, MasterCard, American Express, Discover and PayPal cards at your business for the same low rate. It comes with a free 10-inch tablet and sleek stand with a built-in card reader that will allow you to accept credit cards and PayPal mobile in-store payments.

Wireless Terminals

There are portable machines that are similar to traditional terminals in look and feel, but have one distinctive difference: they’re wireless! Built with rugged use in mind, these wireless terminals can handle most electronic payments including mobile wallets, EMV and magnetic stripe. These are ideal for outdoor retail/restaurant where multiple devices are needed. Commonly called “portables,” these machines provide merchants the chance to accept payments anytime, anywhere.

Mobile and Tablet

Wireless credit card readers are perfect for businesses that are always on the go. Mobile POS systems, like PayAnywhere Mobile, give you the opportunity to process transactions anywhere, anytime. These are great for companies with multiple employees because systems like PayAnywhere Mobile allow you to add unlimited users to your merchant services account. PayAnywhere Mobile turns your iPhone or Android smartphone or tablet into a credit card reader that can put your business’s operations at your fingertips. It offers detailed in-app and online reporting that gives you greater insight into your customers’ purchasing habits.

If you have any questions about PayAnywhere Storefront or PayAnywhere Mobile, contact us at 877-387-5640, or visit our website.

Related Reading

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||